Naira, Nigeria’s authorized tender, misplaced 3.8 % of its worth towards the greenback in final month.

It fell from N737/$ at the start of the 12 months to shut February at N755/$, on the parallel market, often known as black market.

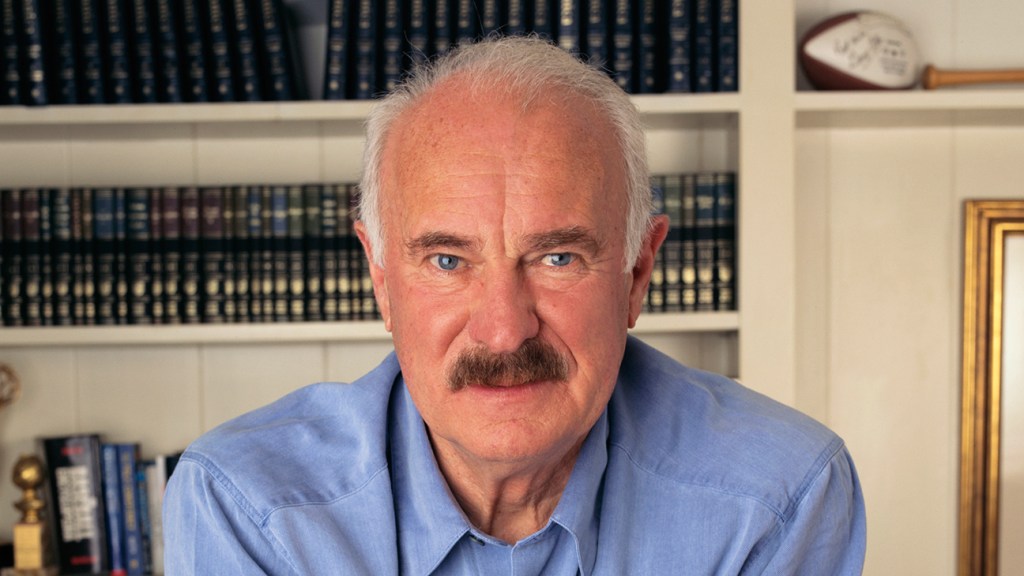

This was fueled by heightened uncertainty as naira money crunch worsened, in keeping with Bismarck Rewane, managing director/chief govt officer of Monetary Derivatives Firm Restricted in a brand new report.

The report famous that change charges on the Buyers and Exporters (I&E) foreign exchange window steadied at N462/$ in January and February

“Official change price stays overvalued,” stated Rewane.

On Tuesday, the naira appreciated throughout overseas change market as demand for {dollars} moderated.

The Naira strengthened by 0.05 % because the greenback was quoted at N461.42 on Tuesday as towards the final shut of N461.67 on Monday on the I&E window, Nigeria’s official market, information from the FMDQ indicated.

Most overseas change sellers who participated available in the market public sale on Tuesday maintained bids between N446.00 (low) and N462.18 (excessive) per greenback.

Learn additionally: Banks raise FX school fees request time, cut BTA, PTA

On the parallel market, the native forex gained 0.4 % because the greenback traded at N750/$ on Tuesday in comparison with N753 on Monday.

In response to Rewane, Nigeria’s sources of overseas change stay weak as a consequence of sub-optimal oil manufacturing induced by oil theft, capital move reversal owing to world financial tightening and change price premium on the parallel market.

He outlined change price administration as using official insurance policies to affect the change price within the foreign exchange market.

Nigeria’s change price administration consists of managed floating change price, introduction of overseas change window for traders and auctions aside from the official window.

Going via the historical past of change price changes in Nigeria, he stated the parallel market charges deviated farther from

official price when foreign exchange restrictions had been imposed, fuelled inflation and led to sub-optimal Gross Home Product (GDP) progress price.

He stated Nigeria’s GDP progress price was beneath a mean of seven % between 2006-2011.”Change price administration is essential to boosting progress in Nigeria.”

The report made reference to Egypt, which adjusted its forex in November 2016, to unify charges on the parallel and the official markets and this led to a pointy rise in inflation price by 30 %.

The nation’s devaluation was complemented with tight financial and monetary insurance policies to scale back liquidity build-up, consequently, inflation dropped again to single digit, foreign exchange demand backlog was cleared and reserve accrued to $45 billion in 2019.

Chinwe Egwim, chief economist and head of financial analysis at Coronation Service provider Financial institution, stated it’s unclear if the Bola Ahmed Tinubu, President elect’s administration would favor a floating change price regime, however the manifesto states that “the

change price can’t be ignored nor left to the whims of the market”.

She stated wholesome accretion in exterior reserves needs to be recorded by the tip of 2024 which might assist overseas change liquidity and provides the Central Financial institution of Nigeria extra room to defend the naira.