November 29th 2021

The Next Wave presents a futuristic diagnosis of BizTech and innovation in Africa. Subscribe right here to earn it at as soon as in your inbox on Sundays at 3 PM (WAT).

In Africa, a variety of miniature, medium, and micro-industry owners assemble now not maintain a checking story and assemble now not abet their money in the financial institution. These industry owners resort to money dealing with and physical bookkeeping, but these methods maintain a costly ripple terminate.

This makes these firms—which building up 90% of the firms on the continent—underserved by damaged-down financial institutions. Because these industry owners are locked out of the financial system, they’ll’t earn insurance protection. As an illustration, in Nigeria, firms lose thousands and thousands from frequent market fires, and it is tougher for them to earn aid on their toes because they don’t maintain insurance protection. Ninety-seven percent of Nigeria’s population assemble now not maintain nicely being insurance protection, and the 3% who assemble earn it by technique of formal employment.

Next up is entry to credit. Companies can’t earn loans from banks because their financial institution observation, story or particulars are now not enough or on hand for the financial institution to lend them money. But you realize who has this important financial mosey files? Online marketplaces, offline wholesalers, logistics firms, and even social media firms. And what assemble these non-financial suppliers all maintain in fashioned? They are familiar with the each day purchases of prospects and maintain entry to buyers’ financial mosey files.

Why embedded finance?

Embedded finance is the provision of financial providers—much like lending, insurance protection, and payment—by non-financial suppliers to buyers, users, or firms. As an illustration, a logistics tech company adore TradeDepot whose ShopTopUp platform presents a eradicate-now-pay-later (BNPL) offering which presents stores with entry to a credit line for all user goods on its software.

Why can also still you hear to the embedded finance alternate? Many reasons.

The embedded finance alternate in Africa and the Center East grew as soon as a year by 45.3% to attain $10.3 billion this year and is anticipated to grow from $10.3 billion to attain $39.8 billion by 2029.

Embedded finance will steal the burden off fintechs and banks to present financial providers and place energy in the hands of firms to manipulate their financial mosey. Here is why pan-African fintech unicorn, Flutterwave launched a fintech-as-a-provider (FaaS) solution, which permits particular individual firms to commence accounts, assemble know-your-customer (KYC) verification, internet payment from, and organize their prospects’ accounts.

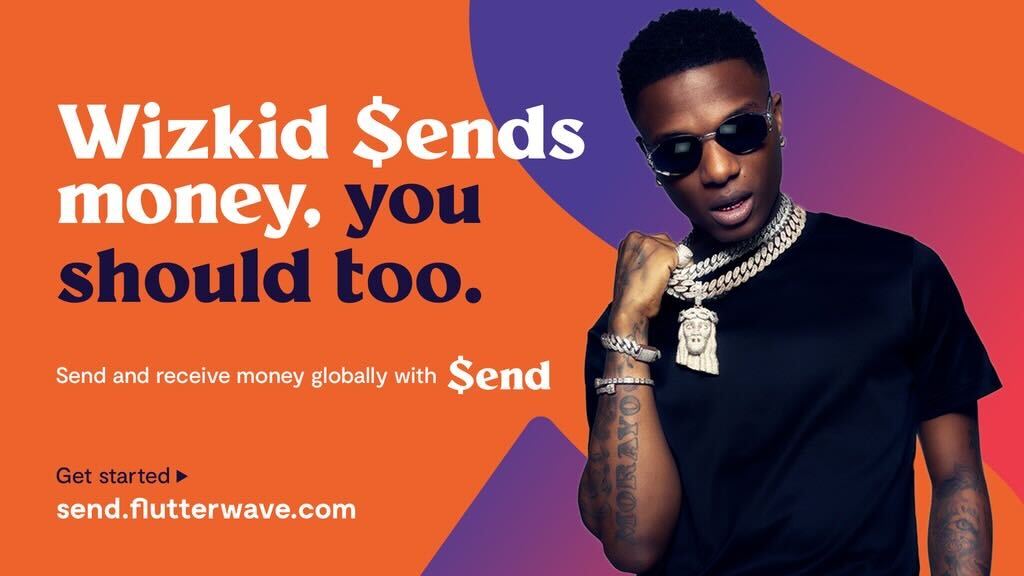

Accomplice Message

Acquire money from over 30 nations on to your checking story or mobile wallet. Seek suggestion from send.flutterwave.com and assemble it now!

With factual that instance, it is evident that embedded finance has the aptitude to present an integrated payment skills that will build the transition from money to digital financial providers more straightforward.

The upward thrust of digital financial providers has helped in rising the level of financial inclusion in Africa from 23% in 2011 to 43% in 2017. This resolve has the aptitude to pork up, and embedded finance has the aptitude to serve the continent’s industry panorama in reaching that aim.

With banks and fintechs opening up the place to permit non-financial our bodies to be a a part of the flee to financially embody Africans, commence them to broader markets, and integrate and streamline their payment skills, connecting Africans to wealth can also factual be a matter of time.

From the Cabal

Within the final 4 months, there were 11,823 recorded casualties from road website online visitors accidents in Nigeria and 10% of these accidents had been caused by spoiled roads and poorly managed vehicles. Autotech platform Flickwheel needs to commerce this by offering to finance vehicle restore and maintenance for drivers. Read more about how it is doing this right here.

Indulge in a gigantic week.

Thank you for reading The Next Wave. Please part right this moment’s version alongside with your community on WhatsApp, Telegram and other platforms, and answer to this e-mail to let us know what we are in a position to also be greater at.

Subscribe to our TC Day after day Newsletter to internet your entire technology and industry tales you would like every weekday at 7 AM (WAT).

Apply TechCabal on Twitter, Instagram, Fb, and LinkedIn to discontinuance engaged in our true-time conversations on tech and innovation in Africa.

Sultan Quadri, Workers Author, TechCabal.