The overall amount of cash owed by six listed shopper corporations to their suppliers rose by 23.1 p.c final yr as foreign exchange losses took a toll on their monetary efficiency, based on knowledge compiled by BusinessDay.

The corporations are Worldwide Breweries Plc, Cadbury Nigeria Plc, Nigerian Breweries Plc, BUA Meals Plc, Dangote Sugar Refinery Plc and Champion Breweries Plc.

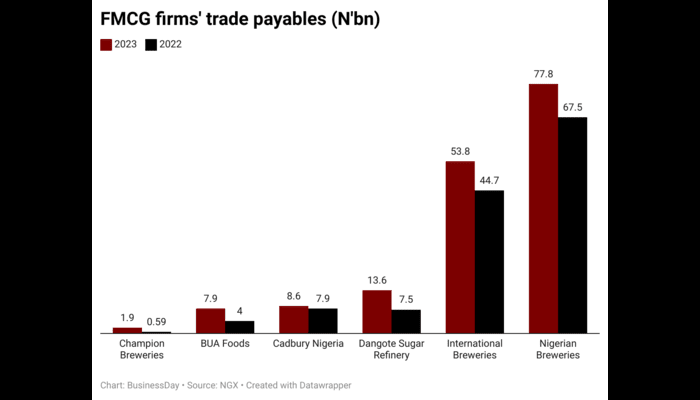

The newest audited monetary statements of the corporations present that their mixed commerce and different payables elevated to N163.6 billion final yr from N132.1 billion in 2022. The payables declined by 21.8 p.c in 2022 from N169 billion in 2021.

Commerce payables, additionally known as commerce accounts payable, are the cash owed by a enterprise for items and companies purchased on credit score.

The FX losses recorded throughout the interval enormously impacted the corporations’ potential to fulfill their obligations, mentioned Oluebube Nwosu, a shopper items analyst at Vetiva Capital.

“As most of those corporations purchase their merchandise from exterior the nation, they’re uncovered to foreign money threat which fluctuates over time,” he mentioned.

Since President Bola Tinubu introduced the removing of petrol subsidies throughout his inauguration on Might 29, petrol costs have greater than tripled to N600, whereas the worth of the naira has plunged following the floating of the foreign money.

The Central Financial institution of Nigeria in June merged all segments of the overseas change market into the Traders and Exporters window and reintroduced the keen purchaser, keen vendor mannequin.

The official change fee fell from N463.38/$ to N1,230.6/$ as of Monday. On the parallel market, the naira is being traded at round 1,240/$ as towards 762/$ earlier than the FX reform.

“Producers rely upon imported uncooked supplies. The scarcity of FX led to a speedy enhance within the costs of the commodities past what their monetary data can maintain,” Uchenna Uzo, professor of promoting and school director at Lagos Enterprise College, mentioned.

He mentioned other than FX losses, the corporations had been affected by hovering vitality prices because of the removing of gasoline subsidy. “The price of vitality, logistics, and provide chain distributions dampened their earnings which impacted the corporations’ potential to fulfill up obligations to their suppliers.”

Information from the Nationwide Bureau of Statistics reveals that Nigeria’s headline inflation fee rose for the fifteenth consecutive time in March to 33.2 p.c from 31.7 p.c within the earlier month.

Meals inflation, which constitutes 50 p.c of the inflation fee, rose to 37.91 p.c from 35.41 p.c.

The World Financial institution’s newest Nigeria Improvement Replace report revealed that rising inflation and sluggish development in Africa’s most populous nation elevated the variety of poor individuals to 104 million in 2023 from 89.8 million at the beginning of the yr.

Champion Breweries’ commerce and different payables recorded the very best development of 245.4 p.c to N1.9 billion from N592 million, whereas that of BUA Meals rose by 97.5 p.c to N7.9 billion.

Dangote Sugar Refinery noticed a rise of 81.3 p.c to N13.6 billion; NASCON, 55 p.c to N1.3 billion; Worldwide Breweries, 20.3 p.c to N53.8 billion; Unilever, 18 p.c to N, Nigerian Breweries, 15.2 p.c to N77.8 billion; Cadbury, 8.8 p.c to N8.6 billion and Nestle (two p.c).

Nigerian Breweries reported an after-tax lack of N106.3 billion final yr; and Dangote Sugar, N73 billion, Cadbury, N19 billion and Worldwide Breweries, N19 billion. Champion Breweries’ revenue declined to N370 million.

BUA Meals nevertheless reported a revenue of N112 billion, up from N91.3 billion.

“As costs of products produced by the FMCG corporations have gone up, customers who purchase from them can now not afford these merchandise, with naira devaluation and inflation impacting their earnings,” Femi Egbesola, nationwide president of the Affiliation of Small Enterprise Homeowners of Nigeria, mentioned.

“With salaries not growing, disposable earnings has turn out to be eroded in order that they purchase much less of FMCGs that they used to purchase earlier than, and when these organisations don’t promote sufficient, it’s all the time troublesome for them to pay their distributors. That’s one of many main the reason why now we have a whole lot of backlogs of their commerce payables,” he added.

The Producers Affiliation of Nigeria mentioned in a report final yr that manufacturing actions continued to endure because of the persisting shortage of FX and additional depreciation of the naira.

The affiliation added that the lingering FX shortage and steady depreciation of the naira have left producers bleeding and restricted their capability utilisation for the reason that importation of non-locally produced essential enter has turn out to be a nightmare.

The robust enterprise atmosphere can be pushing multinationals to exit Africa’s greatest financial system as Procter & Gamble, GlaxoSmithKline Shopper Nigeria, Equinor, Sanofi and Bolt Meals introduced plans to depart the nation this yr.