The yr 2021 marked a watershed second for Africa’s tech ecosystem. A confluence of things, together with considerable overseas capital and a low-interest charge surroundings, fuelled a surge in startup funding. International giants like Tiger International and SoftBank, as soon as synonymous with Silicon Valley, poured billions into African ventures, propelling a number of firms to unicorn standing.

Nevertheless, this period of unbridled optimism was short-lived. A mix of macroeconomic components, together with rising rates of interest, geopolitical tensions, and a worldwide funding crunch, led to a big pullback from these main buyers. The continent’s overreliance on overseas capital grew to become evident because the funding panorama shifted dramatically.

Tiger International and SoftBank, whereas influential, had distinct funding methods. Tiger International prioritised short-term returns, pleasing massive institutional buyers. SoftBank, however, favoured a cluster of quantity ones” strategy, connecting various firms inside its portfolio.

Regardless of their differing approaches, each companies shared a standard trait: a willingness to spend money on emotionally interesting startups. This, coupled with their very own monetary setbacks, led to a slowdown of their funding actions in 2016 and 2019

For example, Tiger’s woeful Q1 2016 efficiency slowed its palms. Softbank additionally stalled its funding in 2019 after it made a dangerous guess, backing WeWork. In 2021, Tiger International and Softbank picked up the tempo of their funding, leveraging on the low-interest charge surroundings and rising their investments by over 300% year-on-year.

Subsequent Wave continues after this advert.

We’re excited to announce our partnership with Wimbart on the second version of their pioneering pan-African analysis publication, “Startup Efficiency Reporting in Africa”. This report is ready to launch within the first week of October and goals to make clear the intricacies of investor relations throughout the African tech ecosystem.

The survey is now open, and we’re calling on all African founders and buyers to take part.

Over the previous decade, Wimbart has labored intently with a variety of stakeholders in Africa’s tech sector. Their first report recognized vital challenges, notably the disconnect between buyers and founders, which poses a serious risk to African tech ventures

This yr’s version goals to discover these points even additional, incorporating new insights from startup founders to higher perceive and handle communication gaps that influence the African tech ecosystem.

By taking part on this survey, you’ll contribute priceless insights that can form the way forward for investor relations and help the expansion of African startups

The survey is now open and can shut on Friday, sixth September 2024 at 23:59 pm UK time. It takes simply 6 minutes to finish and is absolutely confidential.

Make your voice heard.

Click on right here to take part.

The low-interest charge surroundings of 2021 offered a catalyst for renewed funding, fuelling a wave of funding for African startups.

Notable offers included Tiger International’s $170 million funding in Flutterwave and SoftBank’s $400 million funding in OPay. These offers performed an important function in establishing Africa’s presence within the international tech panorama—minting new unicorns.

Nevertheless, the euphoria was short-lived. As international financial situations deteriorated, these buyers confronted mounting losses, forcing them to reassess their methods. The withdrawal of those main gamers had a big influence on Africa’s tech ecosystem, because the continent’s overreliance on overseas capital grew to become obvious.

Whereas the departure of world buyers has offered challenges, Africa’s tech ecosystem is way from stagnant. Native buyers and accelerators have stepped up, fostering a extra sustainable and resilient surroundings. A few of them embody early-stage VC agency, Launch Africa Ventures, a Pan-African VC fund fixing the numerous funding hole in seed and pre-Collection A funding. The fund has the widest geographical unfold, concerned in 12% of all fairness offers between $100,000 and $10million that occurred on the continent since 2021. They signal a couple of deal every week on common. Different distinguished African companies like Flat6Labs, LoftyInc, and Future Africa are additionally lively on this area.

Different buyers like Verod-Kepple Africa Ventures, Founders Manufacturing unit, Norrsken, Plug and Play, Ventures Platform, Musha Ventures, 4DX Ventures and 500 International participated in at the least one $100,000+ deal a month in Africa in 2021–2022. Most of those buyers have been lively in a couple of area in Africa, contributing immensely to the brand new progress of the ecosystem.

Subsequent Wave continues after this advert.

