Entry Holdings Plc, the dad or mum firm of Entry Financial institution, spent a file ₦193.5 billion ($120.5 million) on know-how infrastructure and digital enterprise in 2024, whilst its fraud-related losses dropped sharply by 73%, in keeping with its newest full-year monetary assertion.

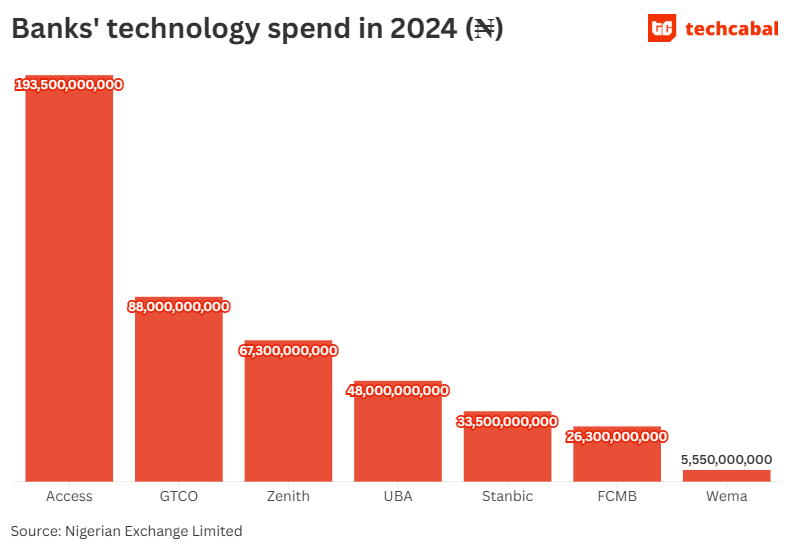

The tech spend—a 147% leap from 2023—is the very best within the banking sector, greater than double the quantity opponents reminiscent of Warranty Belief Holding Firm (GTCO) Plc, United Financial institution for Africa (UBA) Plc, and Zenith Financial institution Plc spent final yr.

A number of elements drove the surge in know-how spending: inflation amplified by trade charge volatility, main upgrades to its core banking software program Flexcube, cybersecurity enhancements, and growth into Tanzania, Namibia, and Hong Kong. Entry Holdings says these strikes have been essential to help its rising digital buyer base and fend off competitors from fintech firms like Opay, PalmPay, and Moniepoint.

“Our know-how spend displays a deliberate stability between capital investments in new capabilities and working bills that help present methods, reminiscent of subscriptions and repair licenses,” Entry Holdings’ spokesperson mentioned in an electronic mail to TechCabal.

The spokesperson added that a good portion of their IT spend stays vendor-driven, particularly in areas like licensing, technical help, and area of interest providers.

“Roughly 80% of our operational IT prices are tied to licensing, 15% to help providers, and the remaining portion to consultancy {and professional} providers.”

