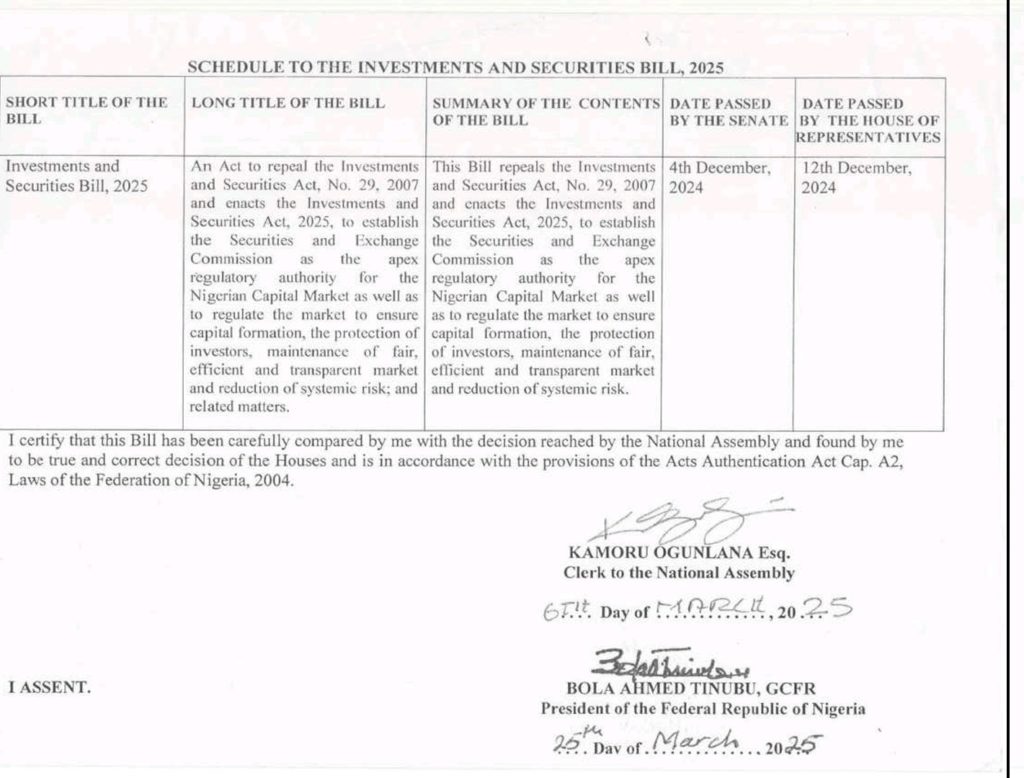

On March 25, 2025, Nigeria took a decisive step towards regulating its fast-growing cryptocurrency sector. President Bola Tinubu signed the long-awaited Investments and Securities Act (2025), changing the outdated 2007 model. Buried within the 226-page doc is a landmark provision: digital property at the moment are recognised as securities.

The brand new legislation marks the clearest regulatory framework Nigeria has ever given the sector. It provides the Securities and Change Fee (SEC) wide-ranging authority over the issuance, buying and selling, and promotion of digital property, legalising crypto below capital market guidelines.

The SEC can now monitor the actions of securities exchanges, conduct audits, impose penalties, droop firm operations, and even take away their executives. Whereas the legislation legitimises crypto, questions linger over how its enforcement will unfold.

A framework years within the making

Crypto’s authorized standing in Nigeria has lengthy been murky. In 2021, the Central Financial institution of Nigeria (CBN) barred banks from processing crypto-related transactions, successfully shutting crypto startups out of the formal monetary system. Startups tailored by routing funds by means of offshore banking companions or pivoting to peer-to-peer (P2P) fashions.

The SEC issued sporadic circulars and launched the Accelerated Regulatory Incubation Programme (ARIP) in June 2024—a regulatory sandbox—however Nigeria by no means formalised a complete framework till now.

Below the ISA 2025, a digital asset is “a digital token that represents property corresponding to a debt or fairness declare on the issuer” and contains any asset issued on a blockchain. This definition captures cryptocurrencies like Bitcoin and Ether, stablecoins, safety tokens, and probably tokenised real-world property used as investments or that maintain buying and selling worth.

The Act additionally grants the SEC oversight of token issuers, together with meme coin creators and initiatives elevating funds by means of utility or investment-based cash (preliminary coin choices). Creating and selling tokens with buying and selling worth or supposed to behave as shops of worth will now face tighter regulatory scrutiny.

