In 2024, Nigerians more and more used financial institution transfers as digital funds continued their dominant run after a money crunch in 2023.

Whereas money stays the dominant technique of fee within the nation, “Nigerians now desire digital strategies for making funds, reflecting a shift away from conventional cash-based transactions,” the Central Financial institution of Nigeria (CBN) mentioned in a June 2024 report.

The amount and worth of on the spot on-line transactions surged to five.63 billion and ₦476.89 trillion within the H1 2024, up from 3.5 billion and ₦256.85 trillion in the identical interval of 2023. To place it in perspective, Nigerians elevated how typically and the way a lot they paid on-line by 60% and 85%, respectively.

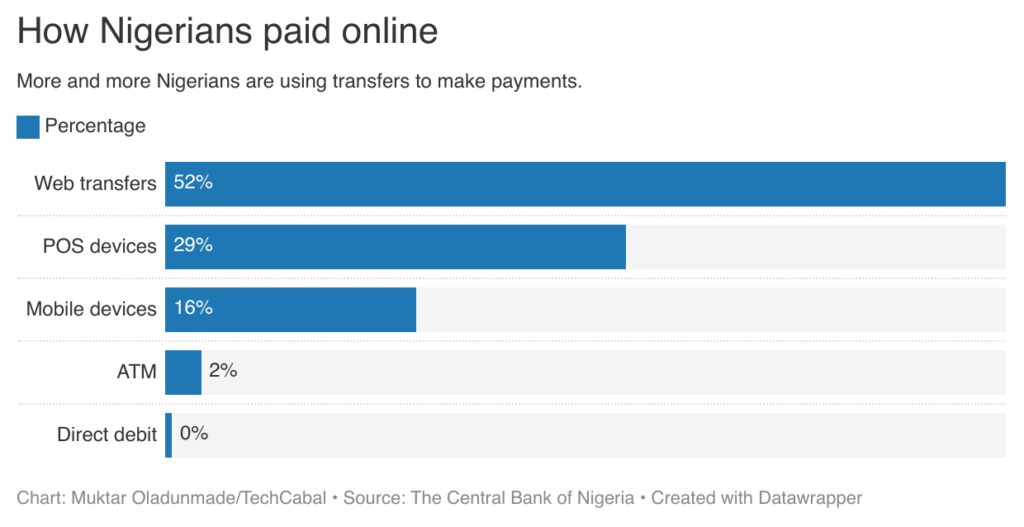

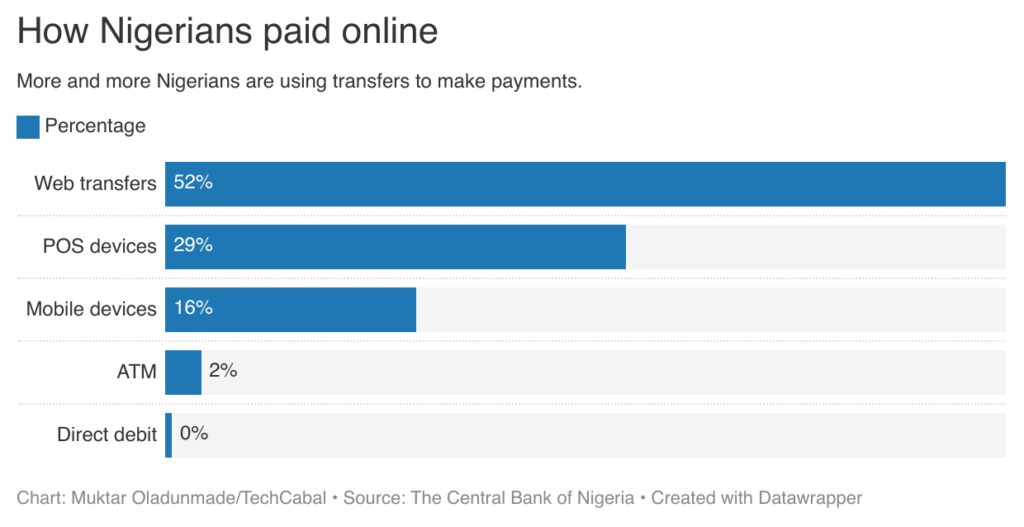

When Nigerians pay on-line, over half use financial institution transfers, as internet transfers account for over 51% of complete on-line fee transactions, in accordance with the Central Financial institution of Nigeria.

