Oil manufacturing from onshore and shallow-water fields in Nigeria is in decline as the majority of manufacturing strikes to offshore fields the place worldwide oil firms (IOCs) dominate, and analysts say this might influence the nation’s oil revenues.

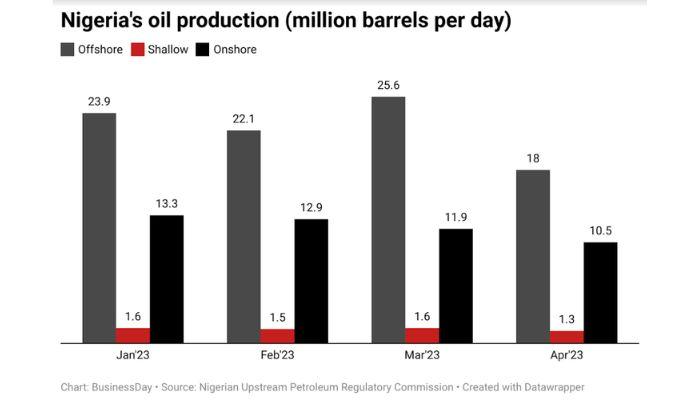

In line with information from the Nigerian Upstream Petroleum Regulatory Fee (NUPRC), Nigeria’s complete oil output from January to April averaged 22.4 million barrels from offshore, 12.2 million from onshore, and 1.5 million from shallow-water fields.

The pattern alerts a shift from Nigeria’s conventional onshore oil fields, the place manufacturing has stagnated as a result of militancy, pipeline vandalism, and oil theft.

With IOCs dominating offshore manufacturing, the Nigerian Nationwide Petroleum Firm Restricted (NNPC), is struggling to keep up its share of the nation’s oil output, elevating considerations concerning the long-term sustainability of the nation’s oil trade.

Nigeria’s oil and gasoline manufacturing construction is principally cut up between JV with NNPC onshore and shallow water and Manufacturing Sharing Contracts (PSC) in deepwater offshore.

IOCs started abandoning onshore fields when sabotage of oil pipelines by vandals and oil thieves grew to become a norm. The scenario was made worse by NNPC’s incapacity to pay its share of prices for oil manufacturing.

“The decline in JV manufacturing is problematic for Nigeria’s financial system because it deprives the nation of much-needed income,” mentioned Ndubuisi Okereke, a lecturer within the petroleum engineering division on the Federal College of Know-how Owerri.

“Pressing motion is required to handle the problems affecting onshore manufacturing and appeal to funding within the sector to make sure the long-term sustainability of Nigeria’s oil trade.”

In line with Okereke, IOCs moved offshore due to the disturbances from Niger Delta youths and different community-related issues, together with pipeline sabotage. Nonetheless, NNPC has made severe progress in stemming the instances of oil theft.

For Uwaye Omijie, a petroleum manufacturing engineer at Midwestern Oil and Gasoline Firm, if all manufacturing services in Nigeria have been on land, we could have points exporting crude oil. That can imply the financial system can be down as a result of low income from oil.

In April this yr, Nigeria’s common crude oil manufacturing fell to 998,602 barrels per day (bpd), the bottom in seven months, in line with NUPRC information.

Oil and gasoline analysts have pinned the latest decline on the shutdown of actions on the Forcados oil terminal, one in all Nigeria’s main export terminals, which is a JV. In line with specialists, the oil terminal has been shut down for 2 weeks. Additionally, strike motion on the Nigerian unit of ExxonMobil has minimize off manufacturing.

In line with information from NUPRC, complete crude oil manufacturing from the Forcados oil terminal declined by 28 % from 6.8 million barrels in January to 4.8 million barrels in April.

Learn additionally: Nigeria’s oil rig falls first time in 8 months as production dips

“It’s extra worthwhile for IOCs to go offshore as a result of the deeper the offshore, the extra the inventory oil. No group points, much less safety deal with, and most significantly the straightforward entry to export the crude,” Omijie mentioned.

“These land areas have been doing effectively for Nigeria and have been operated by the multinationals, till not too long ago when too many group points, pipe vandalism, and oil theft emerged. And upon this, you continue to pay expenses to the federal government.”

Omijie added that regardless of deep offshore being dearer, producing crude oil is way safer. IOCs took benefit of promoting their troubled land areas to the federal government and indigenous firms and focus on deepwater manufacturing.

Okereke additional mentioned that IOC’s skilled conduct helps optimise offshore manufacturing. Nonetheless, indigenous marginal area operators might want to up their sport by way of higher skilled conduct and administration of their belongings.