This is Follow the Money, our weekly series that unpacks the earnings, business, and scaling strategies of African fintechs and financial institutions. A new edition drops every Monday.

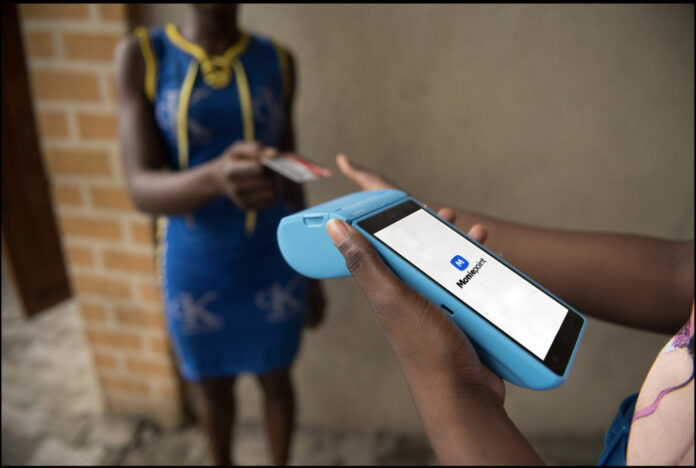

In 2015, Moniepoint, then TeamApt, one of Nigeria’s most prominent fintechs, was building payment infrastructure for banks. By 2025, it was no longer a company in the shadows. It had become one of the most important pipes through which Nigeria’s informal economy moves money.

Founded as a back-end technology provider, TeamApt built payment infrastructure for banks before it started courting merchants directly in 2019 as Moniepoint. That year, it crossed 100,000 daily transactions. In 2023, TeamApt rebranded as the name of its flagship product, Moniepoint. According to the company, the move was a testament to the success of Moniepoint and part of a desire to bring the company closer to its customers.

By 2025, it processed ₦412 trillion ($297 billion) and handled over 14 billion transactions.

Between 2019 and 2025, Moniepoint has moved from being a merchant acquiring company with strong distribution to becoming something closer to a national infrastructure, with payments as the hook, credit as the engine, and product depth as the lock-in.

Moniepoint’s early start as a backend provider gave it visibility into transaction flows, failure points, settlement bottlenecks, and how banks break under volume. That knowledge shaped its expansion into Point of Sale (PoS) acquiring, agency banking, and credit.

Moniepoint’s 2025 numbers reveal a shift from agency banking. Its payment terminal had become one of the major processors for everyday commerce at supermarkets, restaurants, small retail shops, fuel stations, traders, and informal businesses.

Moniepoint did not disclose a full channel breakdown for 2025, but it noted that “8 out of 10 in-person payments in Nigeria are made with Moniepoint.” It also said it processed ₦8 billion ($5.77 million) daily for restaurants, ₦1.7 trillion ($1.23 billion) at bakeries, and ₦90 million ($64,909) at gyms daily.

Moniepoint’s transaction volumes show how quickly digital payments are scaling in Nigeria, especially over the last two years. Alongside OPay and PalmPay, the fintech unicorn has been one of the biggest beneficiaries of this growth.

According to data from the Nigeria Inter-Bank Settlement System (NIBSS), the country’s central payment gateway processed 9.6 billion transactions worth ₦600 trillion ($432.73 billion) in 2023. One year later, it processed ₦1.07 quadrillion ($771.69 billion) in transaction value.

Based on Moniepoint’s 2025 figures, its total transaction value of ₦412 trillion is equal to 38.5% of NIBSS’s full-year 2024 transaction value.

How much of ₦412 trillion becomes revenue?

Moniepoint processed ₦412 trillion in 2025, but what percentage became revenue?

The Revenue Reality Check

Visualizing Moniepoint’s ₦412 Trillion Volume

0.30%

Est. Payment Revenue

₦1.24T

Net Interest Income

₦180B

Moniepoint Est. Revenue

Vs. Big 8 Banks (₦514bn)

At this rate, Moniepoint isn’t just a fintech; it generates 2.4x the electronic fee revenue of Nigeria’s 8 largest banks combined.