POS gadgets observe at a distant second, accounting for 28.5% of transactions, whereas cellular gadgets contributed 15.5%. ATMs ranked fourth with 2.2%, and direct debit accounted for simply 0.44%.

Financial institution transfers are a handy technique of fee for a lot of Nigerians as they’re on the spot and with fintechs like OPay, PalmPay, and Moniepoint changing into trusted and common decisions, it has shortly develop into the popular alternative for small ticket funds.

Many fintechs, realising the dominance and progress of transfers in on-line funds, have more and more constructed merchandise leveraging this development. Paystack has built-in with a number of Nigerian banks and fintechs to permit prospects to pay on-line instantly from their accounts after transfers accounted for over half of all transactions it processed in 2023.

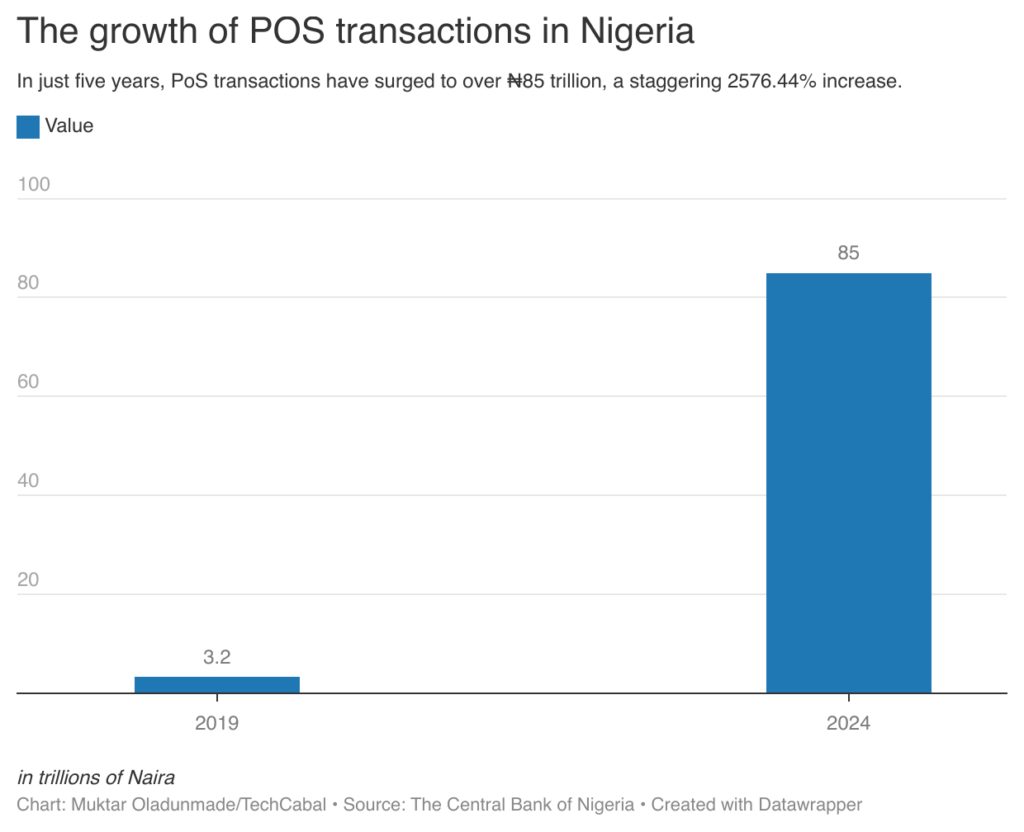

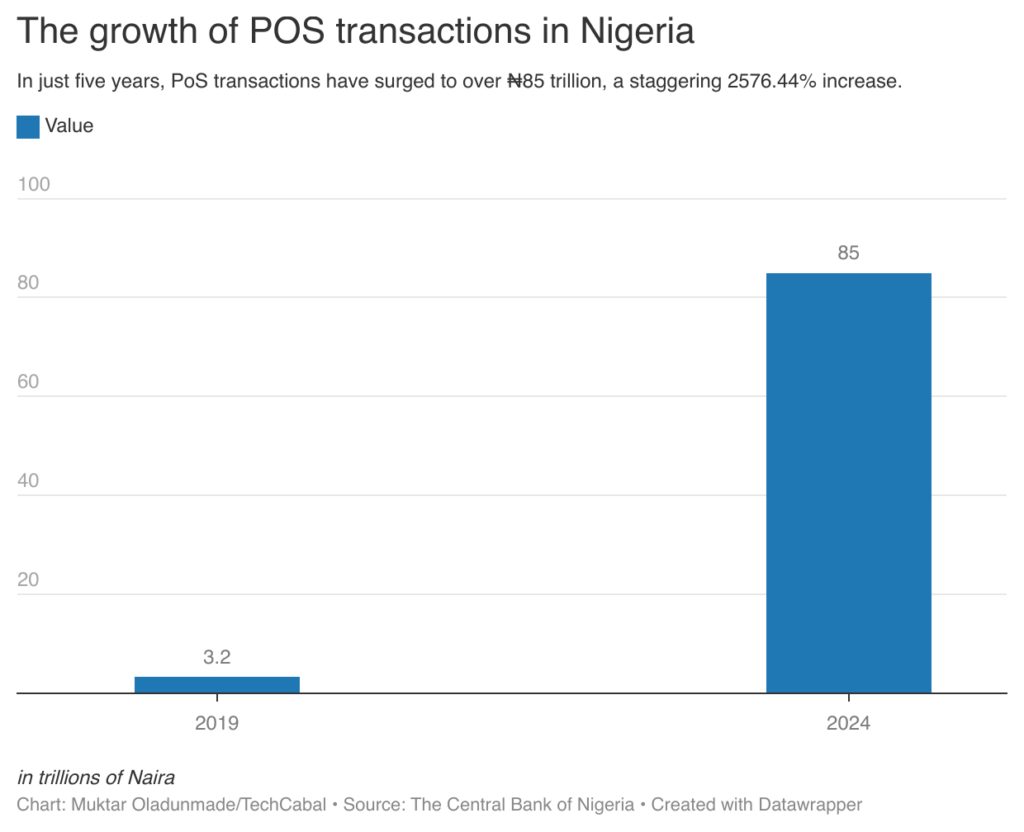

POS transactions have grown wildly up to now 5 years

In 2019, PoS transactions had been valued at ₦3.21 trillion. In simply 5 years, PoS transactions have surged to over ₦85 trillion, a staggering 2576.44% enhance.

Quite a bit has modified in that point, however the progress of POS transactions has been pushed by the company banking trade, which now boasts 1.5 million brokers, and fintechs like OPay, Moniepoint, and PalmPay.

Within the first half of 2024, over 6 billion transactions had been accomplished by way of PoS gadgets, which quantities to a billion month-to-month, over 33 million transactions each day, and over 1.3 million each hour.

How typically do Nigerians use cheques right now?

