BlackRock CEO Larry Fink just lately addressed the Group of Seven (G7) leaders. He highlighted a major shift within the international monetary system.

Fink emphasised the rising function of capital markets as the first supply of private-sector financing. This transformation alerts a urgent want for brand spanking new methods to unlock monetary potential.

Larry Fink: The “Progress Dilemma”

In a keynote deal with, Fink highlighted a urgent “development dilemma” impacting rising economies and established financial powers.

“The Worldwide Financial Fund and the World Financial institution have been created 80 years in the past when banks, not markets, financed most issues. Immediately, the monetary world is flipped. The capital markets are the most important supply of personal sector financing,” Fink famous.

Latest reforms have already yielded vital outcomes, with billions of {dollars} funneled into infrastructure in creating nations. Nevertheless, he emphasised the need for a brand new strategy to unlocking capital, which differs from conventional financial institution steadiness sheet fashions.

In consequence, Fink introduced the formation of the Investor Coalition, together with BlackRock, GIP, and KKR, which is able to commit $25 billion to Asia’s rising economies. This initiative mirrors efforts in Africa, aiming to stimulate financial development via infrastructure investments.

Fink pressured that the necessity for development extends past rising economies.

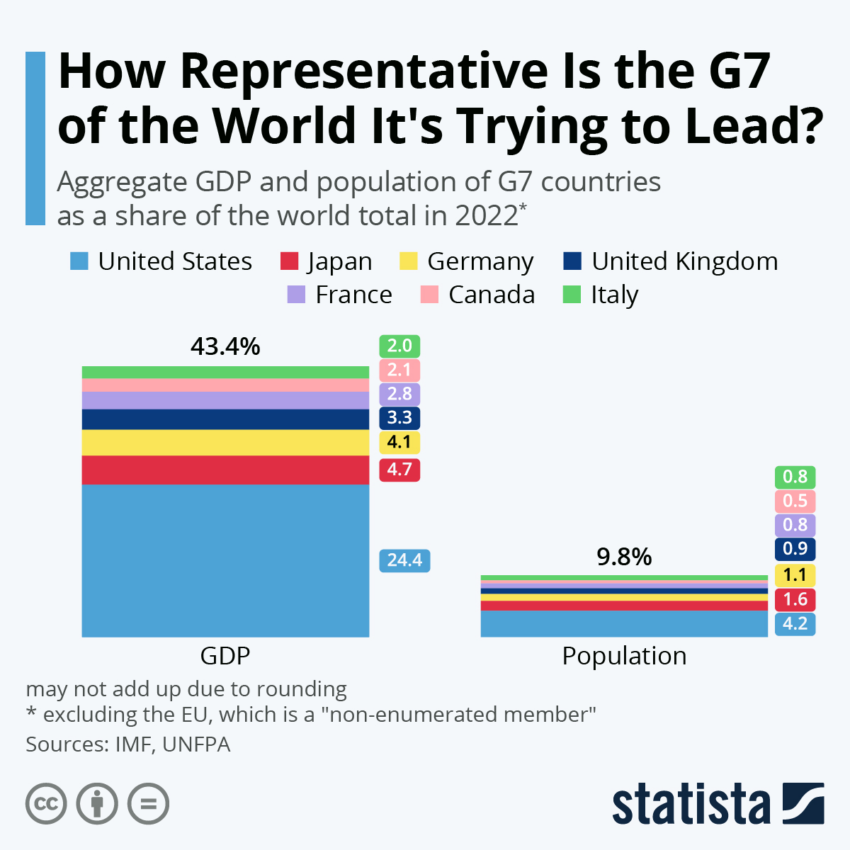

“Nice financial powers, together with the G7, are the truth is on the checklist. Certainly, development going ahead. All of us are staring down a development dilemma, whether or not we resolve it or not. It’s a major financial fork within the street for our nations,” he acknowledged.

With G7 nations averaging a debt-to-GDP ratio of 129%, conventional strategies of taxation and spending cuts are inadequate. Fink argued that real development is important to overcoming this financial hurdle, although attaining it’s more and more difficult as a consequence of demographic shifts and declining working-age populations.

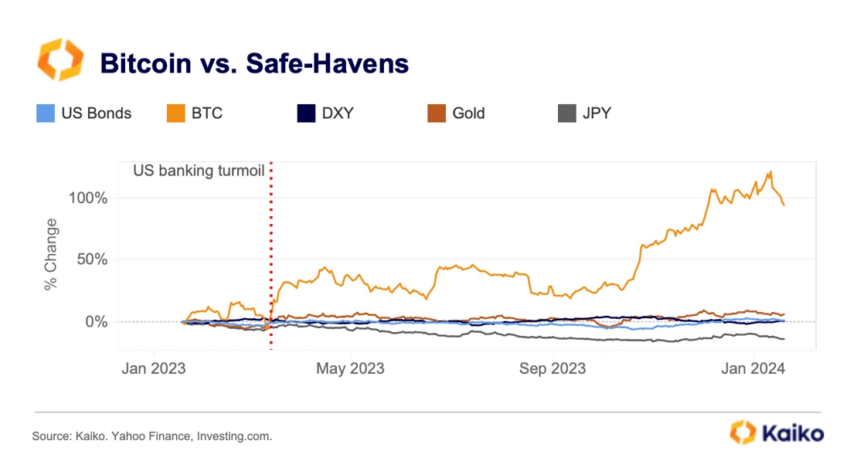

Amid these financial issues, Bitcoin has garnered consideration as a possible secure haven. Analysts at blockchain analytics agency Kaiko have observed massive institutional gamers, resembling Franklin Templeton, Constancy, and even BlackRock, lauding Bitcoin’s safe-haven traits.

Not like conventional secure havens, Bitcoin offers higher returns and a low correlation with equities, notably throughout market turmoil.

Kaiko’s evaluation reveals that Bitcoin’s 60-day correlation with the Nasdaq 100 has considerably decreased over the previous yr, averaging near zero since June 2023. This low correlation enhances its enchantment as a secure haven, particularly throughout monetary crises, resembling final yr’s US banking crisis, the place Bitcoin outperformed conventional property like gold and US bonds.

The introduction of spot Bitcoin exchange-traded funds (ETFs) within the US has additionally seen robust demand, with greater than $15 billion in internet influx since its launch in January 2024. These ETFs profit from Bitcoin’s uneven returns and its status as a dependable asset throughout financial instability.

Learn extra: How To Trade a Bitcoin ETF: A Step-by-Step Approach

As the worldwide financial system faces unprecedented challenges, Bitcoin’s function as a secure haven turns into more and more vital. With institutional endorsements, Bitcoin stands out as a viable possibility for buyers in search of stability amid financial uncertainty.

Trusted

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.