The Nigerian might be sentenced on 20 January by a US district courtroom for utilizing about 470 financial institution accounts to defraud at the least 10 American banks.

A Nigerian man, Ahmed Ponle, has pleaded responsible to opening and utilizing 470 faux financial institution accounts to defraud American banks.

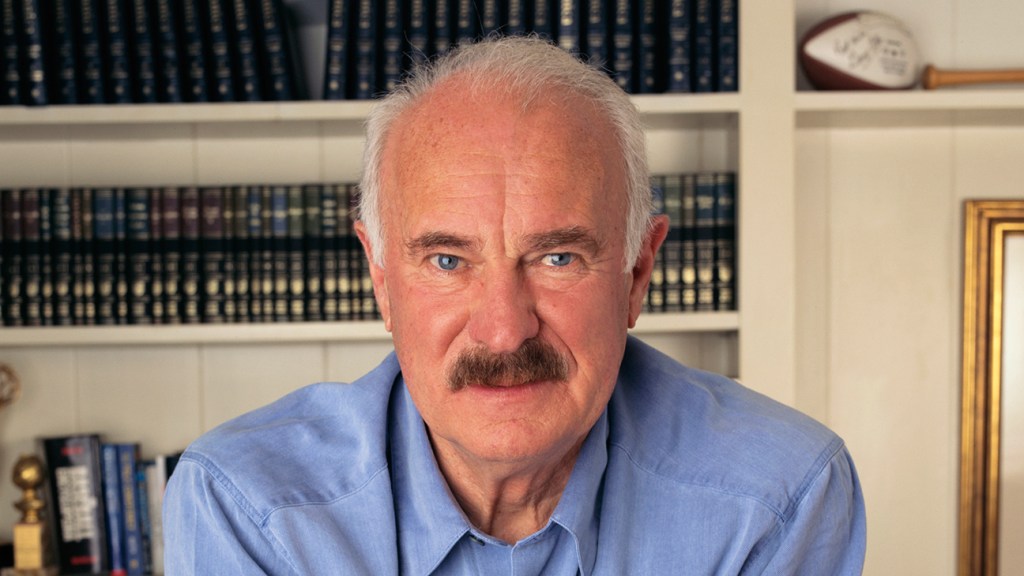

The 42-year-old prolific fraudster pleaded guilt to a financial institution fraud cost on the US District Court docket, District of New Jersey, in April final yr, in response to courtroom paperwork seen by PREMIUM TIMES.

He faces as a lot as 30 years jail time for an offence involving defrauding at the least 10 American banks with practically $6 million publicity.

The district courtroom decide, Noel Hillman, has now scheduled Mr Ponle’s sentencing for 20 January, after sequence of adjournments because the defendant’s responsible plea final yr.

US investigators revealed in courtroom paperwork that Mr Ponle used suspected fraudulent overseas passports bearing faux American visas to open roughly 470 financial institution accounts at numerous American banks’ branches in numerous states.

The fraudulent passports bearing his picture however with faux names have been mentioned to incorporate West African, Kenyan, and Senegalese passports.

He used from a pool of tens of pretend names to open the completely different accounts which additionally bore his {photograph}.

In keeping with US investigators, the acounts had a complete publicity of virtually $5.7 million, implying the quantity the sufferer banks might have misplaced to the rip-off that went on for practically 4 years.

“I need to plead responsible pursuant to this plea settlement,” Mr Ponle acknowledged in a letter he signed on 15 August 2021 after reviewing the plea settlement he entered into with the US authorities along with his lawyer Caroline Cinquanto.

On 7 April 2022, he and his lawyer signed an software for the courtroom’s permission to plead responsible.

“My lawyer has additionally defined to me, and I perceive, that if I plead responsible, I waive my proper to not incriminate myself and I should acknowledge my guilt as charged by setting forth my actions in order that the decide is glad that I’m, certainly, responsible,” he acknowledged.

The US authorities confirmed within the plea settlement filed in courtroom on 7 August 2022, that Mr Ponle cooperated with authorities in investigating his case.

Faces as much as 30 years in jail

However Mr Ponle faces as much as 30 years in jail with a $1 million wonderful and restitution, the utmost penalty for the financial institution fraud cost most well-liked towards him.

Though he and the prosecution have advisable a discount in jail time within the plea settlement, the suggestion is just not binding on the decide.

The plea settlement between the defendant and the US authorities acknowledged that “the sentence to be imposed upon Ahmed Bamidele Ponle is inside the sole discretion of the sentencing decide, topic to the provisions of the Sentencing Reform Act and the sentencing decide’s consideration of america Sentencing Pointers.”