The reply isn’t. Clients are slowly phasing out cheques as the amount of cheques cleared dropped by 13% from 7.92 million within the second half of 2023 to six.88 million within the first half of 2024.

Whereas the worth rose barely by 2%, growing from ₦8.553 trillion to ₦8.741 trillion, prospects desire to make use of digital and different fee channels over cheques.

ATMs is likely to be relics in 5 years

Many Nigerians have grown accustomed to seeing “Out of Service” messages displayed on ATMs. Not solely are ATMs typically out of service, however there are additionally far too few of them throughout the nation to satisfy demand. There are solely 16,000 lively ATMs in Nigeria and with a banking inhabitants of 106 million adults, Nigeria requires virtually 70,000 ATMs to satisfy demand.

This shortage and unreliability led to the worth of these transactions falling by 10%, as Nigerians used ATMs for less than ₦12 trillion price of transactions—seven instances lower than the worth of POS transactions.

Surprisingly, the amount of ATM transactions elevated by 1%, rising from 492.76 million within the second half of 2023 to 496.44 million within the first half of 2024. However this progress is a uncommon spot with ATMs; simply 5 years in the past, Nigerians carried out 839.8 million transactions with ATMs.

Whereas different fee strategies have grown over time, ATM transactions have halved, and in simply 5 years they is likely to be a relic of a distant previous when Nigerians relied on them for money.

General, 2024 marked a pivotal 12 months in Nigeria’s fee ecosystem, with a transparent shift in direction of digital fee strategies, pushed by elevated web penetration, smartphone utilization, and a rising choice for handy and safe transaction channels.