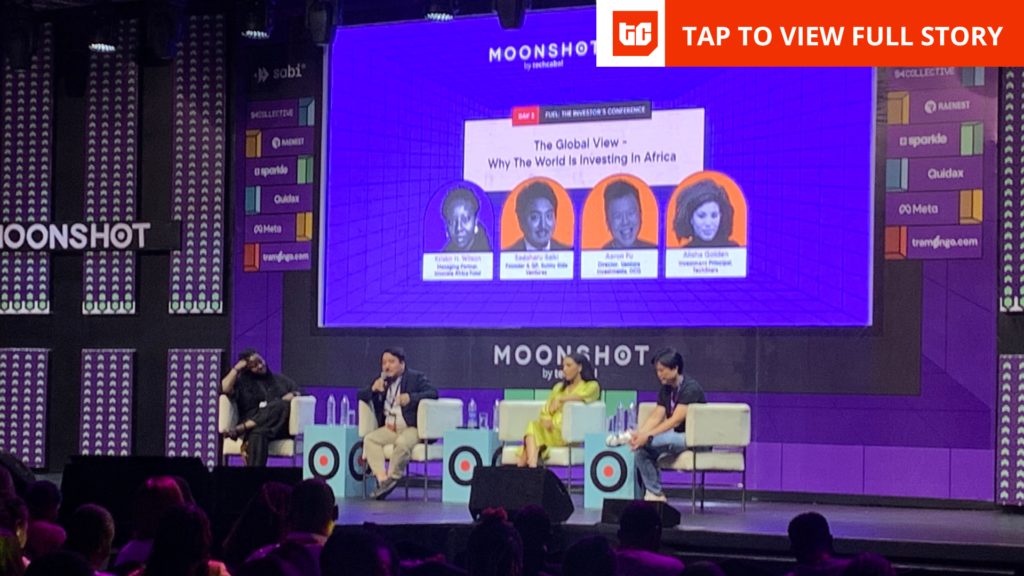

African startups can construct options which might be scalable throughout the worldwide market, traders who spoke at Moonshot by TechCabal on Thursday mentioned. They want help by way of funding, entry to networks and market information to attain international ambitions.

In Africa, the concept of growth is generally centred round launching in one of many “Massive 4” markets and scaling from there. In recent times, African startups like TymeBank, Flutterwave, and Moove have arrange store in markets like Southeast Asia and North America.

Penetrating overseas markets requires startups to have a transparent thought of what it takes to reach completely different international locations. This clear image of the market comes from having traders who can again the founders’ ambitions.

“It appears apparent however what works in African markets would possibly want important tweaking to work in markets like LatAm and Southeast Asia,” mentioned Sadaharu Saiki, founder & GP at Sunny Facet Ventures.

Startups like TymeBank, which launched in South Africa and is now current within the Philippines, Vietnam, and Indonesia, usually cite the same macroeconomic situations in Africa and Southeast Asia Nevertheless it takes extra than simply comparable market dynamics to construct a profitable product. That is the place partnerships with native gamers turn out to be useful.

“There’ll at all times be somebody who is aware of the market greater than you. Leverage that information by effectively although partnerships,” added Aaron Fu, director of enterprise investments at DCG.

Because the African market turns into extremely aggressive and someway saturated, overseas markets have gotten more and more enticing. To achieve their potential of penetrating these markets, it should take a mixture of “affected person capital,” deep information of the markets and partnerships with important synergies.