By Rystad Vitality – Jul 17, 2024, 2:00 PM CDT

- The tip of the Russia-Ukraine fuel transit settlement in 2024 will disrupt fuel provides to a number of European nations, notably Slovakia, Austria, and Moldova.

- To switch Russian fuel, the EU might want to improve LNG imports and make the most of different pipelines, such because the Trans-Balkan pipeline and the Balkan Stream.

- Central and Jap European nations are collaborating on the Vertical Fuel Hall initiative to boost vitality safety and diversify fuel provides.

The European Union (EU) targets a ban on Russian gasoline imports by 2027. Nevertheless, almost half of Russia’s pipeline fuel provides to Europe and Moldova are nonetheless passing via Ukraine, totaling 13.7 billion cubic meters (Bcm) in 2023. Because the EU discusses the opportunity of involving Azerbaijan in a future transit deal, the present five-year fuel transit settlement between Russia and Ukraine is about to run out by the top of 2024, resulting in considerations concerning the future circulate of those fuel volumes. Rystad Vitality predicts that Russia’s fuel will should be rerouted to Europe via different paths, requiring an extra 7.2 Bcm per yr of liquefied pure fuel (LNG) to exchange the fuel transiting Ukraine. Provide disruptions might happen ahead of initially anticipated, as indicated by the Austrian firm OMV’s market warning in Could.

Slovakia, Austria and Moldova are the European nations most depending on transit volumes, importing about 3.2 Bcm, 5.7 Bcmand 2.0 Bcm, respectively, in 2023. Final yr, Russian fuel passing via Ukraine equipped EU nations through entry factors in Slovakia and Moldova. Moldova is adjusting its provide whereas having agreed with Ukraine on a steady circulate of Russian fuel till the top of 2025, largely equipped to the pro-Russia separatist area of Transnistria. In 2023, the nation imported 74% of its fuel via Ukraine and, for the primary time, obtained fuel from Romania and the south via reverse flows through the Trans-Balkan pipeline. Italy’s vitality firm Eni and Hungary additionally imported Russian fuel via Ukraine, whereas Slovenia and Croatia have been smaller takers of Russian fuel through Ukraine.

Halting Russian fuel pipeline flows through Ukraine would considerably influence nations counting on these volumes. For instance, when the transit extension expires after 2025, Moldova would want to reroute its 2 Bcm equipped through Ukraine, probably via reverse flows of the Trans-Balkan pipeline. To succeed in Moldova, Russian fuel may use the Isaccea entry level between Romania and Ukraine, however a transit settlement for the brief 25-kilometer distance via Ukraine could be required. The Trans-Balkan pipeline has been operated in reverse circulate for the reason that finish of 2022, with 0.54 Bcm of fuel getting into Moldova through Ukraine from Romania via the Isaccea entry level in 2023. Moreover, fuel from the Southern Fuel Hall in Azerbaijan, in addition to from Turkish and Greek LNG import terminals, can attain Moldova through the south. When the Russia-Ukraine transit settlement ceases, the one different provide routes for Central and East European nations could be the Balkan Stream and the Horgos entry level between Serbia and Hungary.

Russian producer Gazprom and European importers are eager on steady provides through Ukraine, whereas Ukrainian officers deny any intention for a renewed settlement with Russia. With out Azerbaijan or one other third celebration transiting the fuel following a swap take care of Russia, the EU would require about 7.2 Bcm of fuel to be sourced from the LNG market. Terminals in Poland, Germany, Lithuania and Italy may ahead these volumes to essentially the most affected counties, resembling Slovakia and Austria,

Christoph Halser, Fuel & LNG Analyst, Rystad Vitality

Study extra with Rystad Vitality’s Fuel & LNG Resolution.

