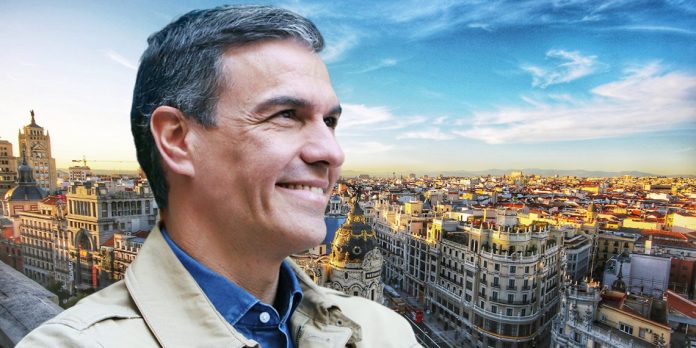

Whereas the financial system in some EU international locations is stagnating and even slipping into recession, Spain’s financial system is displaying speedy progress. Spain’s socialist Prime Minister, Pedro Sánchez, has carried out authorities interventions to control costs. This strategy has stored inflation low over the previous few years and stimulated financial progress. Because of this, Spain is now a driving power throughout the EU and is projected to have the very best financial progress fee within the Eurozone for 2024.

Value Controls as a Profitable Financial Technique

Spain is without doubt one of the EU international locations that has weathered the COVID-19 pandemic, power disaster, and inflation surge notably effectively. Its financial progress in recent times has far surpassed the EU common, and predictions for 2024 estimate a progress fee of two.4–2.7%, making Spain the fastest-growing financial system within the Eurozone. The Sánchez authorities took motion through the power disaster by intervening in costs, which helped hold inflation persistently low. Key measures included a gasoline value cap and hire controls, which helped curb value will increase. As well as, the federal government suspended VAT on important meals objects, serving to to ease the burden of rising meals prices.

Immigration as a Key to Spain’s Prosperity

One other issue behind Spain’s sturdy financial progress is the inflow of expert staff, notably from Latin America. This immigration has eased the labor scarcity in sectors like know-how and hospitality. New immigration insurance policies are anticipated to assist this development additional.

Whereas many European international locations concentrate on limiting immigration, Spain has embraced an open strategy. In mid-October 2024, Sánchez offered his plans to the Spanish Parliament, emphasizing that immigration shouldn’t be solely a humanitarian challenge but additionally important for the nation’s financial future:

“It’s crucial for the prosperity of our financial system and the sustainability of the welfare state.”

The federal government plans to simplify the popularity of international {qualifications}, introduce a brand new labor migration program, and cut back bureaucratic hurdles for residence permits. On the similar time, integration measures are being expanded.

Lowest Unemployment Fee in 15 Years

Spain’s unemployment fee skyrocketed following the monetary disaster of the late 2000s. Nevertheless, it has now fallen to round 11.3%, the bottom stage in 15 years. This enchancment is essentially as a result of sturdy financial progress underneath Sánchez’s management throughout latest crises.

Regardless of being excessive by European requirements, many sectors in Spain, corresponding to know-how and building, are dealing with a scarcity of expert staff. Rural areas, particularly, are battling depopulation and are discovering it more and more troublesome to keep up important infrastructure.

“Now we have aged individuals who want caregivers however can’t discover them. Companies are on the lookout for programmers, technicians, and builders however can’t discover them. Rural faculties want extra kids to keep away from closing,” stated Prime Minister Sánchez.

Sánchez additionally plans to ask the European Fee to deliver ahead the implementation of the EU-wide migration pact to subsequent 12 months. Beneath this plan, migrants and asylum seekers can be extra evenly distributed amongst EU member states based mostly on components like GDP and inhabitants.

Spain’s Monetary Market Extra Steady than France

Spain’s constructive financial developments are additionally mirrored in its monetary market. Not too long ago, the yields on 10-year French authorities bonds surpassed these of Spain for the primary time. In easy phrases, traders now obtain the next return for buying French authorities bonds in comparison with Spanish ones, suggesting that traders see Spain as a lower-risk nation than France, the EU’s second-largest financial system.

In January 2024, Spain’s bond yields had been nonetheless 0.4 proportion factors greater than France’s. Through the worst of the Eurozone disaster, the distinction between Spanish and French bonds was almost 5 proportion factors.

This text was up to date on October 11 to incorporate the data that Spain intends to concentrate on migration in its labor market coverage sooner or later.

This work is licensed underneath the Artistic Widespread License. It may be republished without cost, both translated or within the authentic language. In each instances, please cite Kontrast / Michael Thaler as the unique supply/writer and set a hyperlink to this text on TheBetter.information. https://thebetter.information/spain-economy-boom/

The rights to the content material stay with the unique writer.