Enterprise capital funding in Africa’s tech ecosystem continues to say no. Founders solely raised $779.7 million in H1 2024, the bottom quantity since 2020, based on the newest version of the State of Tech in Africa (SOTIA) report by TechCabal Insights. Over 1 / 4 of this funding was from non-equity raises; debt offers, and grants, which means founders proceed to order extra possession of their firms.

The decline in fairness offers continues regardless of startups refocusing on changing into worthwhile and taking cost-cutting measures together with layoffs.

“There’s no glossing over a number of the difficulties the African tech ecosystem has seen within the interval below assessment as layoffs continued and mega offers have been nowhere to be discovered,” the report stated.

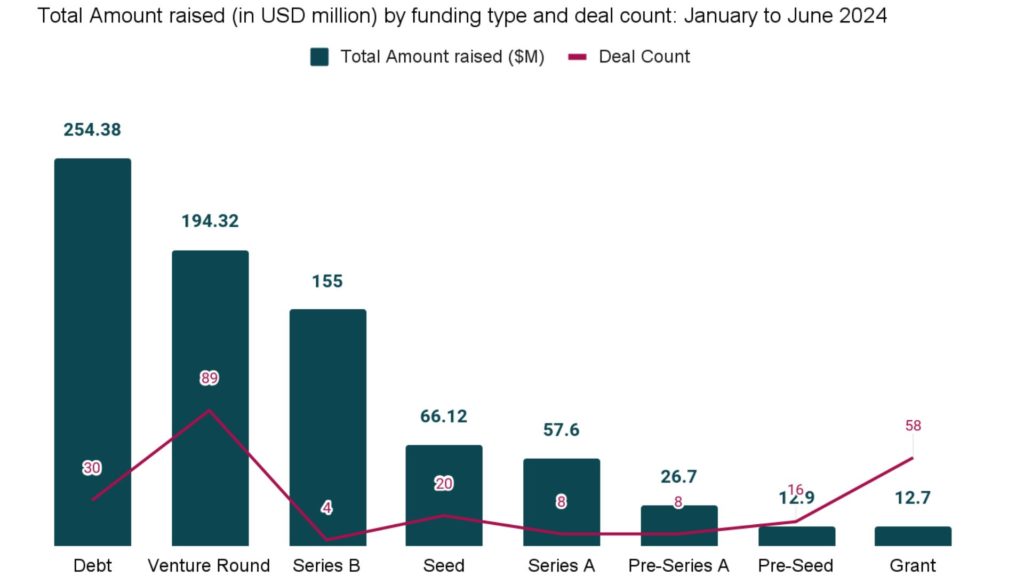

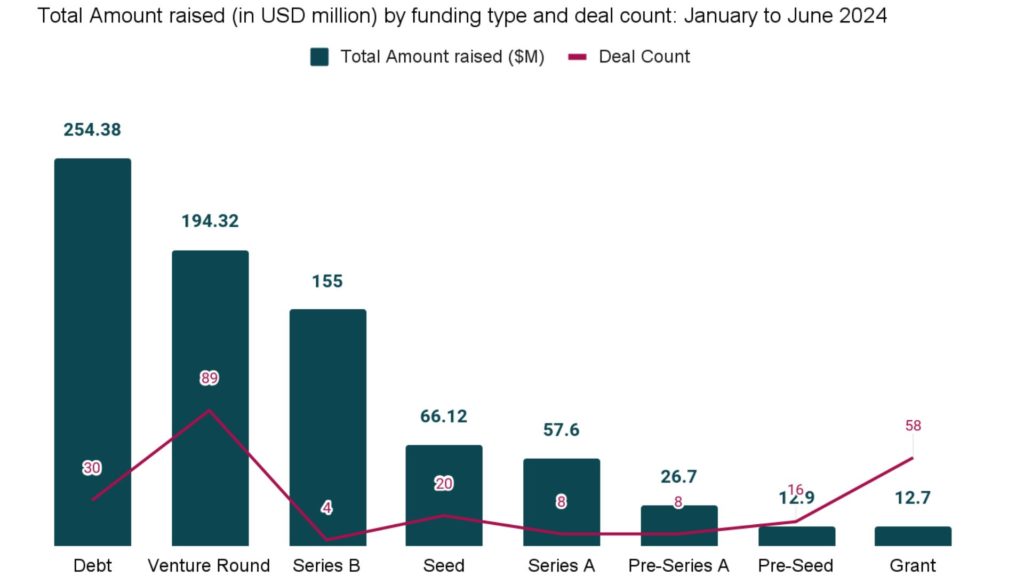

The variety of fairness offers halved and the worth of the investments diminished by 24%, 12 months on 12 months, based on SOTIA. Founders secured essentially the most funding from debt offers, about $254 million.

Nevertheless, enterprise offers stay the most typical type of funding, and most of it went to early-stage startups. In 16 rounds pre-seed startups raised about $12.9 million. As seed-stage startups raised $66.2 million in 20 rounds. However essentially the most enterprise deal funding—$155 million— got here from solely 4 series-B rounds.

The least funding got here from grants—$12.7 million.

On this persistent decline, most of what has remained the identical is the vacation spot of the funds. Buyers proceed to point out confidence within the Huge 4. Egypt, South Africa, Nigeria, and Kenya accounted for 65% of the funding.

Nevertheless, that will change quickly, as Benin and Ghana raised—$50 million and $18.6 million respectively— extra funds than Nigeria and South Africa in Q2 2024.

Extra new developments will be seen within the sector traders favoured in H1 2024. Fintech which obtained $863 million in H1 of 2023 misplaced its first place to the logistics and transportation sector which raised over $218 million. The fintech sector obtained $185 million, adopted carefully by the power and water trade, which attracted about $132 million.

The telecom, media & leisure trade was most impacted by the funding crunch, elevating solely 3.5 million, its lowest since 2021, per the report.