The naira fall has pushed Nigeria’s competitiveness to a 25-year excessive, with the nation’s commerce surplus rising to its highest in additional than a decade.

The naira, which has been devalued by greater than 70 %, fell from 460 to the greenback round 2023 to only under 1,500/$ now — one of many largest forex changes anyplace on the planet for years. Solely the Ethiopian birr has seen an even bigger transfer not too long ago.

“With the naira’s fall, Nigeria is arguably now extra aggressive than at any time previously 25 years,” in line with a report by British assume tank Chatham Home.

“The trail to a extra capital-rich, extra various Nigerian economic system can solely be constructed on a aggressive naira,” Chatham Home stated in its report entitled, ‘Nigeria’s economic system wants the naira to remain.’

Learn additionally: Banks’ greenback hoarding threatens naira stability, say BDCs

Weak naira lifts commerce surplus

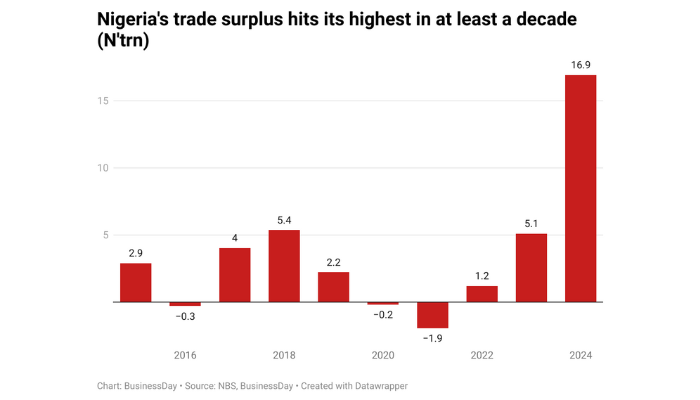

Equally, Nigeria’s commerce surplus surged to its highest degree in not less than a decade, powered by naira devaluation that made exports extra aggressive. Analysts see the streak extending in 2025.

Africa’s greatest oil producer recorded a web commerce surplus of N16.9 trillion in 2024 — the best on document. That is greater than double the nation’s commerce surplus within the earlier 12 months, in line with BusinessDay’s evaluation.

A commerce surplus, often known as a constructive steadiness of commerce, happens when a rustic’s exports exceed its imports. Commerce deficit, alternatively, is the other.

Nonetheless, any much less volatility of the naira might doubtlessly scale back good points from forex devaluation on commerce surplus.

“We anticipate a sustained rise within the commerce surplus because of the anticipated growth in Nigeria’s export commerce volumes pushed by the ramp-up in crude oil manufacturing on the again of elevated refining capability,” analysts at FBNQuest Service provider Financial institution stated.

“A pick-up in import volumes pushed by improved FX liquidity and enhanced accessibility to overseas forex will doubtless compress the nation’s commerce surplus steadiness.”

Weaker naira higher than cheaper greenback

Whereas the naira has depreciated in comparison with what it was two years in the past, it has improved Nigeria’s steadiness of funds, sustaining regular progress for 9 straight quarters.

It has introduced in overseas capital, which has seen the nation’s reserves balloon to greater than $40 billion.

The naira devaluation and the removing of gasoline subsidies have supplied some breather for the Nigerian finances, with the nation’s fiscal deficit narrowed from 6.4 % of GDP in early 2023 to 4.4 % in early 2024.

Learn additionally: Why naira stability is the cornerstone of Nigeria’s financial future

However a less expensive greenback makes imports rise whereas widening commerce deficits and hampering financial development.

“Excessively low-cost {dollars} encourage firms and people to seek out methods of getting cash overseas, to park wealth in safer havens at low price,” the report acknowledged.

Whereas the naira devaluation and removing of subsidies have seen the economic system flip the nook, the reforms birthed by President Bola Tinubu have had far-reaching penalties on bizarre Nigerians, whose spending energy has been hammered by poverty that has blighted the lives of not less than 129 million individuals.

“President Tinubu’s financial reforms give Nigeria the very best hope for sustainable development that it has had for many years. The trail the reform course of takes subsequent can be essential for the nation’s future,” Chatham Home famous.

Nigeria ‘desperately’ wants FDI to stay productive economic system

Nigeria’s financial restoration lies in attracting capital within the type of overseas direct funding (FDI) to enhance productiveness, job creation and development.

“It’s one thing of a tragedy that this nation of 230 million individuals has failed to draw greater than $2 billion price of web FDI inflows yearly lately.”

Stronger naira will wipe out good points of reforms

There was a push for the nation to permit the naira to strengthen in opposition to the greenback to abate inflationary pressures that ended 2024 at 34 % and crashed to 24 % in January 2025 on account of the inflation knowledge overhaul.

Learn additionally: NNPC suspends naira-for-crude deal for Dangote, others

However it will erase the hard-won forex stability and produce the nation again to its establishment as good points of reforms diminish.

“A forex that stays aggressive is a crucial – though certainly not adequate – situation to encourage extra productive capital to enter the nation.

“Additionally important is a steady dedication to enhance the enterprise local weather – all the pieces from bettering electrical energy provide to tackling corruption, decreasing crimson tape and enhancing the sanctity of contracts,” the report indicated.