Ethereum value scored large beneficial properties after the profitable Shanghai Improve to achieve $2,150. A month later, Ethereum is down 14%. Nevertheless, essential on-chain knowledge exhibits that the constructive affect of Community Improve might now lead strategic traders to start out making bullish ETH value predictions.

A month after the Shanghai Upgrade, Ethereum seems to dispel bearish issues associated to contemporary ETH 2.0 withdrawals. This comes as traders have begun to maneuver cash off exchanges. With staking deposits additionally hitting new-high, right here’s how bullish traders are positioning for the following value rally.

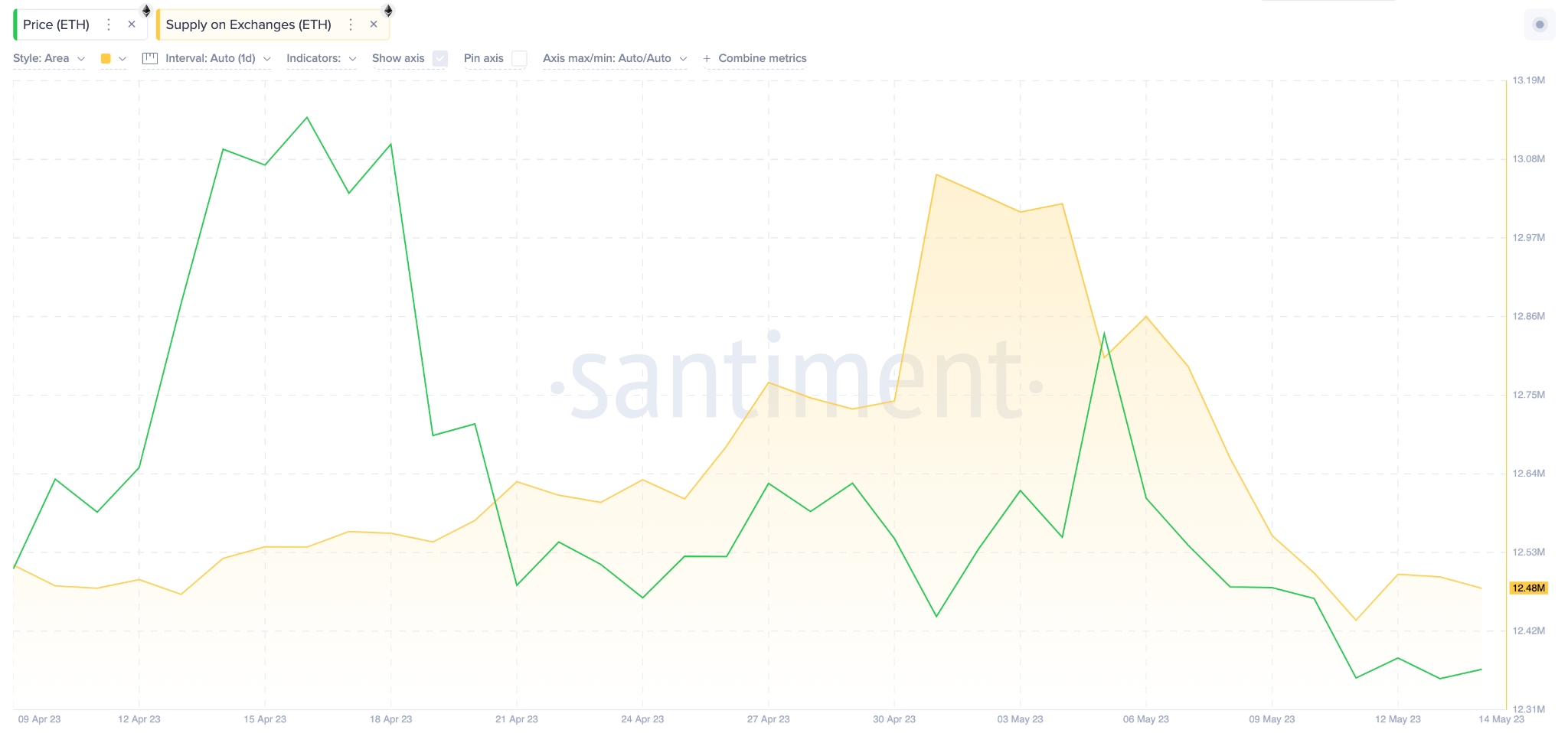

Ethereum Provide on Exchanges Has Dropped to an All-Time-Low

In keeping with knowledge from the on-chain analytics platform Santiment, ETH provide on exchanges is now at its lowest for the reason that cryptocurrency began buying and selling publicly in July 2015.

The Provide on Exchanges metric evaluates the variety of Ethereum cash which might be at the moment deposited in acknowledged change wallets.

