- Sam Bankman Fried, the son of Two Stanford professors and the ex-CEO of FTX alternate, painted himself because the Robin Hood of crypto.

- SBF’s motto was efficient altruism, however in the long run, he didn’t give as a lot as promised to charity.

- FTX’s philanthropic fund, FTX Future Fund, ambition was to donate $1B in new tasks.

- After FTX’s collapse, the workers of FTX Future Fund all resigned.

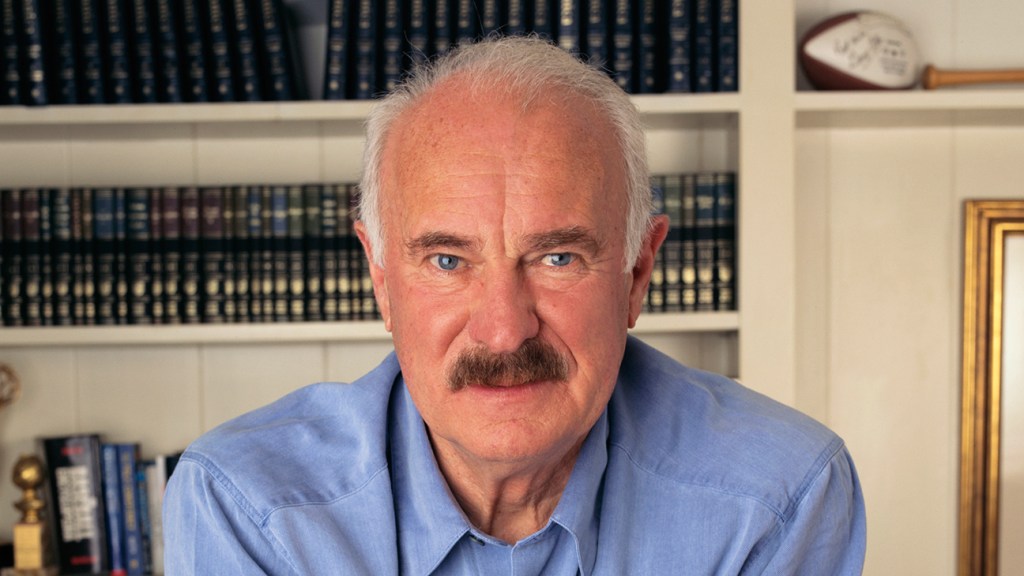

Sam Bankman Fried, the ex-CEO of FTX, was as soon as one of many wealthiest folks in crypto, with an estimated web price of $17.2B earlier than his empire got here all crashing down in November 2022. The son of two Stanford legislation professors who studied physics at MIT and traded ETFs earlier than switching to crypto in late 2017, Bankman-Fried was identified for his beneficiant persona, painted himself because the Robin Hood of crypto, who needed to turn into so wealthy that he would ultimately give all his wealth away. However how a lot of this was only a facade?

Bankman-Fried initially made his wealth via arbitrage alternatives within the crypto trade he exploited at Jane Avenue. He took benefit of the value distinction of Bitcoin, which traded at a better 10% premium in Japan in comparison with the U.S. The chance was there to earn 10% every single day by shopping for bitcoin on a U.S. Change and sending it to a Japanese alternate to promote. With this technique, wealth amassed from $10,000 would flip to $1 billion in lower than 4 months.

At simply 30 years outdated, Sam Bankman Fried went from shopping for his first Bitcoin to changing into a crypto billionaire. His primary objective? To provide all his earnings away to charity.

How A lot Did SBF Donate To Charity?

Based on a report from Sequoia, SBF had adopted the philosophy that “he was going to get filthy wealthy, for charity’s sake.” Based on an interview with CNBC, SBF gave $100M away in 2022 to charity. His motto is efficient altruism; he needed to make as a lot cash as potential so he might donate as a lot out as he might to the world’s most effective charities.

SBF hasn’t been excellent with donating his billions away. In truth, essentially the most vital donations he has made are political. Based on Open Secrets, a platform following donations in politics, SBF is the sixth largest contributor who donated over $36M to Democrats and$235,200 to Republicans.

The FTX Future Fund, his philanthropy group, claims to have dedicated over 160 million in grants however doesn’t specify the place these grants have gone. Following the FTX chapter proceedings, The FTX Future fund’s whole workers resigned on the 11 of November. Based on their resignation letter, there are a lot of grants the fund might be unable to honor.

The fund has had unimaginable ambitions, saying earlier within the yr, that they might make investments $1 billion in new tasks averaging 100M a yr.

Nathan Younger, the director of Head of Forecasting at Zeitgeist, a crypto prediction market that seems to be one of many funds to have obtained $182K by FTX Future Fund, has expressed on Twitter that he’s horrified by the entire charade.

I’m greater than conscious that I’m funded by @ftxfuturefund. And certain the fraud was already occurring when the cash was donated. That weighs on me.

I’m horrified by the conceitedness of this complete charade. And by its all of the folks it would damage.

— Nathan 🔍 (@NathanpmYoung) November 11, 2022

FTX 32 Billion Greenback Collapse

Bankman-Fried’s $32B fortune evaporated after revelations of large illiquid property on Alameda’s & FTX’s steadiness sheets. It’s reported that FTX had illegally siphoned consumer funds from the alternate to Alameda.

“I’m deeply sorry that we acquired into this place and for my position in it,” Bankman-Fried tells workers after his resignation. “I Fucked Up”.

In an interview revealed by Bloomberg, the secretary of the US Treasury additionally commented on FTX’s collapse.

“It exhibits weak spot in the complete sector,” Yellen mentioned. ” The notion that you may use the deposits of shoppers of alternate and lend them a separate enterprise that you simply management to do dangerous leveraged investments – this wouldn’t be one thing that’s allowed.