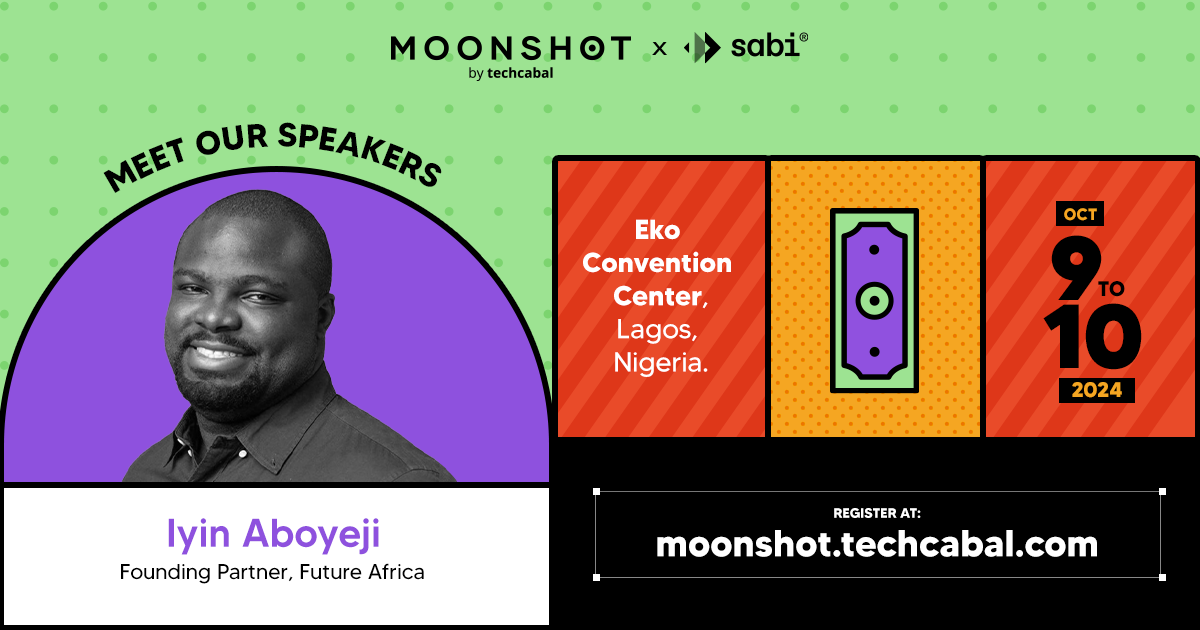

Difficulties inside Africa’s financial panorama have raised questions in regards to the feasibility of constructing profitable startups on the continent. Iyin Aboyeji, a Nigerian entrepreneur who co-founded two firms valued at over $1 billion earlier than the age of 30, is now a distinguished startup investor. He is among the featured audio system at Moonshot 2024, becoming a member of different innovators and trade leaders engaged on groundbreaking options to Africa’s most urgent challenges.

Save your seat at Moonshot! Get tickets right here

The main focus has shifted from speedy progress to profitability and long-term worth creation. The brand new Africa-focused buyers are the product of a 2021 guess on the continent. This improvement factors to the truth that the success of Africa’s tech ecosystem is a catalyst for future improvement and win-win for everybody.

As Africa continues to develop its expertise pool, enhance its infrastructure, and handle regulatory challenges, it’s well-positioned to turn into a serious participant within the international tech panorama. The way forward for the continent’s tech ecosystem will rely on its skill to draw and retain high expertise, develop a strong exit market, and foster a supportive regulatory surroundings.

Joseph Olaoluwa

Senior Reporter, TechCabal

Thanks for studying this far. Be happy to e mail joseph.olaoluwa[at]bigcabal.com, together with your ideas about this version of NextWave. Or simply click on reply to share your ideas and suggestions.

We’d love to listen to from you

Psst! Down right here!

Thanks for studying right this moment’s Subsequent Wave. Please share. Or subscribe if somebody shared it to you right here at no cost to get recent views on the progress of digital innovation in Africa each Sunday.

As at all times be happy to e mail a reply or response to this essay. I get pleasure from studying these emails lots.

TC Every day publication is out each day (Mon – Fri) transient of all of the know-how and enterprise tales it’s essential to know. Get it in your inbox every weekday at 7 AM (WAT).

Observe TechCabal on Twitter, Instagram, Fb, and LinkedIn to remain engaged in our real-time conversations on tech and innovation in Africa.