The courtroom doc, seen by PREMIUM TIMES, added that “the Sentencing Pointers are advisory, not necessary and the decide could impose any affordable sentence as much as and together with the statutory most time period of imprisonment and the utmost statutory wonderful.”

Mr Ponle as a part of the responsible plea agreed to forfeit particular property derived immediately and not directly from proceeds traceable to the fee of the offense.

The forfeiture contains $99,700 in Western Union cash orders seized by federal brokers on June 25, 2020 from Snapbox Self Storage Unit 4100, 2240 Island Avenue, Philadelphia.

Not being a US citizen, he might be deported or faraway from the US after serving out his jail time.

How 470 financial institution accounts have been opened

American investigators mentioned Mr Ponle opened at the least 470 sham financial institution accounts in numerous states within the US between June 2016 and June 2020, a interval of three months and 9 months, to defraud at the least 10 American banks.

The prosecution mentioned Mr Ponle, in Camden County, within the District of New Jersey, and elsewhere, knowingly and deliberately conspired and agreed with co-conspirators to defraud a monetary establishment, specifically TD Financial institution and different sufferer banks.

Mr Ponle of Darby, Pennsylvania, is a part of a prolific felony organisation engaged in an enormous financial institution fraud in a number of states, together with New Jersey, Pennsylvania, Maryland, and Rhode Island, between June 2016 and March 2020.

He perpetrated the fraud by opening financial institution accounts utilizing suspected

fraudulent overseas passports and visas at banks’ branches situated in New Jersey and Pennsylvania.

Mr Ponle, together with different conspirators, whose identities haven’t been revealed, stole quite a few enterprise cheques from america mail, altered the names of the payees on the cheques to fraudulent names.

On or about 16 August, 2017, an investigator in one of many Sufferer Banks affected by the fraudulent actions of Mr Ponle contacted america Postal Inspection Service (USPIS) regarding a number of financial institution accounts that have been closed by the financial institution as a consequence of suspected fraudulent exercise.

A consultant advised USPIS that the accounts have been opened utilizing suspected fraudulent overseas passports and visas at branches situated in New Jersey and Pennsylvania.

The accounts had minimal actions within the first two months of its opening which consisted of Western Union, MoneyGram, US Postal cash orders, or money deposits.

After the two-month interval, people deposited massive enterprise cheques into the account and rapidly withdrew the funds both by ATM withdrawals or by buying cash orders at numerous cash order distributors comparable to grocery and low cost shops.

Shortly after the cheques have been deposited, the banks began receiving claims stating the cheques have been stolen and the payee part was altered to indicate somebody that was not meant to obtain the cheque. Though the payee on the cheque was altered, the quantity was not modified.

By October 2017, over 30 fraudulent accounts with a complete publicity of roughly $800,000 to a number of monetary establishments have been recognized.

“To this point, the entire loss to the sufferer banks is roughly $6 million,” US Division of Justice mentioned.

The accounts have been opened at quite a few monetary establishments within the state of New Jersey beneath the assumed names of Wunmi Akrana, Emanuel Kuti, Olawale Johnson, Steven Akpan, Olawole Adefarasin, and Anthony Tunde Camara.

Join free AllAfrica Newsletters

Get the most recent in African information delivered straight to your inbox

Mr Ponle deposited the cheques into financial institution accounts that had been opened with cast overseas passport paperwork (Kenya and Senegal) and fraudulent U.S. visas that matched the names on the stolen cheques.

Completely different names

Mentioning different accounts opened by Mr Ponle to defraud banks, the courtroom doc famous, “from 23 November, 2016 by means of 29 March, 2019, financial institution information revealed that Ponle opened roughly 9 accounts beneath the assumed identify Stephen Snow, eight accounts beneath the assumed identify Macheal Kurum, six accounts beneath the assumed identify Moussa Traore, eight accounts beneath the assumed identify Boubou Niakate, 4 accounts beneath the assumed identify Michael Houle, six accounts beneath the assumed identify Jasper Darrell, one account beneath the assumed identify Emeka Ayanyinka.

“Three accounts beneath the assumed identify Olaribigbe Niakate, seven accounts beneath the assumed identify Kuponu Suszy, six accounts beneath the assumed identify Ebele Johnson, seven accounts beneath the assumed identify Alassane Mbaye, three accounts beneath the assumed identify Chuks Godwin, three accounts beneath the assumed identify of Olajimi Moyo, one account beneath the assumed identify of David Akinyi, one account beneath the assumed identify of Luis Thompson, and one account beneath the assumed identify of Owoola Agada for an estimated meant lack of $1,113,061.66,” the courtroom paperwork revealed.

“To this point, the investigation has revealed that the total extent of the felony exercise recognized to date entails roughly 470 fraudulent financial institution accounts with an estimated publicity of $5.7 million,” it mentioned.