In 2024, on the launch of PaidHR’s cross-border payroll product, Seye Bandele, the CEO and co-founder of the Nigerian HR-tech upstart, spoke to TechCabal in regards to the firm’s plans to incorporate extra fintech-adjacent merchandise.

On the time, we requested if PaidHR—which processed over ₦29 billion ($18 million) in employees salaries in that very same yr—was venturing into fintech; the reply was a definitive no.

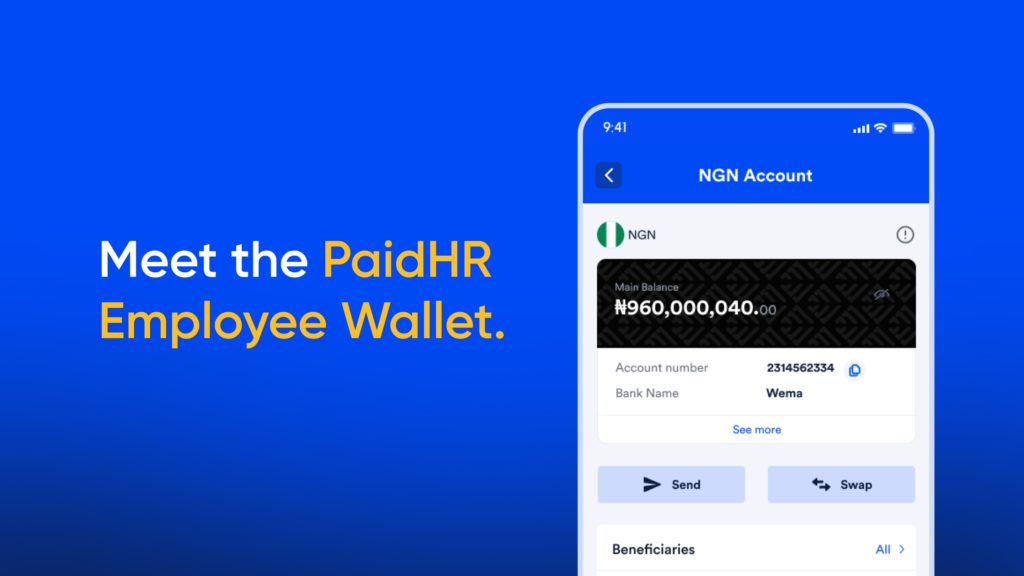

Months after our dialog, the HR-tech startup launched an worker pockets app that permits workers to entry and spend their wages without having to switch to a financial institution. The pockets app, which at present processes over ₦1.3 billion ($835,134) month-to-month, has triggered a knee-jerk response: “Yet one more startup promoting airtime.”

PaidHR’s playbook isn’t new. International HR-tech firms like Deel, Distant, and Rippling have adopted an identical arc—beginning with payroll, then embedding monetary companies to deepen person engagement and drive income. Deel affords world payroll with built-in wallets and a Deel Card, enabling cross-border employees to carry and spend earnings. Rippling, which started as an HR platform, now contains company playing cards, expense administration, and monetary automation. Distant additionally facilitates multi-currency funds and localized advantages. PaidHR’s evolution mirrors this path.

Blurring the strains between HR and fintech

PaidHR launched in 2021 with a easy thesis: if you wish to enhance productiveness in Africa, you might want to repair how folks work and the way they receives a commission. The corporate launched its core HR and payroll software program for small and medium companies, layering totally different performance over time: Earned Wage Entry (EWA) in 2023, cross-border payroll in 2024, and now a pockets product that permits workers to entry and spend their wages without having to switch to a financial institution.

Every characteristic solved a person ache level. EWA, which disbursed ₦150 million ($93,803) final yr, tackled liquidity gaps. Cross-border payroll simplified compliance and FX danger for distant groups. And the pockets? That’s the place the cash stays and will get spent.

“Any person takes an advance of ₦5,000 however finally ends up with ₦4,700 after expenses,” Bandele stated. “Then he has to pay extra charges simply to ship it to a financial institution or Opay. It didn’t make sense. We constructed utility immediately into the pockets. Airtime, meals, payments—every little thing he already spends on.”

Since PaidHR had an present expertise that gives an employer pockets, it was simple to offer an worker pockets, Bandele stated.

Observe the cash

PaidHR’s pockets has processed ₦1.3 billion ($835,134) in transaction quantity month-to-month since inception. That’s the portion of salaries that workers select to maintain contained in the platform as an alternative of cashing out.

1. Worth-Added Providers (VAS) Margin

In response to Bandele, most pockets spend goes towards airtime, knowledge, energy payments, and transportation—routine however high-frequency bills. PaidHR doesn’t supply these companies immediately; it aggregates licensed companions and takes a reduce of every transaction.

If 10% of the ₦1.3 billion is spent on these VAS channels and PaidHR earns a 2% margin via income sharing, that’s ₦2.6 million in “passive” income per 30 days—₦15.6 million during the last six months.

That’s 0.2% of belongings underneath administration (AUM) generated with out lending, danger, or buyer acquisition prices.

2. Float Leverage by way of EWA

By conserving cash in-app, PaidHR additionally positive factors management of float, which might fund earned wage entry. It’s successfully recycling employer payroll funds into worker credit score with out exterior financing.

Staff withdraw wages early, spend in-app, and the platform will get paid twice—as soon as on the credit score unfold and once more on the utility margin.

3. Cross-Border Payroll Margins

The platform additionally facilitates multi-currency payroll throughout 49 international locations. PaidHR earns charges on FX and disbursement, particularly for employers with distributed groups. “The complete cross-border rail sits on the pockets infrastructure,” Bandele stated.

The corporate doesn’t escape FX margins, however in comparable platforms, they will vary between 1.5–3%, relying on the vacation spot.

HR infrastructure, Fintech economics

Regardless of the fintech-style income mechanics, PaidHR nonetheless identifies as an HR firm. Its greatest earnings stream stays subscription charges paid by employers to handle payroll and employees.

However the strains are beginning to blur.

Employers fund pockets accounts month-to-month to run payroll. Staff more and more preserve their wages on the platform to avoid wasting, spend, or borrow. And PaidHR captures margin at each node.

“Individuals spend the place they earn,” Bandele stated. “We’re simply making it seamless to do each.”

The platform now companions with licensed fintechs like Risevest to supply financial savings and FX choices immediately from the pockets. Payroll has change into a gateway into broader monetary habits.

What comes subsequent

PaidHR is elevating a seed spherical and trying to broaden throughout Nigeria into different West African international locations in addition to East Africa. Worldwide employers can already pay African employees in {dollars} or native foreign money via the platform. The following section could contain extra embedded finance—healthcare, insurance coverage, and transport.

Requested if the pockets or FX rails will finally overtake subscriptions because the core enterprise, Bandele didn’t rule it out. “We’ll see,” Bandele stated.

But when the present numbers are any information, the logic is obvious:

The extra money PaidHR strikes, the extra it makes. Whether or not or not it calls itself a fintech.