Methodology: Payment Revenue = ₦412T Vol × Take Rate. Interest = (₦1T Loans × (1-NPL%)) × 20% APR.

Bank Benchmark: ₦514bn (9-month e-fees for Access, GTCO, etc.).

Because it is a merchant acquirer and payment processor at scale, Moniepoint’s business model depends on volume rather than high pricing.

Transaction fees in payments are usually thin. For instance, Kuda, a Nigerian fintech, charges a merchant service commission of 0.5% per PoS transaction, capped at ₦1,000.

For Moniepoint, its estimated transaction fee could sit anywhere between 0.1% and 0.5%, depending on channel mix (PoS, transfers, bills, collections), pricing caps, and incentives. Although a CBN guideline puts the maximum take rate at 1.25%.

Using ₦412 trillion as the total transaction value across all its platforms, the estimated gross revenue could look like:

· Low case (0.10%): ₦412 trillion × 0.10% = ₦412 billion ($297.14 million)

· Mid case (0.30%): ₦412trillionn × 0.30% = ₦1.24 trillion ($894.31 million)

· High case (0.50%): ₦412 trillion × 0.30% = ₦2.06 trillion ($1.49 billion)

This is not net profit, or even net revenue. It does not take into account costs, incentives, chargebacks, fraud losses, and settlement expenses.

In the first nine months of 2025, eight of the country’s biggest banks, including Access Holdings Plc and Guaranty Trust Holding Company (GTCO) Plc, earned ₦514.82 billion ($371.29 million) from electronic payment fees.

Banks earn a commission on every transfer: ₦10 for transactions below ₦5,000; ₦25 for transfers between ₦5,001 and ₦50,000; and ₦50 for anything above ₦50,000.

While Moniepoint earns ₦20 on interbank bank transfers, its estimated revenue from payment was calculated with a blended rate because its 2025 presentation does not break down transaction value by channel. In 2023, the company said it was processing transactions profitably.

For its loan income, Moniepoint disbursed over ₦1 trillion ($721.22 million) in 2025. The company claims that its non-performing loans (NPLs), a loan when payments of principal or interest are overdue by 90 days or more, are small.

According to the Central Bank of Nigeria (CBN), NPLs rose to 7% in 2025. Assuming Moniepoint’s NPL ratio is closer to 10% of disbursed loans, that implies roughly ₦900 billion ($649.09 million) of the loan book remained performing. At an annual interest rate of at least 20%, that could translate to around ₦180 billion ($129.82 million) in gross interest income, depending on average outstanding balances and loan tenors.

Moniepoint’s growth between 2023 and 2025

Transactions

In 2023, Moniepoint processed 5.2 billion transactions and $182 billion in transaction value. It disclosed that 3.3 billion transactions were made on its terminals. It also said $92 billion of its transaction value was bank transfers, and it processed $194 million in airtime and bill payments.

Two years later, the company processed over 14 billion transactions and ₦412 trillion in transaction value.

According to Moniepoint, it has over one million active terminals and processes ₦10 trillion monthly. Annualised, that is ₦120 trillion.

For context, the CBN said total PoS transaction value amounted to ₦223.27 trillion ($161.03 billion) in 2025. Nigeria had 5.90 million active PoS terminals as of March 2025. PoS transactions between January and June 2025 totalled ₦147.19 trillion ($106.16 billion), according to the CBN.

These figures show that Moniepoint now controls about half of Nigeria’s PoS economy. In 2023, Moniepoint had over two million businesses onboarded. By 2025, the number of active businesses had grown to over six million.

Credit matured

Like most banks, Moniepoint has used the breadth of the transaction data flowing through its network to expand into lending.

In 2023, it disbursed $71 million in working capital loans. By 2025, the figure rose to over ₦1 trillion ($721.22 million) in loans to small businesses, reporting a 36% increase in transaction value after the loans were issued.

