GBP/USD to stay above 50 day transferring common till US debt ceiling disaster resolved

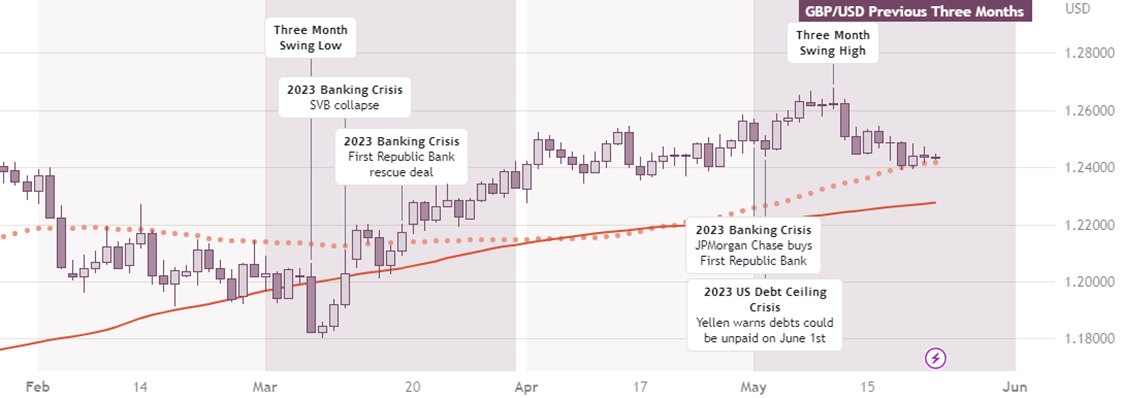

In March, the worth of the British pound reached a low of 1.18 towards the US dollar, which strengthened after Federal Reserve Chair Jerome Powell commented that larger rates of interest are wanted to regulate inflation.

Nonetheless, a number of days later, the Silicon Valley Financial institution (SVB) collapsed, which started the ‘2023 Banking Disaster’. This weakened the USD, as traders theorised that the Federal Reserve would want to chop charges to keep away from deepening the disaster. Because of this, the GBP has been rising in worth towards the USD since then. Read more …

GBP/USD Forecast: Pound Sterling stays fragile

GBP/USD has misplaced its traction within the early European morning on Tuesday and touched its lowest degree in a month, barely under 1.2400. The pair’s near-term technical outlook means that sellers retain management. Bank of England (BoE) Governor Andrew Bailey will testify on financial coverage earlier than the UK Treasury Choose Committee and traders will proceed to pay shut consideration to danger sentiment.

Following Monday’s face-to-face assembly, US President Joe Biden and Home Speaker Kevin McCarthy failed to achieve a deal to carry the federal government’s $31.4 trillion debt restrict, inflicting markets to stay cautious. Early Tuesday, US inventory index futures commerce blended and a damaging shift in market temper within the second half of the day might permit the US Greenback (USD) to protect its power. Read more …

GBP/USD drops to over one-month low, additional under 1.2400/50-day SMA on weaker UK PMIs

The GBP/USD pair comes beneath some renewed promoting stress on Tuesday and drops to over a one-month low throughout the first half of the European session. The pair is at present positioned slightly below the 1.2400 round-figure mark, down round 0.35% for the day, confirming a contemporary breakdown via the 50-day Easy Transferring Common (SMA).

A mixture of things lifts the US Greenback (USD) again nearer to its highest degree since March 20 touched final Friday, which, in flip, is seen dragging the GBP/USD pair decrease. The in a single day hawkish remarks by a slew of influential Federal Reserve (Fed) officers reaffirmed expectations that the US central financial institution will hold curiosity rates larger for longer. Read more …

Data on these pages comprises forward-looking statements that contain dangers and uncertainties. Markets and devices profiled on this web page are for informational functions solely and mustn’t in any means come throughout as a suggestion to purchase or promote in these belongings. It’s best to do your individual thorough analysis earlier than making any funding choices. FXStreet doesn’t in any means assure that this data is free from errors, errors, or materials misstatements. It additionally doesn’t assure that this data is of a well timed nature. Investing in Open Markets includes a substantial amount of danger, together with the lack of all or a portion of your funding, in addition to emotional misery. All dangers, losses and prices related to investing, together with complete lack of principal, are your duty. The views and opinions expressed on this article are these of the authors and don’t essentially replicate the official coverage or place of FXStreet nor its advertisers. The creator is not going to be held answerable for data that’s discovered on the finish of hyperlinks posted on this web page.

If not in any other case explicitly talked about within the physique of the article, on the time of writing, the creator has no place in any inventory talked about on this article and no enterprise relationship with any firm talked about. The creator has not obtained compensation for writing this text, aside from from FXStreet.

FXStreet and the creator don’t present customized suggestions. The creator makes no representations as to the accuracy, completeness, or suitability of this data. FXStreet and the creator is not going to be answerable for any errors, omissions or any losses, accidents or damages arising from this data and its show or use. Errors and omissions excepted.

The creator and FXStreet will not be registered funding advisors and nothing on this article is meant to be funding recommendation.