Implications for startups and international operators

Earlier than the ISA was signed into legislation, the SEC mandated digital asset exchanges and international operators to arrange a bodily presence in Nigeria to make sure nearer supervision. With full regulatory backing now in place, that requirement is prone to be enforced extra firmly. This raises issues for native startups that rely closely on international infrastructure suppliers like Stellar, Ethereum, Solana, Polygon, and developer instruments corresponding to Alchemy or Infura.

Web3 startups like Sytemap, a Nigerian Web3 actual property market, use the Stellar blockchain to retailer property and transaction data. Others depend on international APIs and infrastructure to supply crypto wallets, blockchain funds, run analytics, and handle core backend providers.

Startups construct their decentralised finance (DeFi) apps on low-cost blockchains like Stellar. In addition they combine stablecoins like USDC and USDT by connecting to the infrastructure supplied by Circle and Tether, two of the world’s largest stablecoin suppliers. International infrastructure suppliers supply the constructing blocks that make native startups viable.

However the want for native compliance by these international infrastructure suppliers will finally depend upon how the SEC enforces its mandate. If the regulator imposes strict necessities on international gamers, it may set off resistance, probably affecting native builders who depend on their instruments and networks.

“We constructed our tech stack on Stellar due to the immutability benefit, plus we needed to restrict how usually we transfer issues round,” mentioned Ndifreke Ikokpu, CTO and co-founder of Sytemap, a Nigerian blockchain-based actual property market. “We’re compliant with native client and knowledge privateness legal guidelines, however the provisions of the Act don’t fairly apply to us now, except we begin buying and selling. And that’s not one thing we’re interested by.”

A few of these blockchain networks—like Stellar, which funds Nigerian Web3 startups by means of its Stellar Growth Basis scheme; Sui; Solana; and Lisk—present funding to Nigerian Web3 builders, serving as essential different sources of capital throughout slowdowns.

But, regulating international blockchain infrastructure gamers is a two-sided coin.

The Stellar blockchain has a utility token referred to as $XLM. If $XLM is classed as a ‘safety’ in Nigeria, primarily based on the SEC’s definition, compliance obligations would usually fall on a number of events.

Crypto exchanges that facilitate the shopping for, promoting, or buying and selling of $XLM can be categorized as securities exchanges and should adjust to native legal guidelines. Retail buyers may very well be paying tax on capital positive aspects—earnings produced from promoting property like $XLM at the next value than they purchased it—if the tax invoice for digital property goes by means of.

But when Stellar itself points or promotes its coin to Nigerian retail buyers, it could even be topic to native compliance.

“It’s a value versus profit factor,” mentioned Timothy Mark-Ugwumba, a Web3 and fintech compliance supervisor. “If these international gamers see that they’re benefitting extra from the ecosystem, they’ll are available. However we clearly want them.”

Smaller crypto startups may very well be neglected

The legislation nonetheless leaves gray areas. First, it doesn’t clearly outline how non-trading platforms like prediction markets, crudely referred to as “crypto playing platforms,” and Web3 gaming apps utilizing tokens shall be handled. With out clearer steerage, startups threat unintentionally violating securities legal guidelines.

“The ISA 2025 is a constructive and vital evolution for the digital asset area in Nigeria,” mentioned Ayotunde Alabi, CEO of Luno Nigeria, an area crypto trade. “That mentioned, the implementation shall be simply as vital because the laws itself. The chance of overregulation exists if frameworks are utilized rigidly or with out sufficient session, notably for startups and early-stage innovators.”

Second, whereas the Act empowers the SEC to create regulatory sandboxes and licence operators, current mechanisms like its ARIP nonetheless face bottlenecks. The price of making use of for ARIP is over ₦2 million ($1,245), and prices may rise as startups undergo extra regulatory steps.

Latest due diligence audits, by regulators and startups, have uncovered gaps in how crypto platforms monitor transactions. In response, the SEC mandated operators to undertake Chainalysis, a blockchain analytics software, to watch transactions and strengthen compliance. This will increase operational bills for smaller gamers, making it tough for them to take part.

That is the place a tiered licencing system, just like the one utilized in conventional finance, may very well be helpful. With out it, regulators threat regulating each crypto startup like a full-fledged fintech or financial institution. That is counter-productive as a result of, in contrast to conventional finance, crypto and digital property haven’t hit the vital mass market that drives the type of demand seen with banking options and fintechs. Because of this, this expectation may very well be unrealistic and probably turn out to be a blocker.

“The ISA could result in innovation focus amongst just a few licenced gamers, particularly if licencing turns into pricey and selectively utilized,” mentioned Mark-Ugwumba. “The SEC’s ₦500 million ($311,000) capital requirement, for instance, may block out startups that really have promising options.”

