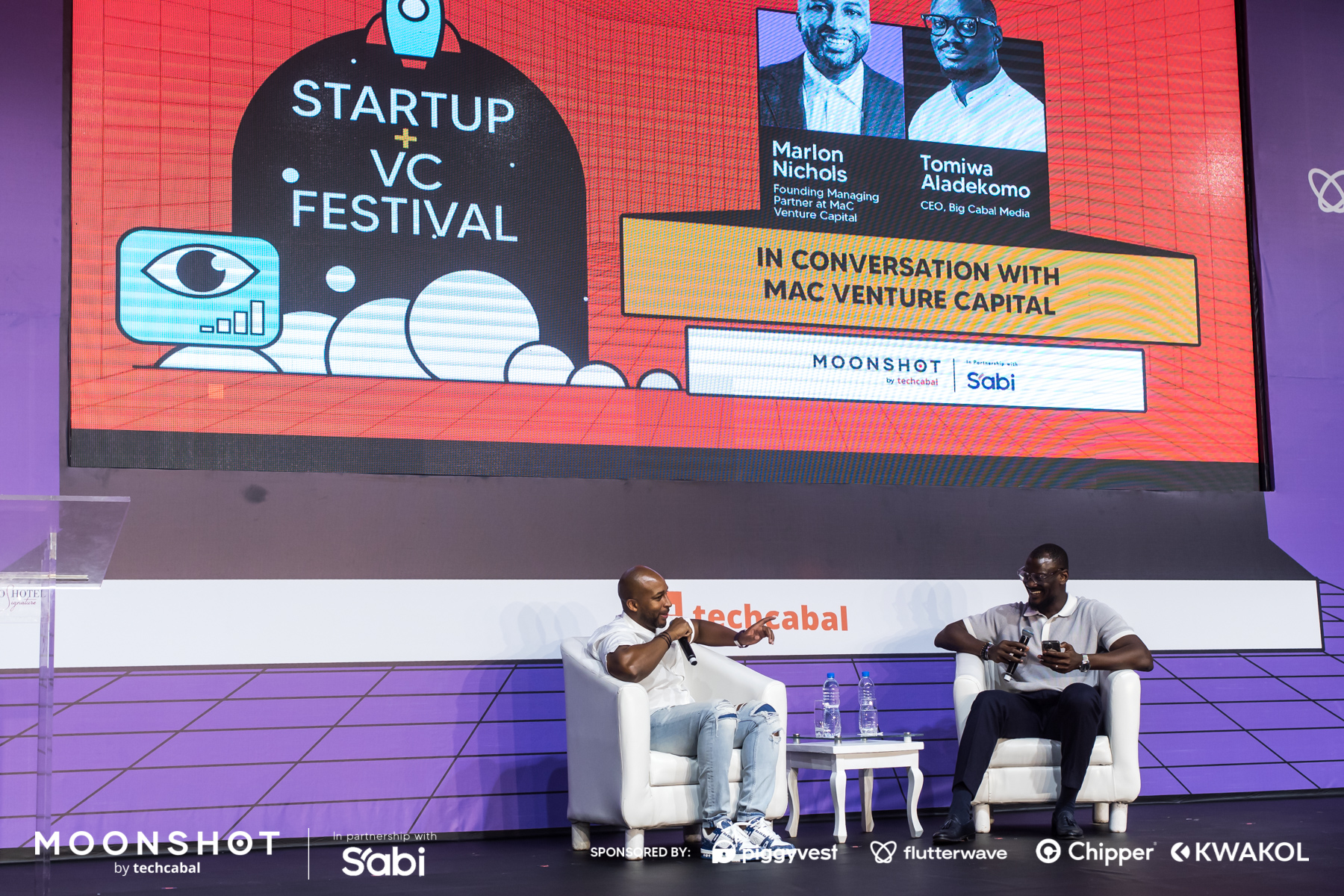

In a hearth chat on the Moonshot by TechCabal Convention, Marlon Nichols, a managing common companion at MaC Enterprise Capital, a agency with over $20 million invested in Africa, shares his funding thesis.

Funding for Africa’s tech ecosystem has been on a downward spiral for the reason that begin of the 12 months as rates of interest rise globally and traders proceed to make safer bets. Nonetheless, some enterprise capital corporations are nonetheless growing their footprint on the continent. One such VC agency is MaC Enterprise Capital, a sector-agnostic agency with $500 million in belongings beneath administration and an African portfolio with greater than 10 startups.

MaC Enterprise Capital invests as much as $3 million in seed-stage corporations as its preliminary entry ticket measurement, in alternate for 10–15% possession within the corporations on a completely diluted foundation. “For us, seed means that you’ve got a viable product that you’ve got not too long ago taken to market, or that you simply’re about to take to market,” Nichols said in a fireside chat with Tomiwa Aladekomo, CEO of Big Cabal Media, at the recently-held Moonshot by TechCabal conference

. “We really feel we are able to add essentially the most worth to the go-to-market technique,” Nichols added.

Among the African startups which might be within the agency’s portfolio embrace Massive Cabal Media, the guardian firm of TechCabal; Spleet, a prop-tech startup; and Prembly, a digital safety startup. Nichols shared that the agency’s funding thesis on the continent is centred on discovering the challenges “stopping individuals from dwelling their greatest lives”.

“We wish to earn cash for our traders,” Nichols mentioned, “so we search for actually massive issues in massive markets which might be being tackled by very sensible those that have a match with the market, the corporate, and the problem.”

With 197 startups of their portfolio, Nichols mentioned MaC Enterprise Capital determined to spend money on Africa after being launched to Ajua, a Kenyan buyer expertise startup. “What occurs is [that] you begin to construct this community of individuals and also you study extra thrilling alternatives, so that you simply begin writing extra cheques.”

Due diligence and company governance have been working themes in Africa’s tech ecosystem this 12 months as a number of startups have closed because of unhealthy company governance. On due diligence, Nichols mentioned that the agency depends on angel traders and founders of their portfolio for recommendation and validation of the pitches they obtain in markets the place they don’t have sufficient context.

Watch the full video of the hearth chat with Marlon Nichols and Tomiwa Aladekomo on YouTube.