In a brand new weekly replace for pv journal, OPIS, a Dow Jones firm, gives a fast have a look at the primary value tendencies within the international PV trade.

OPIS

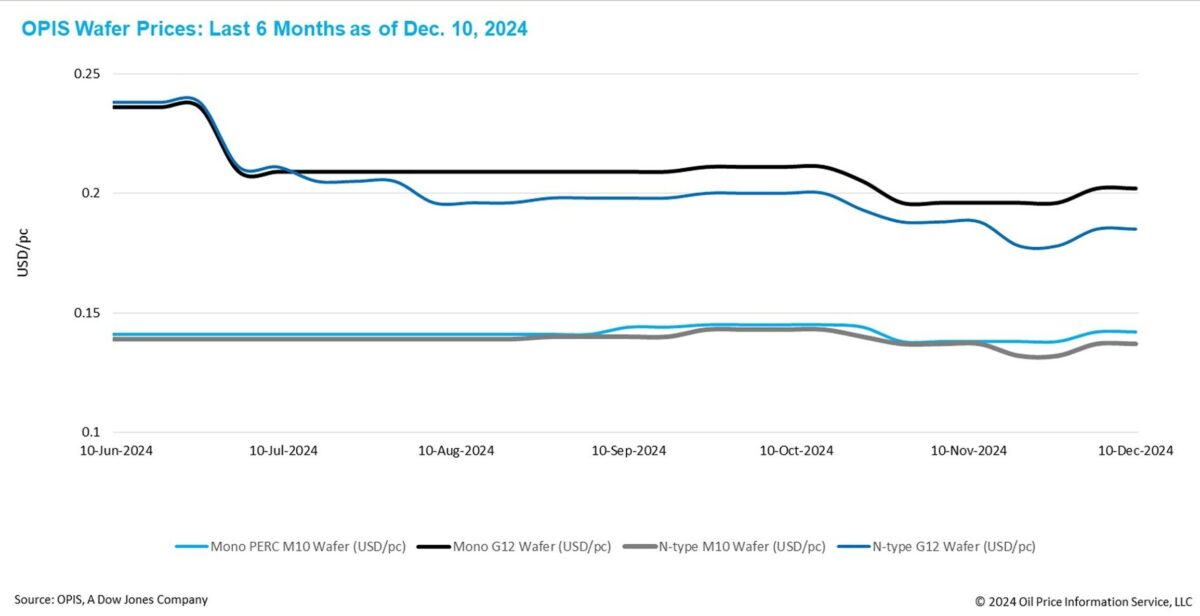

FOB China costs for Mono PERC wafers remained steady this week, with Mono PERC M10 and G12 wafers priced at $0.142/computer and $0.202/computer, respectively. Equally, FOB China costs for N-type M10 and G12 wafers confirmed no week-to-week modifications, holding regular at $0.137/computer and $0.185/computer, respectively.

The Chinese language market has made notable progress in decreasing wafer stock ranges. Stories point out that the general working price for ingot manufacturing in China stays under 50%. Moreover, wafer manufacturing within the nation has been on a downward trajectory for 3 consecutive months since August. In consequence, sources counsel that wafer inventories have now stabilized at a standard turnover degree, equal to roughly two weeks of manufacturing.

However, trade insiders maintain restricted optimism for the near-term outlook of the wafer market, citing the conclusion of the height buying season. Stories counsel that some main cell producers are planning to close down operations at sure services and start the Chinese language New 12 months vacation as early as December, a month forward of schedule.

With weak end-user demand more likely to persist by means of the primary quarter of subsequent yr worldwide, wafer producers are anticipated to prioritize controlling manufacturing volumes and striving to take care of value stability within the close to time period.

Lately, a number of areas have launched new insurance policies within the photo voltaic market that would impression wafer manufacturing or commerce. In China, a number of photo voltaic producers have signed a self-regulatory settlement geared toward controlling manufacturing capability throughout your entire worth chain, together with polysilicon, wafers, cells and modules. Tier-1 wafer producers, main built-in producers with wafer manufacturing capabilities, and main specialised wafer producers have reportedly all signed the settlement. These corporations have been reportedly allotted most permissible wafer manufacturing quotas, collectively totaling roughly 650 GW for 2025, representing a modest 2% progress in comparison with 2024 ranges.

Market observers usually view the signing of the self-regulatory settlement and the allocation of capability quotas as solely an preliminary step in direction of clearing the extreme capability. The settlement’s future implementation and effectiveness stay unsure and are more likely to face vital challenges.

In India, the Ministry of New and Renewable Vitality (MNRE) introduced this week that from June 2026, photo voltaic initiatives should use cells from Checklist-II of the Accredited Checklist of Fashions and Producers (ALMM). Whereas the introduction of Checklist-II is anticipated to spice up home PV cell manufacturing in India subsequent yr, India’s restricted ingot and wafer capability could drive increased wafer imports within the quick time period.

Within the U.S, the commerce consultant introduced this week that, efficient Jan. 1, 2025, tariffs on imported Chinese language photo voltaic wafers and polysilicon will rise from 25% to 50%. This determination is meant to help home investments beneath the Biden-Harris Administration, geared toward fostering the expansion of a clear power economic system.

Insiders imagine this growth may elevate the price of Chinese language wafer exports to the U.S, undermining their market presence or probably driving up photo voltaic cell and module costs within the area. Whereas U.S wafer imports from China are already minimal attributable to restricted home cell manufacturing, the enlargement of U.S cell manufacturing could immediate Chinese language corporations to speed up the institution of abroad services in areas like Southeast Asia and the Center East.

OPIS, a Dow Jones firm, gives power costs, information, knowledge, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. It acquired pricing knowledge property from Singapore Photo voltaic Trade in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are the writer’s personal, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.