JPMorgan’s Marko Kolanovic is abstaining from the early 2023 rally.

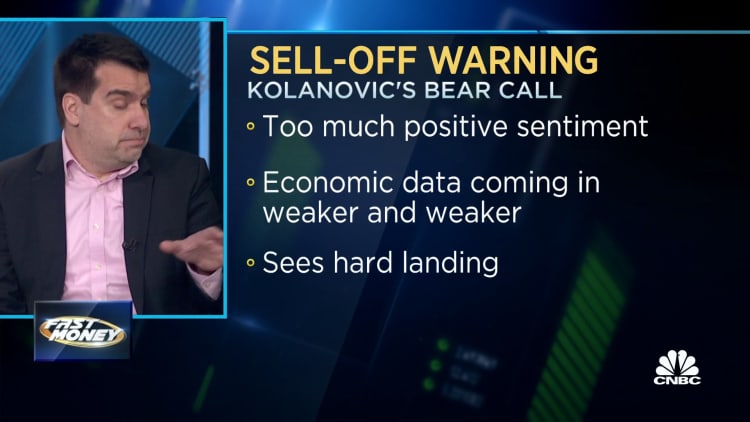

As a substitute, the Institutional Investor hall-of-famer is bracing for a ten% or extra correction within the first half of this yr, telling traders he is “outright unfavourable” available on the market.

“Fundamentals are deteriorating. And, the market has been transferring up. So, that has to conflict sooner or later,” the agency’s chief market strategist and world analysis co-head advised CNBC’s “Fast Money” on Tuesday.

Kolanovic slashed his agency’s publicity to shares final week to underweight. In a current be aware, he warned the market isn’t presently pricing in a recession. His base case is a tough touchdown.

“Quick-term rates of interest moved rather a lot within the final six months, and so they’ll most likely nonetheless go a bit greater and keep there,” he stated. “The patron took numerous debt. Rates of interest went up. The patron was resilient, and that was kind of our thesis final yr… However as time progresses, they’re much less and fewer resilient.”

Kolanovic, who’s ranked because the primary fairness strategist by Institutional Investor for the twelfth time, cites troublesome tendencies in current key financial knowledge — together with ISM providers, retail sales and the Philadelphia Fed Survey as causes to show bearish.

“We predict issues first flip south, get a lot worse,” stated Kolanovic.

But, the tech-heavy Nasdaq is up greater than 8% thus far this yr, and the S&P 500 is up virtually 5%. It closed on Tuesday at 4,016.95.

He lists constructive developments together with China’s reopening from Covid-19 lockdowns and a weaker dollar for market enthusiasm. Kolanovic believes they helped create a story the more serious is behind us and a recession “in some way magically ” occurred final yr.

“I simply do not assume that at 5% charges we will have this financial system functioning,” stated Kolanovic, who famous personal fairness and enterprise capitalists cannot exist in this type of setting. “One thing should give, and the Fed might want to flinch.”

And, it might occur this yr as a price minimize.

“Sooner or later, they’re going to [the Fed] backstop it. So, the large query is the place. Is it [the S&P at] 3,600? 3,400? 3,200? We do not have a really robust conviction. However we do assume decrease is the course,” he stated. “There’s normally some contagion or one thing that occurs surprising.”

Kolanovic lists Treasury bonds and money as viable locations to cover out for now.