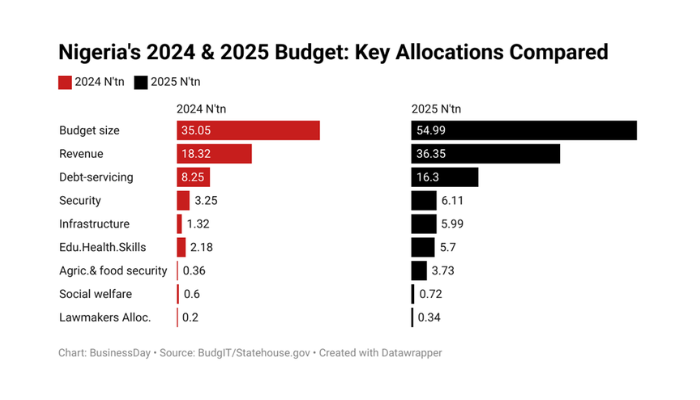

The Nigerian authorities has unveiled its largest nationwide funds in 65 years, a record-breaking ₦54.99 trillion, representing a 56.89 % enhance from the ₦35.05 trillion budgeted in 2024 (together with a supplementary ₦6.2 trillion).

President Bola Tinubu describes it because the “Funds of Restoration,” aimed toward stabilising the economic system and driving development.

The blueprint boasts bold spending on infrastructure, safety, and social programmes. However with a historical past of income shortfalls and debt dependency, can the federal government actually finance these plans?

And extra importantly, will peculiar Nigerians really feel the impression?

The place the cash goes

Consider the funds like a family spending plan. If more cash is put aside for safety, it means much less for meals or hire. This yr, the federal government is prioritizing safety with ₦6.11 trillion, an 88 % enhance from ₦3.25 trillion in 2024.

The objective? To sort out terrorism, banditry, and rising insecurity-a fix-it-once method, if historical past doesn’t repeat itself.

Infrastructure follows carefully with ₦5.99 trillion for roads, bridges, and main initiatives just like the Lagos-Calabar Coastal Freeway and the Sokoto-Badagry Superhighway, a rise of over 350 % from ₦1.32 trillion final yr.

Think about fixing a long-neglected home. If achieved proper, these initiatives may enhance commerce and create job alternatives.

Training, healthcare, and expertise improvement get ₦5.7 trillion, up 161 % from ₦2.18 trillion in 2024. In the meantime, agriculture and meals safety obtain ₦3.73 trillion, an enormous enhance from ₦362 billion, aiming to maintain meals costs in test.

However will this further spending truly make life simpler for peculiar Nigerians?

Specialists on the Centre for Financial Coverage Analysis (CEPR) argue that with out correct implementation, elevated budgetary allocations could not translate to actual enhancements.

Learn additionally: Nigeria’s N54.99trn funds helps financial growth, says Bagudu

The elephant within the room

Think about a household deciding to improve their dwelling, however as a substitute of saving, they take huge loans. That’s Nigeria proper now. Regardless of Tinubu’s promise of fiscal self-discipline, “We can’t spend what we don’t have,” borrowing stays a key pillar of this funds.

Debt servicing alone will swallow ₦16.3 trillion, a virtually 98 % enhance from ₦8.25 trillion in 2024. Image incomes ₦100,000 month-to-month however spending ₦50,000 simply to pay curiosity on previous loans.

That’s Nigeria’s dilemma-spending extra on money owed than on healthcare, schooling, and even infrastructure mixed.

The federal government expects income to leap from ₦18.32 trillion to ₦36.35 trillion, a 123.19 % % enhance, primarily by means of higher tax assortment and overseas investments.

However given Nigeria’s historical past of lacking income targets, economists from the Nigerian Financial Summit Group (NESG) warn that these projections may very well be overly optimistic.

“Nigeria’s funds measurement has practically doubled in only one yr, but the income construction stays weak. If income targets are missed once more, the nation may face an excellent deeper fiscal disaster,” NESG famous in a latest evaluation.

Gaps and excesses

Whereas the funds emphasizes infrastructure, some spending selections increase questions. For example, lawmakers get ₦344.85 billion, a rise from ₦197.93 billion in 2024—more cash for themselves whereas asking residents to tighten their belts.

The State Home funds additionally consists of over ₦7 billion for journey and transport alone, together with hefty allocations for refreshments and media bills.

In the meantime, social welfare applications, meant for struggling Nigerians, get simply ₦723.68 billion, up from ₦600 billion, but nonetheless a fraction of what’s being spent on authorities operations.

It’s like an organization rising executives’ bonuses whereas giving staff a tiny increase, barely sufficient to cowl inflation.

The brand new minimal wage of ₦70,000, up from ₦30,000, goals to spice up buying energy. But when inflation retains rising, the additional cash may vanish shortly, like pouring water right into a leaking bucket.

Monetary analysts from the Nigeria Affiliation Macroeconomic Modeler (NAMM) warn that wage will increase with out tackling inflation may result in increased client costs, eroding any actual good points for staff.

Learn additionally: Tinubu rejects N942bn census funds, proposes NYSC members to chop prices

Sport-changer or cash pit?

The federal government is banking on infrastructure to drive financial development, with initiatives just like the Lagos-Calabar Freeway anticipated to enhance connectivity and enhance commerce.

However Nigeria has a historical past of grand initiatives that fail to ship. Take Buhari’s Abuja mild rail to nowhere—hundreds of thousands have been spent, but the trains stay principally empty as a result of poor planning.

Valentine Okenwa, a transport economist warns that except challenge feasibility research enhance, billions may very well be wasted on infrastructure that doesn’t serve the general public successfully.

Will this time be completely different, or will these new initiatives change into yet one more costly, unfinished dream? With out strict oversight, they danger changing into monetary black holes reasonably than engines of development.

What it means for the common Nigerian

For hundreds of thousands of Nigerians battling excessive meals costs, gasoline prices, and unemployment, the massive query stays: Will this funds make any actual distinction? Will more cash for agriculture imply cheaper meals available in the market?

Will infrastructure spending create jobs and develop the economic system? Or will waste and corruption swallow the advantages, leaving residents pissed off?

A funds of restoration or reckoning?

Nigeria’s 2025 funds is bold, however ambition alone doesn’t put meals on the desk. The true take a look at lies in execution, transparency, and the federal government’s capability to curb waste.

With out these safeguards, the Funds of Restoration dangers changing into simply one other high-stakes gamble with Nigeria’s future, one which residents can’t afford to lose.

Oluwatobi Ojabello, senior financial analyst at BusinessDay, holds a BSc and an MSc in Economics in addition to a PhD (in view) in Economics (Covenant, Ota).