The yellow line within the chart under depicts how the variety of ETH Provide on Exchanges has entered a pointy decline since Could 1. Between Could 1 and Could 15, traders moved 550,000 ETH off of exchanges.

Notably, ETH provide on exchanges dropped to a brand new all-time low of 12.4 million on Could 11.

When the liquid stability of a cryptocurrency obtainable on exchanges declines significantly, it causes a relative shortage throughout the markets which frequently triggers a value surge.

Turbulent macroeconomic circumstances have seen ETH expertise value corrections in latest weeks. However, if traders proceed to maneuver cash off exchanges, the constructive ETH value prediction could possibly be validated as soon as the market sentiment shifts.

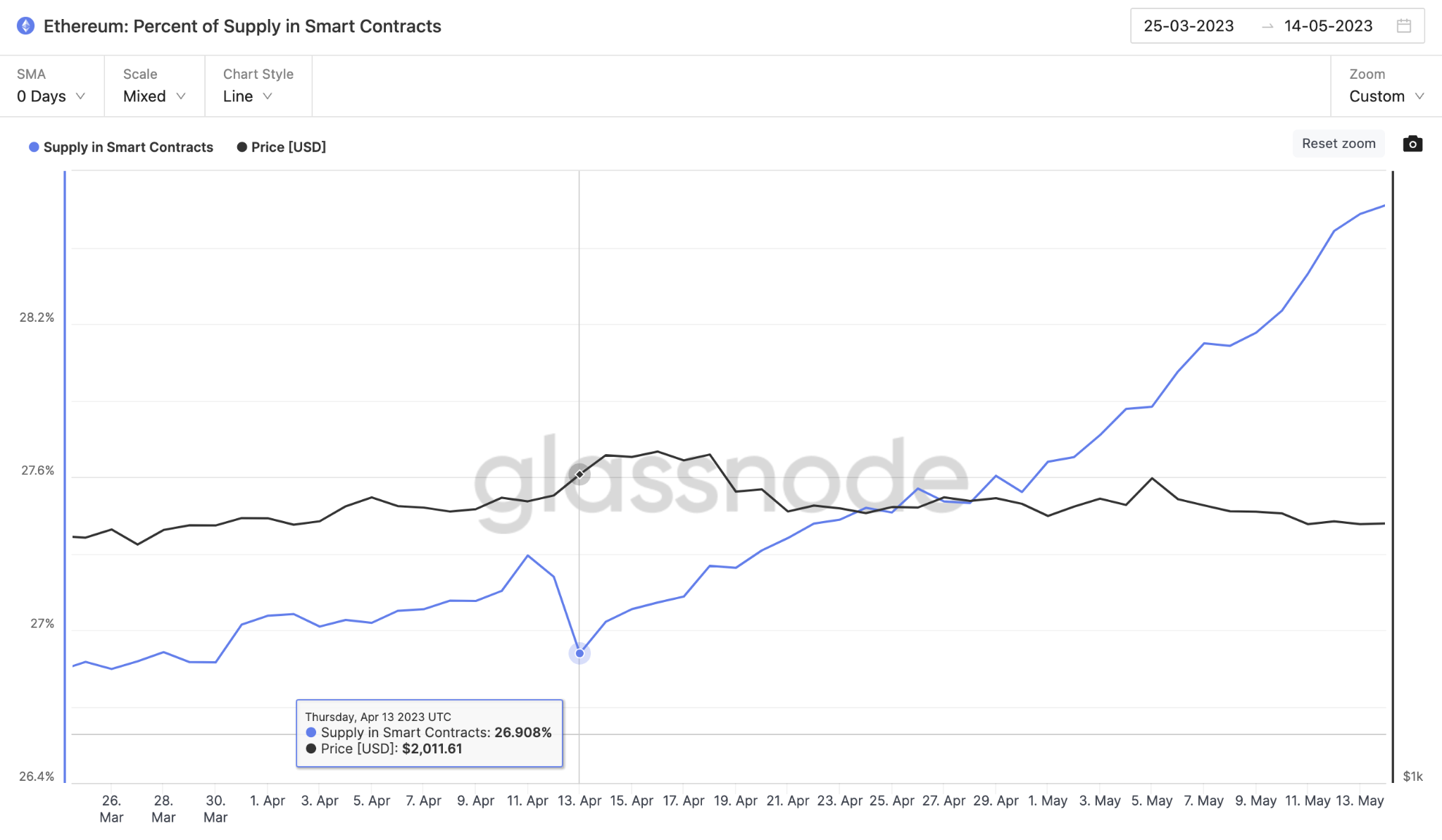

Fairly than Promote, Buyers Are Staking ETH to Earn Yield

Because the community improve approached, bearish traders aired issues that hundreds of thousands of ETH unstaked might set off a large sell-off and a value crash. However the Provide in Good Contracts knowledge now exhibits that almost all ETH 2.0 traders are re-staking their cash to earn yield moderately than promote.

