After a rally that added N6.52 trillion to their complete market worth in 4 months, Nigerian shares completed March within the crimson amid considerations over the fallout of the final election and the doable ripple impact of the turmoil within the world banking system.

The inventory market had been on an upward trajectory since October, defying the Central Financial institution of Nigeria’s aggressive interest-rate mountaineering cycle and pre-election tensions to finish 2022 with a return of virtually 20 p.c.

It prolonged its successful streak within the first two months of this yr regardless of election dangers because the market worth hit the N30 trillion mark for the primary time ever because the nation awaited the result of the presidential election, whereas the principle inventory index gained 8.89 p.c as of the top of February. However the market declined on March 1 after 5 consecutive days of positive factors and has been wobbling since then.

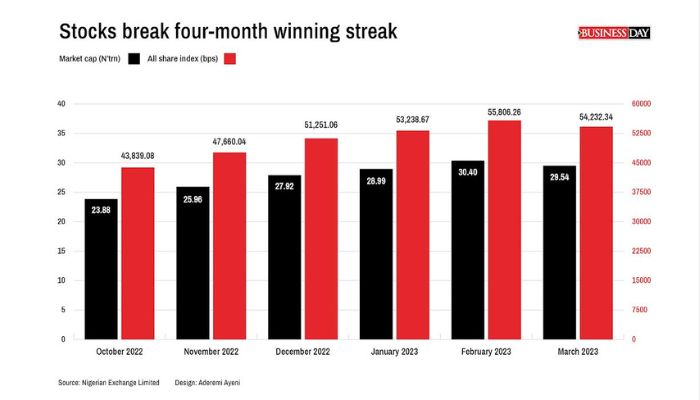

The All Share Index of the Nigerian Change Restricted (NGX) retreated 2.82 p.c to 54,232.34 foundation factors (bps) on the finish of final month, shedding greater than 60 p.c of the positive factors it posted in February.

The decline within the benchmark fairness index wiped N860 billion off the worth of shares on the NGX because the market capitalisation ended the month at N29.54 trillion.

The inventory market completed the primary quarter of the yr up 5.82 p.c, in comparison with a return of 9.95 p.c in the identical interval of 2022.

Ayodeji Ebo, managing director/chief enterprise officer at Optimus by Afrinvest, stated the final elections contributed to the draw back within the inventory market final month.

“There have been agitations submit election which despatched a wave of uncertainties to the traders. We noticed a slight rebound in direction of the top of the month on account of optimistic scorecards and company actions,” he stated on Saturday in a response to questions from BusinessDay.

Analysts at Monetary Derivatives Firm Restricted (FDC) stated in a report on Thursday that the inventory market recorded a cumulative lack of 3.59 p.c within the second half of March.

They stated the damaging inventory market efficiency inside the evaluate interval (Mar. 16-28) was because of the rise within the financial coverage charge from 17.5 p.c to 18 p.c and the lingering political uncertainties.

The central financial institution raised its benchmark rate of interest for the sixth consecutive time in March, bringing the cumulative improve to 750bps since Might final yr.

“The elevated charges within the mounted revenue market will trigger the inventory market to undergo losses within the coming weeks as traders turn out to be extra keen to promote their high-liquidity shares,” FDC analysts stated.

World banking woes weigh on market

The current turmoil within the world banking sector brought on by financial institution failures in the USA and Europe despatched ripples via monetary markets.

Ebo stated the worldwide banking turmoil impacted the Nigerian equities market however not in a big approach.

The US banking sector has been in turmoil after regulators on March 10 closed Silicon Valley Financial institution (SVB) within the largest financial institution failure within the nation for the reason that 2008 monetary disaster.

The collapse of SVB and Signature Financial institution, one other US midsized lender, prompted a rout in banking shares and led to UBS Group AG’s takeover of 167-year-old Credit score Suisse Group AG to avert a wider disaster, in accordance with Reuters.

“Monetary markets throughout sub-Saharan Africa have struggled and have underperformed their rising market friends for the reason that world banking sector turmoil erupted,” Capital Economics stated in a Mar. 23 word.

The London-based financial analysis agency stated that amid broad risk-off sentiment, African sovereign greenback bonds had bought off almost throughout the board and equities have been down in a lot of the area too.

Learn additionally: Stock market dips by 1.20% in week ended March 31

International traders eschew equities as FX disaster lingers

Information from the NGX present that international influx into the Nigerian inventory market fell to a document low of N3.68 billion in February from N9.84 billion within the earlier month amid a lingering shortage of international alternate that’s crimping traders’ means to repatriate their funds.

International traders offloaded shares price N15.94 billion in February, in comparison with N15.06 billion within the earlier month.

International transactions decreased by 21.20 p.c to N19.62 billion in February whereas home offers dipped by 0.53 p.c to N169.29 billion.

“Notably, whereas international traders stay web sellers of Nigerian equities, inflows declined sharply by 62.2 p.c month-on-month to N3.68 billion – the bottom stage since no less than 2013 amid lingering FX liquidity constraints, election uncertainties, and excessive world rates of interest,” analysts at Cordros Capital Restricted stated on Friday in a word.

They anticipate home traders to proceed to dominate the home equities market over the short-to-medium time period, at the same time as increased mounted revenue yields could constrain shopping for actions.

“Additionally, international portfolio traders who’ve exhibited a lacklustre curiosity in home equities are more likely to stay on the sidelines on account of elevated world uncertainties, sustained FX liquidity challenges, and tightening world financing circumstances,” they stated.

BusinessDay reported in February that for the primary time in 5 years, international traders purchased extra Nigerian shares than they bought in 2022, with analysts saying foreigners have been pressured to reinvest their dividends and gross sales proceeds into securities as a result of they may not get {dollars} to repatriate their funds.

Nigeria noticed a web international influx of N12.29 billion into its inventory market final yr, in comparison with a web outflow of N24.74 billion in 2021, in accordance with NGX knowledge.

It marked the primary web influx of international funds into the market since 2017, when a document N772.25 billion entered and N435.31 billion exited.

Final yr, the influx fell to N195.76 billion, the bottom in no less than 13 years, from N204.88 billion in 2021, whereas the outflow dropped to N183.47 billion from N229.62 billion.