House Subsea Shipowner to be taken to courtroom over injury of Finland-Estonia subsea hyperlink

March 3, 2025,

by

Nadja Skopljak

Estonian transmission system operator (TSO) Elering and its Finnish counterpart Fingrid have withdrawn the request to grab the ship that broke the EstLink 2 energy connection in December 2024 for compensation for damages, and plan to sue the shipowner for compensation for restore prices.

To remind, Fingrid reported to the authorities on December 25, 2024, the failure of Estlink 2, prompting an instantaneous investigation into the chain of occasions of the incident in addition to whether or not a overseas ship is concerned within the injury.

A day later Finland seized the Cook dinner Islands-flagged tanker Eagle S, which in response to preliminary stories might have had an unsecured anchor, on suspicion the vessel brought about the outage and broken web traces. Images of the vessel confirmed that the hull had been broken.

Associated Article

Kalle Kilk, Chairman of the Board of Elering, stated that the rationale for abandoning the seizure declare was the related unreasonably excessive prices.

“In response to estimates, the price of holding the ship beneath arrest is tons of of 1000’s of euros per 30 days, plus the arrest assure of 1 million euros and several other different extra prices, because of which the prices arising from the arrest might finally be larger than the worth of the ship. As well as, this can be very tough to promote the ship through the litigation,” stated Kilk.

The businesses plan to sue the shipowner to cowl the restore prices. If the investigation finds the crew members responsible, the matter might be dealt with individually from the compensation for damages in a felony case.

“It’s important for Elering that the damages are compensated and that nobody feels that they will destroy the undersea infrastructure with impunity,” Kilk stated.

Based mostly on the evaluation of a Finnish legislation agency, the trial may last as long as 5 or 6 years, so system operators will initially must cowl the prices themselves with the intention to rapidly restore the connection, Elering reported.

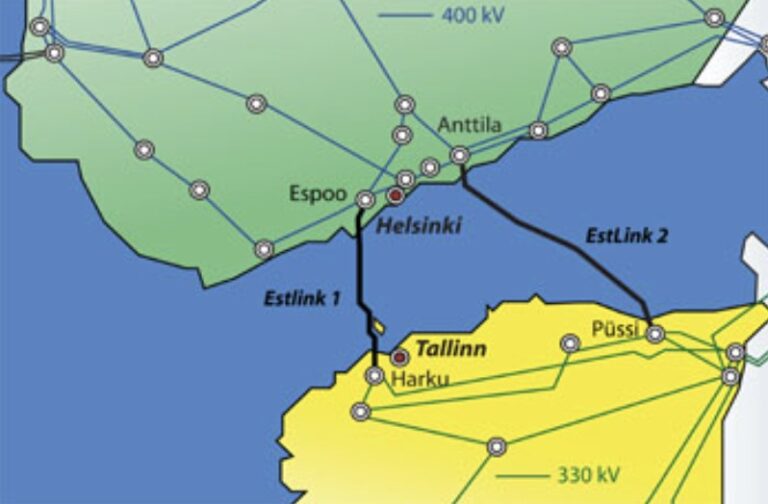

Estlink 2, formally launched in 2014 with a capability of 650 MW, is 170 kilometers lengthy, of which 145 kilometers is submarine cable, 14 kilometers overhead on the Finnish aspect and 12 kilometers underground in Estonia.

This was not the primary time Estlink 2 had been shut down in 2024. Particularly, the hyperlink was shut down within the first hour of January 26, 2024, as a result of a fault situated in “a geotechnically demanding space” on the Estonian coast which stored it out of operation till August 31.

A few months later, a fault was detected within the first electrical connection between the 2 international locations. Estlink 1 was out of service as a result of a technical fault on the converter station in Espoo. {The electrical} connection was switched off at 4:26 a.m. on March 9 on the Finnish aspect, whereas the facility cable remained intact. Operational since 2006, the hyperlink has a capability of 350 MW.

The 2 TSOs signed a memorandum in June 2022 agreeing to begin work on the institution of Estlink 3. In the summertime of 2024, Estonia’s Shopper Safety and Technical Regulatory Authority (CPTRA) initiated the constructing allow process for what would be the third electrical energy connection between Estonia and Finland.