About 30% of these loans are recurring. Moniepoint said its NPL remains low, largely because payment data from its platform allows it to underwrite credit for businesses with visible cash-flow patterns.

To support its lending operations and build deposits, Moniepoint relaunched its savings product in 2025.

Cards moved from usage to habit

PoS relationships are strong, but they are merchant-first. Card usage is where a business builds stickiness.

In 2023, Moniepoint recorded 72 million unique cards used on its terminals. By 2025, it had grown its card users by 200%, and its card was used 1.7 million times daily.

It also said its personal banking customers had grown from over three million personal and business accounts in 2023 to over six million businesses and over 16 million individuals banked.

Monnify stopped being a side quest

In 2023, 1,800 businesses processed payments through Monnify, Moniepoint’s web payments platform, amounting to $13 billion.

In 2025, Monnify processed ₦25 trillion ($18.03 billion) and launched direct debit, pushing deeper into automated collections.

From using global rails to becoming part of the rails

In 2025, Moniepoint said TeamApt, its switching subsidiary, secured certifications from Mastercard and Visa to support international card payments and offer these services to other businesses.

This shift means the business won’t only be processing payments for itself but for others. It is shifting from just using global rails to becoming part of the rails.

Product stacking got serious: Moniebook is a lock-in play

In 2025, Moniepoint launched Moniebook, positioning it as a business management platform that unifies payments and bookkeeping.

Once a merchant runs collections (payments), records (bookkeeping), and later inventory/payroll/tax through the same platform, then Moniepoint stops being the POS provider to the business’s operating system.

In April 2025, Moniepoint launched Monieworld, a remittance product that allows UK residents to send money directly to any Nigerian bank account.

Moniepoint did not include Monieworld’s transaction numbers in its presentation, but said word-of-mouth has been its biggest acquisition channel.

UK regulatory filings show the company is betting $7.39 million on its United Kingdom (UK) play, and it has spent $3.77 million since February 2024.

Between February and December 2024, it spent $1.26 million (reported as a loss) on administrative and infrastructure expenses, and another $2.51 million as equity deposit for its acquisition of Bancom, an electronic money institution regulated by the UK’s Financial Conduct Authority (FCA).

The UK is home to over 290,000 Nigerians and is a crucial remittance corridor. In 2021, Nigeria ranked as the third-largest recipient of remittances from the UK, with inflows worth £2.76 billion ($3.69 billion). Moniepoint wants a slice of this market, competing with players like Grey and Lemfi.

National MFB licence means scale and scrutiny

In 2025, Moniepoint got a National MFB licence as the Central Bank of Nigeria moves to align fintech’s licencing structures with its real operational footprints.

National licences come with expectations: more compliance, more visibility, more pressure to behave like an institution. They also come with legitimacy and room to expand formal banking services at scale.

The cost of scale

Moniepoint’s growth has not only come from technological sophistication. People have been a crucial part of its engine.

The company increased staff strength from 1,800 employees in 2023 to over 3,300 full-time employees spread across 19 countries and five continents.

Between 2023 and 2025, Moniepoint has moved through three phases. It began with building a distribution channel, which included a big PoS footprint, high merchant adoption, and credit access. This compounded into payments at the national scale, credit at the institutional scale, and product stacking. It is currently deepening its infrastructure play by expanding it processor/acquirer ambitions, national licensing, and diaspora corridor entry.

While Moniepoint’s growth has been impressive, its next chapter will not be won by hype.

Moniepoint is betting harder on credit, and this turns ugly fast. First HoldCo, parent company of Nigeria’s oldest bank, First Bank, wrote off ₦748 billion ($539.47 million) in bad loans in 2025, crashing its profit by 92%.

In 2025, Moniepoint solidified its stake in Nigeria’s payment rails. In 2026, it will need to prove stickiness as the CBN cracks down on PoS and tightens its grip on digital payments.