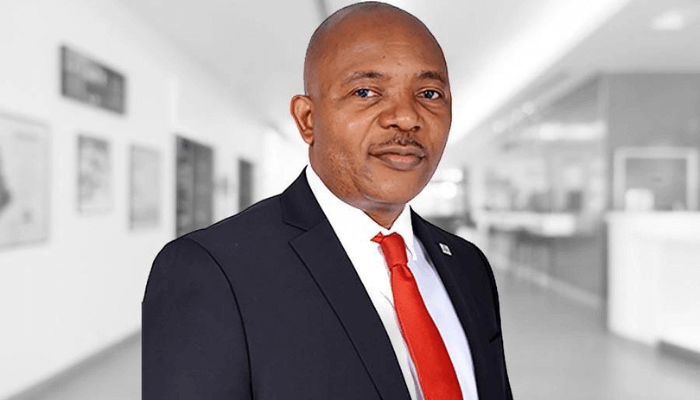

Femi Asenuga, managing director/CEO of Mutual Advantages Assurance.

Underwriting agency, Mutual Advantages Assurance Plc and its subsidiary; Mutual Advantages Life Assurance Restricted have demonstrated stability within the insurance coverage sector with cost of N25.63 billion in claims within the first 9-months of 2024.

That is amidst a difficult financial panorama the place companies are grappling with quite a few difficulties together with inflation and forex fluctuations that threaten their competitiveness and survival.

By constantly fulfilling its claims obligations, Mutual Advantages has demonstrated resilience and dedication to its policyholders, setting itself aside as a trusted supplier in a turbulent market.

The claims breakdown reveals that Mutual Advantages Assurance Plc, the overall enterprise arm paid out in 9-months interval N7.14 billion, whereas the life enterprise arm paid out N18.49 billion, made up of N12.06 billion on deposit administration and N6.42 billion on insurance coverage contracts.

An extra breakdown of the overall enterprise claims reveals that, the corporate paid out N1.77 billion on motor enterprise, adopted by N1.38 billion on hearth. Others are normal accident N1.33 billion; Marine N1.16 billion; Aviation N715.81 million; Engineering N706.75 million; and Oil and fuel enterprise N78.35 million, amongst others.

“This steadfast efficiency not solely underscores our sturdy monetary administration functionality, but in addition highlights our dedication to constructing buyer belief and adapting to the dynamic wants of the Nigerian financial system, Femi Asenuga, MD/CEO, Mutual Advantages Assurance Plc stated.

He additional stated, “By constantly assembly our claims obligations, we’ve been capable of construct belief with policyholders, which has not solely elevated buyer loyalty and retention however has additionally introduced us new shoppers.

Learn additionally: Mutual Advantages resilience strengthens place for progress in 2024

“What we’ve finished is to make sure we offer glorious customer support via our processes. This has enhanced shopper satisfaction and foster long-term relationships that has remained important for retention in powerful financial conditions like this”.

Commenting on the life enterprise and what the corporate is doing, Biyi Ashiru-Mobolaji, MD/CEO, Mutual Advantages Life Assurance Restricted stated its main income sources are from group life insurance coverage, with claims N5.21 billion, and particular person life enterprise, with claims amounting to N994.39 million within the 9-months interval underneath overview.

“When an insurance coverage firm pays claims promptly, it sometimes displays positively on the corporate’s fame and engenders buyer loyalty. operational effectivity”

In line with him, corporations recognized for immediate claims processing can differentiate themselves in a crowded market, making them extra interesting to potential clients with elevated referrals.

“Environment friendly claims dealing with signifies a well-run organisation and that has been our focus and the explanation we’ve continued to make investments in expertise, workers coaching and processes, Ashiru-Mobolaji stated.

Nigeria’s financial system has been closely depending on oil exports, which accounts for a considerable portion of presidency’s income and overseas alternate earnings.

This reliance nonetheless continues to make the financial system susceptible to fluctuations in international oil costs, with home results of excessive inflation, resulting in elevated prices of products and providers.

We perceive the affect that these can have on our shoppers’ lives and companies. Our capacity to satisfy our claims obligations is a testomony to our operational effectivity and the belief our shoppers place in us,” Ashiru-Mobolaji added.

Because the 12 months progresses, Mutual Advantages stays devoted to safeguarding the pursuits of its policyholders and contributing to the expansion and stability of the insurance coverage business in Nigeria.

The 29-year-old group is a number one model within the Nigerian insurance coverage business, famend for its swift and dependable claims settlement.