This can be a growing story.

Replace: A earlier model of this story acknowledged that CBEX may need swept away over ₦1 trillion. Whereas anecdotal claims on-line have prompt this determine, TechCabal has verified losses totalling a whole bunch of hundreds of {dollars} throughout a number of victims. We’ve got up to date the story to mirror solely verifiable losses and will proceed to trace and report further findings as this story develops.

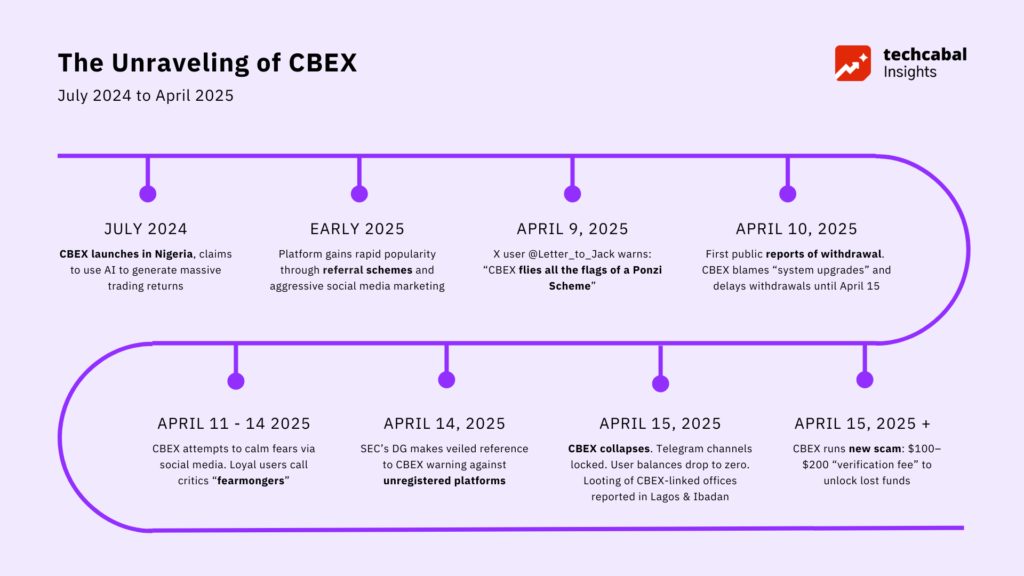

In April 2025, CBEX, a digital asset buying and selling platform, collapsed, leaving hundreds of Nigerians unable to entry their funds. The platform had promised traders a 100% return on funding inside 30 days, a textbook pink flag for Ponzi schemes.

How CBEX labored

CBEX sustained its phantasm of profitability through the use of funds from new traders to pay earlier ones. To speed up progress, it aggressively incentivised its customers to refer others, providing tiered bonuses and rewards based mostly on the dimensions of their referral community. Some customers reported being required to recruit a minimum of 12 folks earlier than being allowed to withdraw earnings.

CBEX, which stands for China Beijing Fairness Change, was a digital asset buying and selling platform that gained prominence in Nigeria in 2024. Regardless of its title suggesting ties to a professional Chinese language entity, the platform had no connection to the precise China Beijing Fairness Change and commenced operations in Nigeria solely just lately, contradicting its claims of existence since 2017.

The platform claimed to make use of synthetic intelligence for buying and selling, however consultants and victims revealed that the buying and selling exercise and earnings displayed had been pretend. Customers confronted a 40–45 day lock-in interval earlier than withdrawals, with penalties for early withdrawal. In April 2025, withdrawals had been suspended completely, and lots of customers noticed their account balances drop to zero.

Like most Ponzi schemes, CBEX enticed customers with excessive returns, engineered proof of bodily places of work, and native officers who claimed they labored with the corporate’s head workplace in China, solely that this was false, and this was a shell enterprise with no actual backing in anyway.

After the crash, CBEX supplied a supposed “lifeline”—customers may pay $100 or $200 in verification charges to unlock $1,000 or $2,000, respectively, a tactic to extract much more cash from determined victims.

How CBEX unravelled

CBEX started operations in Nigeria in July 2024. By April 10, 2025, experiences of withdrawal points surfaced. By April 15, the platform’s collapse turned broadly acknowledged. Social media was flooded with complaints, and movies confirmed indignant traders ransacking CBEX places of work in Ibadan and Lagos. CBEX locked its Telegram channels and tried to reassure customers on social media, however most consultants and regulators confirmed the platform had collapsed.

The collapse triggered intense emotional responses throughout Nigeria. Movies surfaced on-line exhibiting indignant youths looting buildings believed to be linked to CBEX in protest over their misplaced cash. In Ibadan, one CBEX workplace was reportedly ransacked by livid traders. Social media turned a battleground of accusations, with some customers expressing “zero regret” for victims, arguing that warnings had been ignored as a result of greed. In distinction, others pointed to financial desperation because the driving issue behind participation.

In a digital session on April 14, 2025, with fintech stakeholders, Nigeria’s Securities and Change Fee (SEC) issued a agency warning to Nigerians concerning Ponzi schemes, with out explicitly naming CBEX.

SEC Director Normal Emomotimi Agama warned that, “Not too long ago, a selected platform has gained consideration on-line, with quite a few posts going viral concerning its actions. Subsequently, there have been experiences suggesting its shutdown. I need to make this positively clear—if a platform will not be registered with the SEC, it’s unlawful.”

This announcement got here as a part of a digital session with fintech stakeholders centred across the just lately enacted Funding and Securities Act (ISA) 2025, which grants the SEC oversight to fight Ponzi schemes. Beneath the brand new laws, operators and promoters of Ponzi schemes face extreme penalties, together with as much as 10 years imprisonment and a ₦40 million positive. Agama additionally issued a selected warning to celebrities and social media influencers who lend their platforms to questionable ventures, emphasising their duty to make sure what they promote is professional.

The CBEX scandal represents the most recent chapter in Nigeria’s lengthy and painful historical past with Ponzi schemes. From early “marvel banks” within the Nineteen Eighties and Nineteen Nineties like Umana-Umana, Planwell, and Nospecto, to the devastating MMM collapse of 2016-2017 that affected over three million Nigerians, these fraudulent schemes have persistently exploited financial vulnerabilities.

By 2022, the Nigeria Deposit Insurance coverage Company (NDIC) estimated that Nigerians misplaced ₦911.45 billion to Ponzi schemes over 23 years, with ₦300 billion misplaced in simply the 5 years following MMM’s collapse. Different notable schemes defrauded Nigerians embrace Twinkas, Final Cycler, Get Assist Worldwide, Loom, Racksterli, and MBA Foreign exchange, which swindled traders of ₦213 billion between 2018 and 2021.

Whereas the brand new Funding and Securities Act (2025) represents a big step ahead in regulatory functionality, breaking the cycle of Ponzi schemes in Nigeria would require a multi-faceted strategy, together with stronger monetary training, extra accessible professional funding alternatives, and continued regulatory vigilance.

As the complete affect of CBEX’s collapse continues to unfold, it serves as a painful reminder of the adage that has confirmed true in monetary markets: if one thing appears too good to be true, it virtually definitely is.