Lending amongst household and pals is integral to the Nigerian monetary panorama, significantly within the casual sector the place entry to formal monetary providers is proscribed.

Fig. 1: The speed of entry to monetary providers in 2020.

In Nigeria, more than 1 in 2 Nigerian adults are financially excluded – with no entry to formal monetary providers corresponding to cost, financial savings, and credit score. Information from World Economics places it that the dimensions of the casual economic system in Nigeria is estimated to be 57.7% representing $1,164 billion at GDP PPP levels. Which means that financially underserved communities and younger entrepreneurs, usually need to depend on social capital for monetary assist.

The low barrier to entry and inherent belief makes household lending a well-liked various to formal credit score. Nevertheless, the market faces a number of challenges, together with high-interest charges, lack of transparency, restricted entry to formal credit score infrastructure, and lack of regulation.

A brand new report titled; Lending in Nigeria: Can tech make borrowing from household and pals sustainable? goals to supply a complete evaluation of the household and pals lending market in Nigeria. The report which was put collectively by TechCabal Insights and Sycamore, a peer-to-peer lending startup discusses the key stakeholders, why it exists, frequent challenges, and its implications for the Nigerian monetary economic system, in addition to the probabilities therein, particularly with the arrival of digitalization within the house.

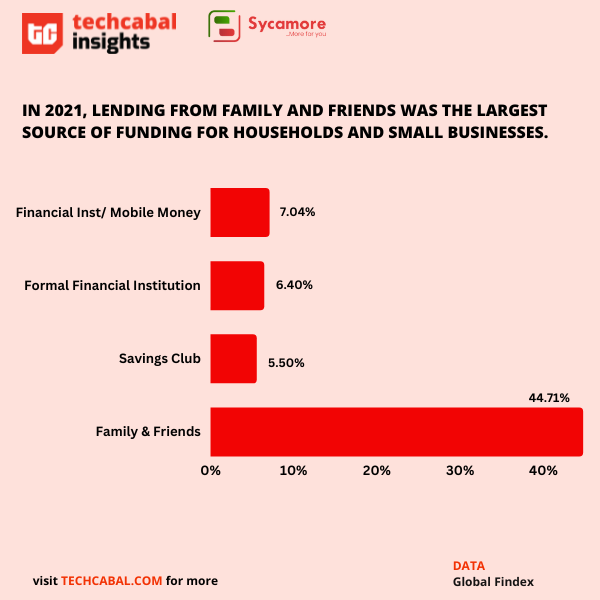

The report attracts on a spread of related research to assist its evaluation. It cites a latest survey performed by Enhancing Monetary Innovation and Entry (EFInA), roughly 43% of Nigerians are financially excluded, with no entry to formal monetary providers corresponding to cost, financial savings, and credit score. In line with the report, borrowing from household and pals accounts for 44.7% of lending channels for young people in Nigeria.

Fig 2: Generally used channels for lending amongst people and small companies in 2021

Addressing the challenges going through the household and pals lending market will enhance entry and finally drive monetary inclusion for underserved communities. One main problem is that assortment and reimbursement are troublesome, as revealed within the report. In lots of circumstances, debtors have little recourse in circumstances of fraud or different unlawful practices on account of the shortage of regulatory insurance policies that information that house.

Expertise presents numerous options to sort out the inefficiencies on this sector by the emergence of digital lending platforms. These platforms present a chance to extend transparency, enhance entry to credit score for underserved communities and supply debtors with higher recourse in circumstances of fraud or different unlawful practices. The availability of regulatory frameworks by the federal government may also assist to additional consolidate the market.

“We at Sycamore have been significantly on this topic as a result of we now have been conscious of this drawback for some time, and have even created a product tagged “Mortgage Pals” to unravel it,” mentioned Tunde Akin-Moses – CEO, Sycamore. “Borrowing between family and friends is a observe that has lasted for generations. We’re assured that expertise would additional cement this observe by growing its sustainability.”

The report recommends a number of methods to advertise monetary inclusion and enhance entry to finance for underserved communities in Nigeria, together with the event of stronger credit score scoring programs, the promotion of economic literacy, and the supply of peer-to-peer digital lending platforms like Sycamore’s “Mortgage Pals”.

Be a part of us on Friday, April twenty eighth at 5 PM (WAT) for the launch of our report titled: Lending in Nigeria: Can tech make borrowing from household and pals sustainable? We’ll deliver collectively fintech consultants to debate the methods to navigate the inefficiencies of communal lending. They may also be discussing insights from the report. Register here. Obtain the report here.