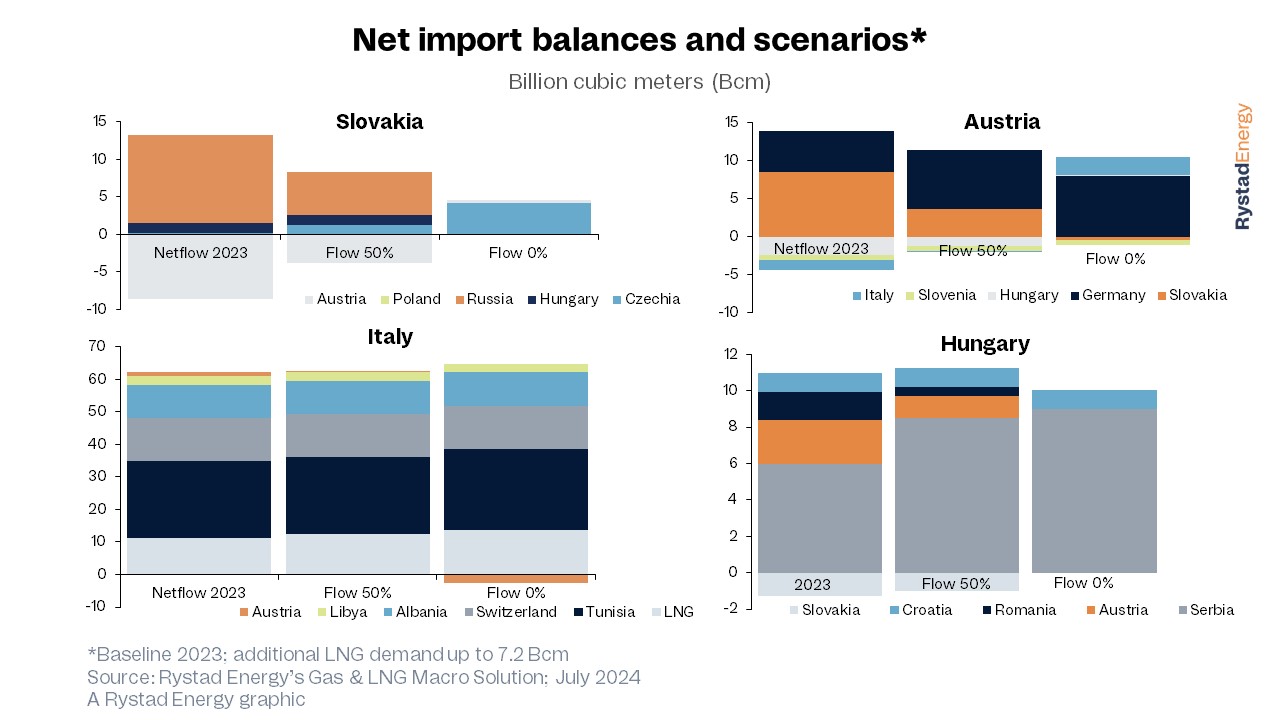

Rystad Vitality forecasts potential modifications to the 2023 fuel steadiness for affected nations beneath the idea of fifty% and 0% circulate of fuel through Ukraine and capability limitations at related entry level options. With out Russian fuel, Slovakia would discover itself on the finish of the circulate chain, requiring about 4 Bcm of fuel delivered via the Lanzhot entry level from Czechia. With further regasification capability in Poland solely out there in 2025, a zero-flow state of affairs might even entail reverse flows from Austria into Slovakia.

Austria, the most important offtaker of Russian fuel in 2023, would pivot in direction of growing imports from Germany through the Oberkappel entry level, anticipated to function at a most annual capability of 8 Bcm. Nevertheless, for Rystad Vitality’s baseline yr of 2023, the import capability at Oberkappel is not going to be enough to shut the 8.53 Bcm import hole. With out short-term capability changes, fuel transits to Hungary would decline, and outflows to Italy could be stopped. If all Russian fuel flows through Ukraine had been to stop, Austria would want to import as much as 2.5 Bcm from Italy through the Arnoldstein-Tarvisio crossing level.

Italy has a number of choices to exchange Russian fuel pipelines and has largely achieved independence from the Ukrainian transit. Nevertheless, the nation could be required to supply about 3.75 Bcm for Slovakia and Austria. These further provides may come from the Ravenna floating storage and regasification unit (FSRU) —5 Bcm per yr from 2025—and 1.23 Bcm from pipeline provides via Tunisia.

Hungary would face massive challenges in case of an entire halt of Russian fuel circulate via Ukraine. Assuming Moldova is equipped through the south, capability through the Trans-Balkan pipeline from Romania could be absolutely allotted, halting inflows from Romania. Moreover, Austria could be unable to ahead fuel to Hungary, whereas Croatia will not have further regasification capability out there earlier than 2025. Hungary must rely solely on elevated fuel circulate via the TurkStream pipeline, whereby the Horgos entry level could be required to function repeatedly at its most capability of 9 Bcm per yr. Alternatively, if Austria may supply enough LNG from Italy, Hungary may obtain further fuel via reverse flows on the Mosonmagyarovar entry level from Austria.

