The Financial institution of Botswana (BoB) has lowered rates of interest by 25 foundation factors to 1.9% regardless of rising inflation. It’s the third consecutive price lower in a yr. The earlier cuts had been in December 2023 and June 2024.

Headline inflation in July rose to three.5%, in keeping with the financial institution’s goal.

“We hope that this choice will help to stimulate the financial system,” Financial institution of Botswana governor Cornelius Dekop stated at Thursday’s MPC assembly.

Botswana inflation is projected to barely enhance within the medium time period however nonetheless keep throughout the financial institution’s 3-6% goal. It’s anticipated to common 3% in 2024.

By lowering the lending price, the financial institution hopes to spice up Botswana’s financial system by encouraging lending. In July, the IMF introduced that Botswana’s financial progress could be 1% in 2024, decrease than an earlier projection of three.6%.

The sluggish financial progress has been pushed by a pointy decline in diamond buying and selling and mining actions which account for 80% of exports, one-third of fiscal revenues, and one-quarter of GDP.

Botswana’s diamond manufacturing was down 24% in H1 2024 in comparison with the identical interval within the earlier yr, in accordance with a report by De Beers proprietor Anglo American.

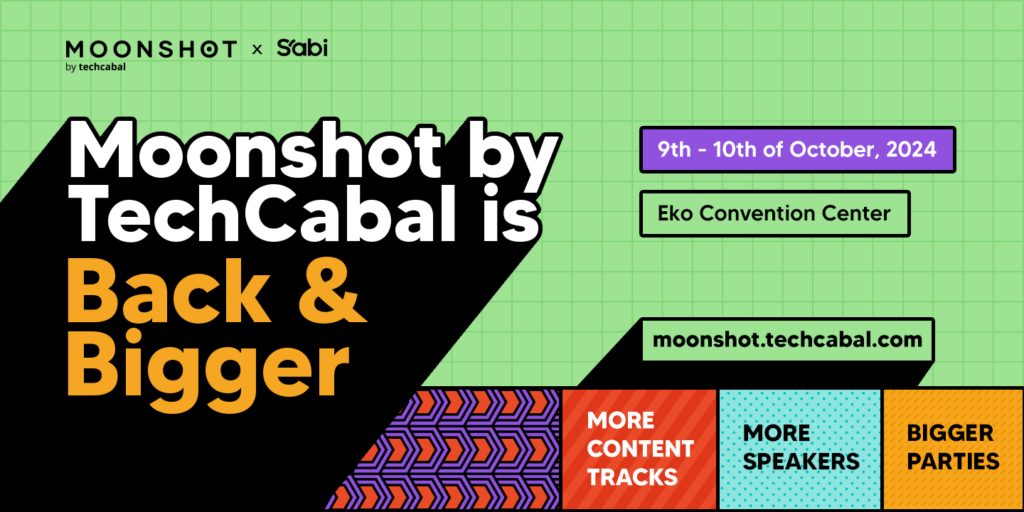

Have you ever bought your early-bird tickets to the Moonshot Convention? Click on this hyperlink to seize ’em and take a look at our fast-growing checklist of audio system coming to the convention!