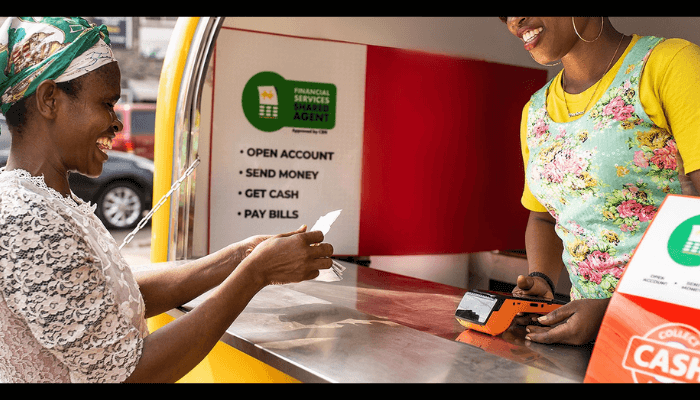

Victor Olojo, Nationwide President, of the Affiliation of Cellular Cash and Financial institution Brokers in Nigeria (AMMAN) has stated, cellular cash has efficiently unlocked entry to monetary providers for the unbanked inhabitants who don’t have the means to business banking providers.

Talking at a current interview with Channels TV, Olojo stated a mean agent serves a minimal of 20 prospects per day, in different to drive extra pockets transactions however Nigeria as a rustic remains to be money dominant”

“Therefore cellular cash brokers in Nigeria are dedicated to educating and sensitising the unbanked Nigerians on the opposite digital fee channels in an effort to drive the cashless economic system,” he stated.

Cellular cash providers are seen as highly effective instruments for bringing unbanked and underbanked folks into the formal monetary sector.

In accordance with Shared Agent Community Growth Services, the variety of financial institution brokers surged by 1,456.9 % to 1.3 million in 2022 from 83,500 in 2018.

Whereas the variety of registered cellular cash agent retailers per one thousand sq. meters in Nigeria has elevated by 380.2 % to 680.9 in 2021 from 141.8 in 2020, in line with the Worldwide Financial Fund (IMF).

Learn additionally: How ESG adoption will drive sustainable insurance growth in Africa

Final 12 months, a 2021 World Findex report acknowledged that the upper adoption of cellular cash is driving the expansion of account possession in monetary establishments notably in Sub-Saharan Africa (SSA) nations.

The report titled ‘Monetary Inclusion, Digital Funds, and Resilience within the Age of COVID-19, confirmed that Nigeria’s banked inhabitants elevated by 15.6 proportion factors to 45.3 % in 2021, the best in 10 years from 29.7 % in 2011.

“Cellular cash has grow to be an essential enabler of economic inclusion in Sub-Saharan Africa, particularly for girls as a driver of account possession and of account utilization by means of cellular funds, saving, and borrowing,” the report acknowledged.

Aside from enhancing or growing monetary inclusion, the elevated adoption of company banking has additionally been an enabler for creating employment alternatives in growing nations particularly Africa’s largest economic system the place unemployment is estimated at 33.3 % as of 2020.

“Nigeria is Africa’s largest unbanked inhabitants, and whereas its fee business has flourished, there’s hardly any lead participant banking the unbanked in a sustainable method. That is the place cellular cash is available in,” stated Nika Naghavi, MFS Africa’s government director of cellular community operators final 12 months.

She added that the adoption of cellular cash in Nigeria by means of MTN and Airtel will change the panorama and introduce modern providers and partnerships that may differ from what we’ve seen up to now.

“The doorway of telcos like MTN and Airtel into the Nigerian cellular cash market is a giant development for cellular cash on the African continent.”

Cellular cash accounts are anticipated to develop by 39 % of the sub-Saharan inhabitants by 2025, a world cellular cash 2021 report exhibits.