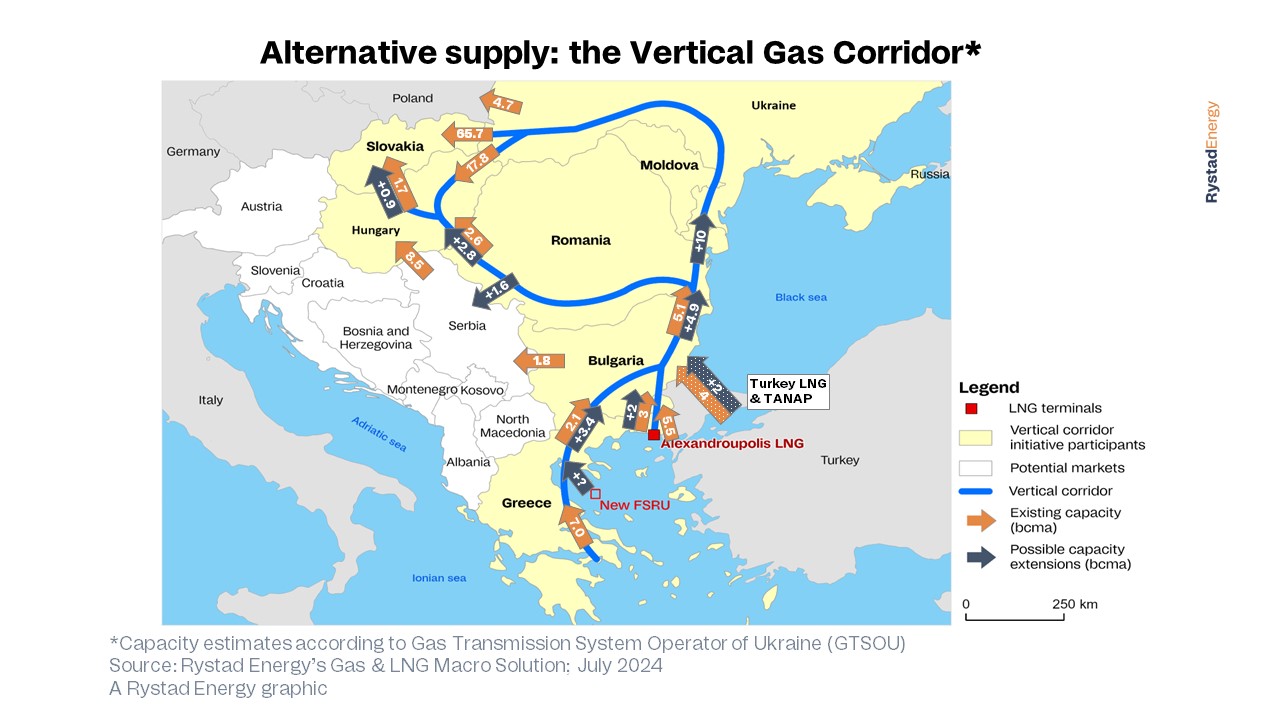

Central and Jap European nations are making ready for a doable halt within the Ukraine fuel transit and have joined forces to create a Vertical Fuel Hall beneath the EU’s Central and South Jap Europe Vitality Connectivity Initiative (CESEC). This yr, on 19 January, a memorandum of understanding (MoU) was signed in Athens involving EU vitality commissioner Kadri Simson and the Transmission System Operators (TSOs) from Greece, Bulgaria, Romania, Hungary, Slovakia, Ukraine and Moldova. The hall would make the most of current infrastructure in Ukraine and Moldova and allow LNG imports from Greece and Turkey to succeed in Slovakia, Hungary and probably Poland.

Moreover, Turkey’s transmission system operator BOTAS and Bulgaria’s operator Bulgartransgaz signed an settlement in January 2024 to extend fuel entry capability on the Strandzha 1 entry level, enabling elevated fuel flows from Azerbaijan and the Caspian Sea area into Europe. This growth may help in elevating Azerbaijan’s EU fuel exports from 13 Bcm to twenty Bcm per yr by 2027 and, in the long term, probably transport Iranian fuel via the Solidarity Ring Initiative.

By Rystad Vitality

Extra High Reads From Oilprice.com:

- Is President Trump Accountable for Decrease Fuel Costs?

- Container Ship Backlogs and Hovering Charges Drive Provide Chain Congestion Issues

- Aluminum Costs Face Downward Stress as Tariffs Affect Market Traits

Obtain The Free Oilprice App At this time

Again to homepage

![]()

Rystad Vitality

Rystad Vitality is an impartial vitality consulting providers and enterprise intelligence supplier providing world databases, strategic advisory and analysis merchandise for vitality corporations and suppliers,…

Extra Data

Associated posts

Go away a remark