The availability of diesel from Dangote oil refinery is anticipated to deliver to an finish the importation of the product from European refiners estimated at 2.5 billion litres yearly, BusinessDay’s findings have revealed.

For many years, European refiners have loved a profitable market in Nigeria because the unreliable energy provide from the national grid compelled corporations throughout Africa’s fourth largest economic system to rely closely on importing refined merchandise with a internet worth of $17 billion yearly.

Analysts and merchants surveyed by BusinessDay stated the availability of diesel from the Dangote refinery is anticipated to mount stress on European refineries already vulnerable to closure from heightened competitors.

Farai Ronoledi, an oil dealer conversant in the European market, stated the emergence of Dangote oil refinery isn’t just a home win but in addition represents a paradigm shift within the international refining panorama.

“Europe’s refineries face closures as a consequence of declining exports to Nigeria and different West African nations,” Ronoledi stated.

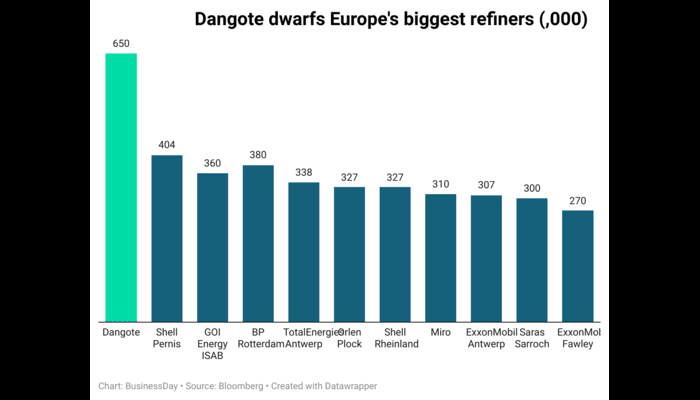

The refinery, which price $20 billion to construct, began manufacturing in January. It may possibly refine as much as 650,000 barrels per day (bpd) and would be the largest in Africa and Europe when it reaches full capability this yr or the subsequent.

“As soon as Nigeria sees Dangote attain a gentle state capability, that would imply some 327,000 bpd gasoline provide and 244,000 bpd of diesel,” Kelly Norways, an analyst at S&P International Commodity Insights, stated in an oil market podcast.

“As soon as we see the refinery ramp up, that would imply that West African gasoline imports or the import reliance that they’ve for the time being might drop by as a lot as 290,000 barrels per day between 2023 and 2026. So actually, this might change into fairly a dominant provider within the West African market,” he added.

Regarding studies on the extent of sulphur within the diesel from the Dangote refinery, a senior govt within the buying and selling enterprise stated merchants within the West that provide the Nigerian diesel market can’t be blissful.

“Dangote has taken away their market. Regardless of the sulphur content material is now will enhance,” he stated. “We should make do with Dangote diesel for now. Let the European sellers search for markets elsewhere.”

Knowledge sourced from Klper, a worldwide commerce intelligence platform, confirmed a few third of Europe’s 1.33 million bpd common petrol exports in 2023 went to West Africa, an even bigger chunk than every other area, with the vast majority of these exports ending up in Nigeria.

“The lack of the West African market can be problematic for a small set of refineries that should not have the equipment to improve their gasoline to European and US specification,” Eugene Lindell, head of refined merchandise at FGE’s consultancy stated, referring to extra stringent environmental requirements for different markets.

The Dangote refinery, funded by Africa’s richest man Aliko Dangote, was configured to provide as a lot as 53 million litres of petrol a day, about 300,000 bpd.

Based on native oil entrepreneurs, diesel produced on the Dangote refinery has no vessel price, import costs, and different prices related to the prices related to the importation of the commodity into Nigeria.

Findings by BusinessDay confirmed the worth of diesel in most depots at present hovers round N950 to N1100. For example, on Saturday, MRS depot at Apapa offered the product for N1,055 whereas Ibeto Depot put the worth at N1,060.

Specialists stated the drop in West African imports will coincide with new environmental legal guidelines in Northwest Europe that may drive vegetation to reconfigure, search new markets for lower-quality petrol or shut down.

Yaping Wang, senior refining analyst at Klper, stated vegetation which have funds to reconfigure might direct petrol exports to the USA or South America.

However upgrading refineries can be tough as a result of banks are cautious of lending cash to fossil gasoline initiatives.

“Even when you discover a financial institution which can fund a European refinery improve undertaking, charges can be too excessive to make it work,” stated an govt at a serious US financial institution that lends to grease corporations.

Round 30 European refineries have shut down since 2009, knowledge from refining trade physique Concawe confirmed, with almost 90 vegetation of assorted sizes and complexities nonetheless in operation.

Closures have been introduced on by competitors with newer and extra complicated vegetation within the Center East and Asia and extra lately due to the influence of the coronavirus pandemic.

Since 2016, Europe has misplaced 1.52 million bpd of operational crude distillation which at present stands at 13.93 million bpd, in response to IIR Power.