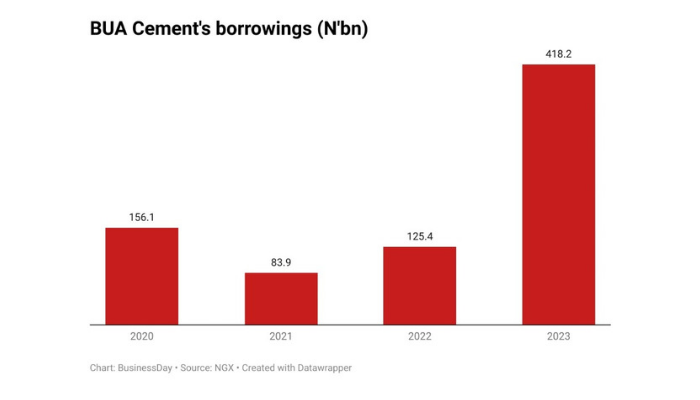

BUA Cement Plc recorded a 233 p.c surge in its financial institution borrowings final 12 months, a BusinessDay evaluation reveals.

The agency’s newest monetary assertion reveals that financial institution borrowings rose to N418.16 billion from N125.44 billion in 2022.

Learn additionally: Market heads further south by 0.03% as BUA Cement tops laggards

“The borrowing spike is basically attributed to the corporate’s enlargement efforts, with many of the overseas alternate losses stemming from these borrowings,” a Lagos-based analysis analyst mentioned.

Additional evaluation of the assertion reveals that of the full borrowings, present financial institution loans stood at N122.68 billion, up from N80.69 billion, whereas non-current loans grew to N295.46 billion from N44.74 billion.

The corporate recorded a internet overseas alternate lack of N69.95 billion, larger than the N5.5 billion in 2022. Of this, N52.5 billion was attributed to finance prices related to the development of further capability at its Obu and Sokoto amenities, whereas N17.47 billion was linked to overseas commerce payables.

“The FX loss capitalised pertains to the portion of the alternate losses arising from overseas foreign money borrowings eligible to be capitalised as a part of the borrowing prices for capital initiatives underneath development,” the corporate mentioned in a press release.

Regardless of a decline in after-tax revenue to N69.45 billion from N101.01 billion in 2022, there was a notable income progress of 27.4 p.c, reaching N460 billion from N360.9 billion within the earlier 12 months, owing to a rise in worth.

Nonetheless, with the naira devaluation and ongoing depreciation, coupled with rising inflation, the corporate confronted rising worth pressures, resulting in a 39.5 p.c improve in manufacturing prices to N276 billion in comparison with N197.9 billion in 2022.

Administrative bills rose to N12.29 billion from N10.5 billion, whereas distribution and promoting bills elevated to N29.06 billion from N19.68 billion.

Regardless of the associated fee pressures, Earnings earlier than curiosity, taxes, depreciation, and amortisation (EBITDA) elevated by 7.8 p.c to N169.72 billion in 2023. Nonetheless, the EBITDA margin decreased by 6.7ppts to 36.90 p.c in 2023 from 43.61 p.c in 2022.

Depreciation and Amortisation have been up by 12.9 p.c to N25.06 billion. Different revenue declined to N2.06 billion from N2.78 billion, primarily as a result of absence of modification grants recorded in 2023.

Working revenue, impacted by overseas alternate losses, decreased to N74.69 billion from N129.72 billion in 2022.

Finance revenue recorded a progress of 563.9 p.c to N12.88 billion, attributed to a rise in curiosity revenue.

Finance prices additionally rose by 89 p.c to N19.94 billion because of larger curiosity bills on lease legal responsibility, profit obligation, borrowing, and an overdraft.

In its monetary assertion, the corporate famous that every one curiosity bills have been calculated utilizing the efficient rate of interest, apart from curiosity bills on outlined profit obligations.

“The capitalisation price used to find out the quantity of basic borrowing prices to be capitalised is the weighted common price relevant to the corporate’s basic borrowings. The decided efficient rates of interest are First Financial institution LC (15.36 p.c), Constancy Financial institution -12 p.c, and Union Financial institution RSSF mortgage – 12.29 p.c (2022: 11.9 p.c).

“The particular borrowing prices have been capitalised utilizing the precise prices which are instantly attributable to the acquisition, development, or manufacturing of the qualifying property. The decided efficient rate of interest of the particular borrowing price is IFC Mortgage – 12.06 p.c” the corporate added.

The corporate’s whole fairness decreased to N385.22 billion from N411.11 billion.

Internet money from working actions noticed a marginal improve to N147.60 billion from N147.46 billion, whereas internet money from investing actions reported a destructive of N104.12 billion from a destructive of N101.43 billion.

Internet money flows generated/(utilized in) from financing actions turned constructive to N89.66 billion from a destructive of N60.36 billion.

Money and money equivalents as of December 31, 2023, amounted to N225.07 billion, up from N48.05 billion.