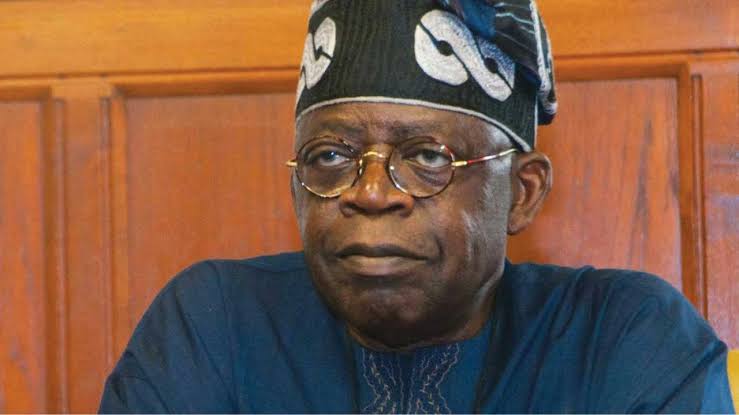

Financial specialists and analysts on Wednesday described President Bola Ahmed Tinubu’s promise to cut back inflation to fifteen per cent in 2025 as an formidable and aspirational purpose however not a practical one.

This was the view of the Chief Government Officer, Monetary Derivatives, Bismark Rewane and the founder and Chief Marketing consultant, B. Adedipe Associates (BAA), Dr Biodun Adedipe.

They spoke on the FirstBank webinar on ‘Nigeria 2025: Pathway to Financial Rebound and Restoration’.

The specialists, nonetheless, projected constructive tendencies by way of financial stability within the 12 months 2025 however insisted that inflation would nonetheless stay above 20 per cent.

That is simply because the Managing Director/Chief Government Officer, of FirstBank, Mr Olusegun Adebiosu, mentioned the whole elimination of gasoline subsidy in 2024 elevated his optimism concerning the 2025 financial efficiency with elevated income to authorities.

President Tinubu had in his New Yr message, final week, spoken on his administration’s plan to cut back the nation’s inflation charge from the present 34.6% to fifteen% this 12 months.

Inflation rose to 34.6 per cent as of November 2024, a big improve within the final one 12 months as in comparison with the December 2023 determine when headline inflation charge was 28.92%.

The inflation charge has been pushed largely by a rise in gasoline worth and the depreciation of the naira which provides to the price of manufacturing.

Adedipe, who gave the keynote handle, mentioned inflation will not be going within the course of 15 per cent projected by the president, noting that “We venture 33% by the tip of 2024 and 27 per cent this 12 months.”

He mentioned meals inflation has been the primary driver of headline inflation, including that for Nigeria to attain “inclusive, sustained and sustainable” financial progress, it should handle the problem of meals deficit, power deficit and manufacturing deficit.

Trying on the 2024 financial progress, he projected that by the tip of 2024, “we see an financial system which will probably finish at about 4.12 per cent progress charge for 2024.”

“Now if it grew at that charge, by any customary globally, that progress charge is critical. Folks usually suppose 3% progress charge is small however by any customary globally, rising at 3.46, 3.47, 3.49, 4.12% is kind of robust however the problem for us is that progress has come principally from companies.

Learn Additionally:

“For many who suppose the expansion numbers will not be that dependable, they’re additionally reminded that it seems as a result of that progress got here principally from companies. That took us again to the place I began from, which is deficit in meals and manufacturing which in fact are two main sectors that may drive inclusive and sustainable progress,” he added.

Adedipe additional projected the moderation of alternate charge in 2025, stabilising at N1,575 to at least one greenback, saying, “For us in Nigeria, the key drivers of the FX charge are the construction of the financial system the place we eat what we don’t produce and we produce what we don’t eat.”

He hailed the expanded capability for native refining of crude oil, stating that it could ease the strain on the FX market.

He additionally acknowledged that addressing the issue of inflation requires greater than elevating the rate of interest, including that there should be meals availability and meals affordability.

“For that to occur, Nigeria should handle causes of meals deficit, like safety. 60% of farm output goes into post-harvest losses as a result of storage inadequacy and processing inadequacy,” he mentioned.

“All nicely and good, 2025 is a 12 months of restoration for Nigeria’s financial system. 2024 has confirmed to be a 12 months of resilience,” he added.

Rewane on his half mentioned the 12 months 2025 wouldn’t be as arduous as 2024, including that whereas inflation is predicted to return down from the yet-to-be-released December determine, the 15% goal in 2025 by the president will not be lifelike.

He acknowledged that the meals import waiver which might have lowered inflation has been “bureaucratically bungled.”

“We’re projecting that the inflation popping out on the finish of subsequent week can be at 35.4%. The spike will not be as excessive because it was and meals inflation is definitely flattening, that’s December inflation. January historically will drop.

“We now have to watch out of false expectations. The president’s purpose of 15% is an aspiration and persons are free to have aspirations, however we deal on this planet of actuality. We’re going to be seeing extra like 27 or 25% in the direction of the tip of the 12 months with some luck.”

The MD/CEO of FirstBank acknowledged that 2025 is “pregnant with potentials for discerning companies and people” with improved authorities income made potential by means of full gasoline subsidy elimination.

He acknowledged that going by the continuing reforms of the federal government and the financial reforms, particularly the soundness within the international alternate market, the 12 months 2025 can be a constructive 12 months for the nation’s financial system.

He acknowledged that FirstBank is dedicated to working with its prospects “by means of this tough period.”