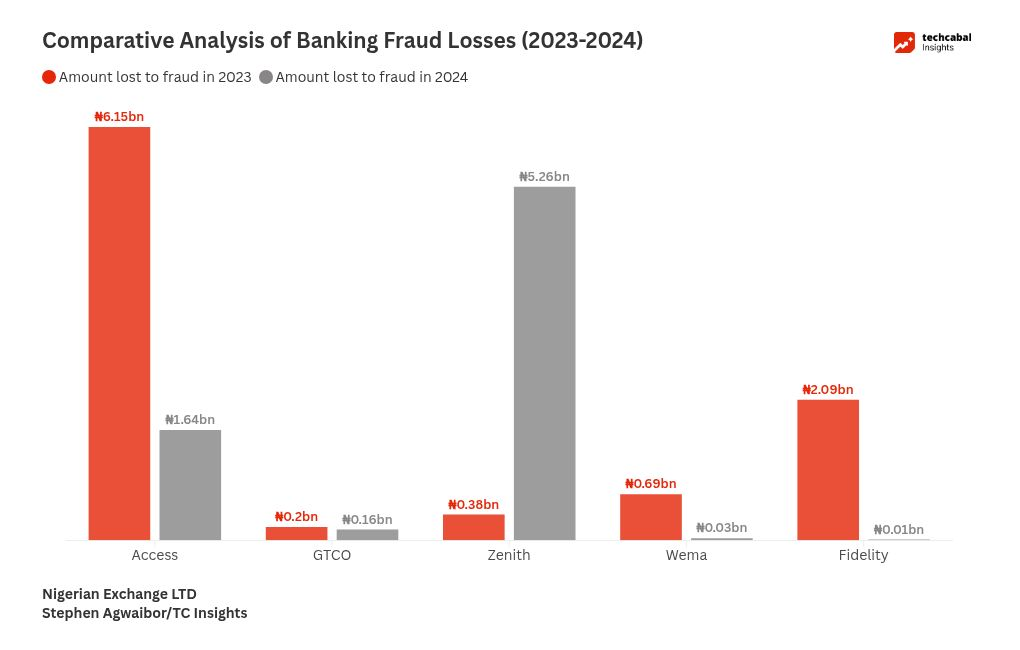

Analysts say the surge in tech spend might have slashed fraud losses by 73% from ₦6.15 billion ($3.8 million) to ₦1.64 billion ($1.0 million).

“I believe that the group invested in some cybersecurity infrastructure, particularly provided that the quantity misplaced to fraud declined considerably,” Mobifoluwa Adesina, funding analysis analyst at Afrinvest West Africa Restricted, mentioned.

Enhanced IT methods result in fewer fraud incidents and monetary losses for patrons, in keeping with Nabila Mohammed, a analysis analyst at Chapel Hill Denham, an funding banking agency in Lagos. “This elevated safety and seamlessness encourage prospects to transact extra, producing elevated price revenue for banks,” she mentioned.

Entry’s aggressive tech push leaves opponents trailing. GTCO reported a 48% rise in IT bills to ₦88 billion ($56.8 million), Zenith doubled its price range to ₦67.3 billion ($43 million), whereas UBA grew its spend by 107% to ₦48 billion ($30.5 million).

Fraud losses throughout the sector present the influence of those investments. GTCO noticed fraud losses fall barely to ₦159.1 million ($99,421) from ₦198.8 million ($ 123,881). Zenith, nonetheless, recorded a spike, from ₦383.4 million ($238,914) to ₦5.26 billion ($3.3 million), underlining the pressing want for higher fraud prevention instruments.

The rise of digital funds in Nigeria has led to a rise in monetary transactions, which has been accompanied by a development in fraud instances inside the monetary system. In keeping with the Nigeria Inter-Financial institution Settlement System (NIBSS), fraud incidents surged 112% between 2019 and 2023, whereas the worth of losses spiked 496% to ₦17.67 billion ($11.1 million). Laptop, cellular, and PoS fraud dominate, pushed by elevated digital exercise and gaps in cybersecurity protocols.

One other report by the Monetary Establishments Coaching Centre (FITC) famous that fraud-related losses in Nigeria rose to ₦10.1 billion throughout 19,007 instances within the third quarter of 2024, up from ₦1.18 billion throughout 12,066 instances in the identical interval of 2023. Nevertheless, on a quarter-on-quarter foundation, the overall quantity dropped from ₦42.8 billion, suggesting some latest positive aspects.

“Elevated belief and confidence within the banking system on this sector will result in stronger development within the coming years and quarters,” Mohammed of Chapel Hill Denham mentioned.

Entry Holdings, with a market capitalisation of ₦1.15 trillion, has not but disclosed its tech price range for 2025, however it intends to deepen funding in employees coaching and superior know-how talent growth to strengthen inside capability and scale back publicity to overseas currency-driven prices.

“We’ll proceed to spend money on modernization, innovation, and buyer expertise, whereas sustaining tech expenditure in step with related international monetary establishments to stability innovation and operational effectivity,” the spokesperson added.