He provides that the Act locations practically the identical compliance burden on startups as on banks. However in contrast to banks, crypto startups don’t have the identical capital or entry to experience. The absence of a tiered system means smaller gamers may very well be squeezed out earlier than they even get an opportunity.

Restoring institutional investor confidence

Belief is the inspiration of any monetary system, and in Nigeria’s crypto sector, it has been strained.

In 2024, Nigeria was locked in a regulatory tussle with Binance, a international crypto trade, which led to tighter scrutiny throughout the complete sector and prompted different exchanges like KuCoin and OKX to exit the market. The standoff rattled customers and decreased transaction volumes as Binance locked Nigerians out of its system. This pushed customers towards different crypto platforms like Bybit, Bitget, and native exchanges.

Whereas this shift offered a possibility for native crypto startups to win again clients from international operators, the dearth of readability round crypto and P2P buying and selling grew to become a blocker. Coupled with the crypto market downturn in early 2024, Nigerians had been cautious; they weren’t transacting crypto, and this squeezed income for startups.

Funding has additionally been a bane for African Web3 startups. Whereas there was a decline globally, international exchanges have usually raised more cash than homegrown gamers, which proceed to wrestle to lift capital.

Some Web3 startups usually department out of VC area to hunt different funding routes. For instance, Scorefam, a Nigerian sports-based gaming startup, raised $25 million in 2022 by means of an preliminary coin providing (ICO). In whole, African blockchain startups acquired $135 million in 2023—about 4.2% of the overall funding—and by H1 2024, they had been on monitor to obtain lower than this quantity.

What may change the tide is regulatory readability. The brand new Investments and Securities Act (ISA) provides Nigeria’s SEC the ability to demand white papers, implement disclosures, and set caps on retail crypto investments. These guidelines carry transparency and construction, serving to restore belief amongst cautious buyers and growing demand for crypto.

“Investor confidence is about notion as a lot as coverage,” says Mark-Ugwumba. “Many buyers don’t absolutely perceive the tech, however they should know their funding received’t be worn out in a single day by regulatory motion. The ISA introduces protections like shopper fund segregation and promoter due diligence, which conventional buyers search for.”

With the demand for crypto reaching the mass market, it’ll enhance income for startups. That, in flip, may reignite institutional curiosity.

Energetic Web3 buyers, like Adaverse, which has slowed its funding prior to now 12 months, instructed TechCabal it stays “optimistic about clearer crypto rules throughout Africa.”

NFTs and prediction markets nonetheless want readability

One of many least mentioned areas is how the legislation treats digital property that aren’t tied to buying and selling. Take non-fungible tokens (NFTs), for instance. Although NFTs haven’t been categorized as digital property, they may qualify as such below the ISA in the event that they signify funding alternatives.

A collectible NFT tied to paintings could not want registration. However whether it is fractionalised or tied to profit-sharing, like membership and society-based NFTs, which maintain particular funding rights, it is going to be regulated.

Previously, Nigerian musicians have issued NFTs as a solution to promote music rights or restricted merchandise. If executed as collectibles, they fall outdoors the SEC’s radar. But when positioned as income-generating property, they may very well be seen as securities.

Prediction markets even have the air of regulatory uncertainty round them. These platforms enable customers to guess on outcomes, from soccer scores to elections. Soccersm and Scorefam are examples in Nigeria.

Globally, regulators have debated the legality of prediction markets. The US classifies them as by-product contracts, which locations them below the regulatory purview of the Commodity Futures Buying and selling Fee (CFTC).

In Nigeria, the SEC oversees all commodity exchanges and derivatives buying and selling. Nevertheless, the regulator hasn’t mentioned a lot about regulating crypto prediction markets. The director basic, Emomotimi Agama, famous on a stakeholder engagement name on April 14 that the Fee plans to progressively have interaction with extra nuanced platforms like these, beginning with the obvious trading-focused ones.

“As soon as NFTs kind inside our purview, they are going to be handled in response to the foundations and rules,” mentioned Agama on the decision. “The ISA gives a broad legislation, and below the broad legislation, we’ll create specifics that can cope with improvements in crypto.”

How briskly will issues transfer?

Execution shall be gradual. The SEC solely just lately started actively partaking with startups by means of the ARIP, and a freeze on provisional crypto licences in April nonetheless highlights inside studying gaps.

Comparatively, South Africa’s Monetary Sector Conduct Authority (FSCA) has made extra progress by working slowly and collaboratively with the sector. Nigeria is already on this path, aiming to achieve a deeper understanding of blockchain expertise.

The ISA will not be absolutely shaped or clear about how all elements of the crypto sector shall be handled but. However it’s the strongest sign that Nigeria is severe about constructing a steady, accountable digital asset ecosystem. For a sector used to uncertainty, that’s a really large win.