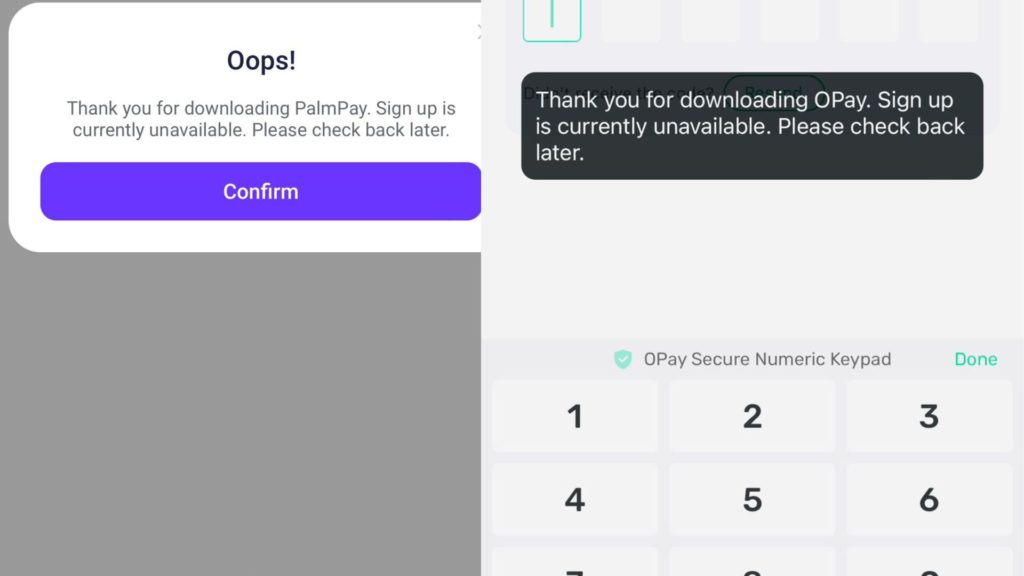

Kuda Financial institution, Moniepoint, OPay and Palmpay have paused account opening for brand new prospects following a directive from the Central Financial institution of Nigeria. The directive got here two days after the EFCC blocked 1,146 financial institution accounts concerned in unauthorised foreign exchange dealings.

“We’ve quickly paused new signups on our platform. Which means you’ll be unable to open a brand new account for the time being. We apologise for any inconvenience this will trigger,” learn a discover on the web site of a distinguished fintech startup.

On the time of this report, TechCabal couldn’t open new accounts on the affected fintech apps.

Buyer deposits and banking actions usually are not affected.

Previously 12 months, fintechs have confronted elevated scrutiny over their account opening processes. In October 2023, Fidelity Bank blocked transfers to OPay, Palmpay, Kuda, and Moniepoint over considerations that lax KYC processes led to a rise in fraud incidents. One month after that incident, the Central Financial institution shared new KYC guidelines for all monetary establishments that appeared focused at fintech startups.

Final week’s directive to pause account opening is linked to an ongoing audit of the KYC course of of those fintechs, one government at an affected fintech claimed. The identical individual described the pause as “short-term.”

On April 26, the Central Financial institution and the Nationwide Safety Company (NSA) held talks with representatives of the affected fintechs on Friday, an individual with data of the assembly advised TechCabal.

“The CBN looks like numerous crypto merchants had been leveraging the fintech platforms to disrupt the FX market,” one other individual with data of the conversations mentioned.

“The banks even have a greater relationship with the regulator whereas fintechs are but to construct that kind of relationship and assist their notion with the CBN.”

An government at one of many affected fintechs advised TechCabal that the directive is linked to the EFCC’s ongoing investigation into financial institution accounts concerned in unauthorised FX dealings.

An evaluation of the 1,146 accounts blocked by the EFCC exhibits that solely 10% are operated by fintechs, with the bulk being industrial financial institution accounts.

An NSA spokesperson denied any hyperlink with the directive to cease opening new accounts.

The CBN didn’t instantly reply to a request for remark.

In March, the Central Financial institution argued that the naira, which skilled file lows in 2024, is being manipulated by speculators after Olayemi Cardoso, the Central Financial institution’s governor, claimed that $26 billion handed by Binance in a 12 months from “sources and customers who we can’t adequately determine.” It knowledgeable a crackdown on the worldwide cryptocurrency trade Binance.

Since then, two Binance executives have additionally been charged with tax evasion and cash laundering and Binance has positioned a a restriction on peer-to-peer trading.

In December, the CBN mandated all monetary establishments to gather ID playing cards earlier than creating monetary accounts, which contradicts a 2013 central financial institution rule designed to help monetary inclusion that allowed Nigerians to open accounts with out identification playing cards. In the identical month, the Nigeria Inter-Financial institution Settlement System (NIBSS) requested banks and cellular cash operators to delist unlicenced fintechs from immediately accepting client deposits.