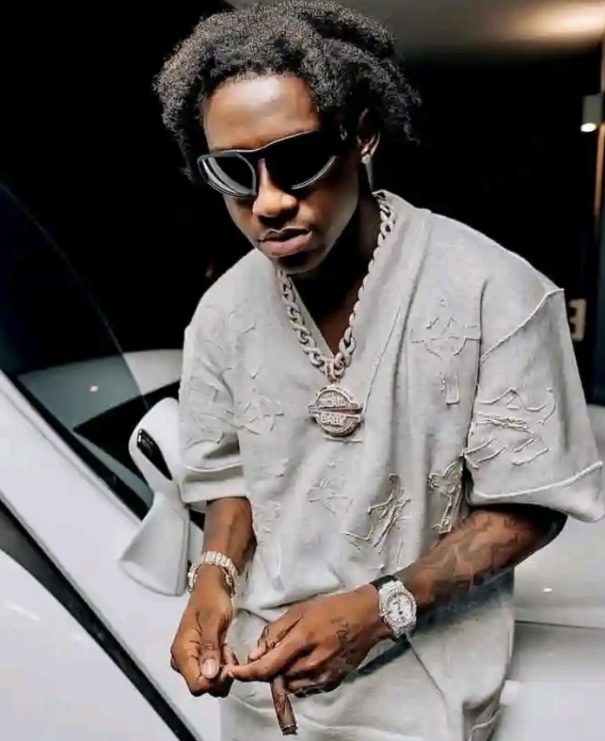

The Chief Govt Officer of the Nigerian Trade Restricted, Mr Temi Popoola, has revealed that the exit of overseas buyers from the capital market led to a depreciation available in the market capitalisation of Trade Traded Funds listed on the trade.

Popoola mentioned this on Wednesday at a digital convention themed ‘ETFs within the Nigerian capital market: Alternatives and challenges’.

He additionally mentioned 4 new listings have been ongoing.

In his opening remarks, the NGX CEO defined that regardless of its low market cap, the Trade was main the ETFs market in West Africa with a market capitalisation of N8.87bn ($19.25m).

He famous that the market was nonetheless in its nascent state, in comparison with the South African ETF market with a $7.11bn capitalisation.

Additionally Learn: FEC Approves N142bn e-Customs Project

Popoola mentioned, “There was a dearth of latest ETFs listings on the NGX lately, nevertheless, there are vibrant spots on the horizon with 4 new ETFs listings within the pipeline. It’s incumbent to state that present macroeconomic challenges ensuing within the exit of overseas buyers, impacted the ETFs house which resulted in a pointy dip within the ETFs market Cap from 2020 highs of N24.5bn. We’re hopeful that the coverage tilt of the brand new administration would impression positively on our market.”

Additionally talking on the occasion, the Govt Commissioner, Operations, Securities and Exchanges Fee, Mr Dayo Obisan, spoke on the challenges available in the market.

Obisan expressed confidence within the capacity of specialists to proffer options.

He urged all stakeholders together with the Fund Managers Affiliation, NGX, and different institutional buyers to increase the message of ETFs to deepen the market and make the asset class extra vibrant, thereby driving progress within the capital market.

The Govt Director, Central Securities and Clearing System Plc, Adeyinka Shonekan, spoke on the CSCS’s developmental efforts within the ETFs market.

He defined how the CSCS was utilizing know-how to enhance the onboarding of retail buyers into ETFs.

The Supervisor, Enterprise Growth and Trade Traded Merchandise on the Johannesburg Inventory Trade, Adele Hattingh, additionally gave an summary of the South African ETFs market together with why buyers ought to take into account investing within the asset class.