Provide in Good Contracts tracks the proportion of a cryptocurrencies’ whole circulating provide that holders have locked up throughout varied DeFi protocols.

When it will increase, it causes a momentary lower within the provide of tokens obtainable to be traded on exchanges. This might put upward strain on the value of the underlying coin.

Between April 13 and Could 15, traders have now locked up a further 2.15 million ETH cash (1.76% of whole circulation provide) in sensible contracts.

At present costs of $1,800, the just lately locked-up ETH cash are value roughly $3.9 billion. This exhibits that almost all ETH 2.0 un-stakes seem like investing their newly-withdrawn cash into the Ethereum ecosystem.

This could possibly be attributed to the truth that most stakers are unwilling to promote as a result of the present ETH costs are nonetheless a lot decrease than their buy value.

Additionally, the elevated burn rate has positioned deflationary strain on ETH, boosting traders’ confidence in potential value beneficial properties.

In abstract, when traders transfer big quantities of cash of exchanges inside a brief interval whereas rising the smart-contract staking, it may be bullish for varied causes.

Firstly, staking incentives can cut back the probabilities of a large sell-off. Secondly, it will increase security and offers much-needed liquidity for tasks constructed on prime of the Ethereum community to develop.

The bullish Ethereum value prediction might quickly be validated if each traits proceed.

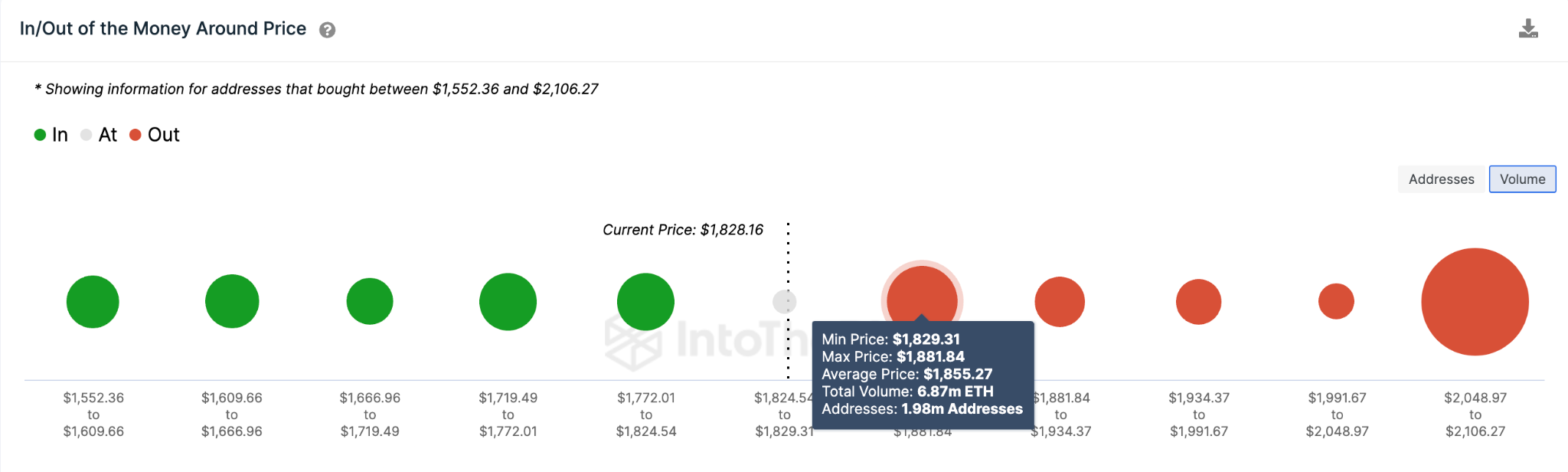

ETH Worth Prediction: Bulls Can Reclaim $2,100

IntoTheBlock’s In/Out Cash Round Worth knowledge factors in direction of a potential rally towards $2,100 if market sentiments shift considerably. However to be assured of the bullish ETH value prediction, Ethereum should first clear the preliminary $1,855 resistance.

At that zone, 1.98 million traders that purchased 6.87 million ETH on the common value of $1,855. This poses a agency resistance.

But when the bulls can garner sufficient momentum to push previous $1,855, the ETH value rally might attain $2,100 once more.

Nevertheless, key resistance ranges could be seen at essential shopping for factors comparable to $1,900 and $2,000 respectively. Each these clusters have roughly 4.21 million ETH distributed between 3.75 million wallets.

Nonetheless, the bears might invalidate the constructive Ethereum value prediction if the ETH value drops under $1,772. However, the two.58 million traders that purchased 3.48 million ETH on the common value of $1,772 will possible stop it.

If that help stage can’t maintain, it might set off a a lot bigger decline towards $1,650.

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections.