Nvidia Corp. executives predicted file income nicely past something the corporate has skilled Wednesday, pushing shares towards all-time highs, as margins enhance with AI-driven data-center gross sales.

Nvidia

NVDA,

guided for second-quarter income of $11 billion, plus or minus 2%; the chip maker has by no means earlier than reported quarterly income larger than $8.29 billion, which it hit within the fiscal first quarter a yr in the past. Analysts on common had been anticipating $7.17 billion, based on FactSet, a achieve from the $6.7 billion in gross sales Nvidia put up within the fiscal second quarter final yr.

See: Nvidia barrels toward rare $1 trillion valuation after putting a dollar figure on AI boost

On a convention name with analysts, Nvidia Chief Government Jensen Huang stated the straightforward manner to consider it’s that the world has “a trillion {dollars} of knowledge heart put in and it was once 100% CPU,” or central processing models, versus Nvidia’s graphics processors that information facilities and AI fashions have embraced in recent times. And whereas the world’s data-center price range is strapped, on the similar time bigger and bigger AI fashions require increasingly computing energy, he stated.

“The best manner to consider that’s over the following 4 or 5, 10 years, most of that trillion {dollars}, and compensating adjusting for all the expansion in information heart nonetheless, will probably be largely generative AI,” Huang stated.

“What occurred is, when generative AI got here alongside, it triggered a killer app for this computing platform that’s been in preparation for a while,” he added.

The corporate forecast adjusted gross margins of 70% plus or minus 50 foundation factors for the second quarter, after reporting 66.8% for the primary quarter, which was down from the year-ago quarter’s 67.1%, as stronger gross sales of higher-margin data-center merchandise counter the gross sales drop in lower-margin gaming chips.

Again when shares had been struggling within the mid-$100s three quarters in the past, Nvidia was not solely coping with how to salvage about $400 million in data-center sales to China blocked by U.S. national security concerns, however was spending billions of dollars clearing inventory to prep for the launch of its subsequent technology “Ada Lovelace”-architecture. Nvidia Chief Monetary Officer Colette Kress advised analysts on the decision late Wednesday: “We imagine the channel stock correction is behind us.”

One of many causes data-center merchandise are larger margin has loads to do with how a lot Nvidia’s software program ecosystem is required for the {hardware} that run exponentially rising AI fashions, Kress advised MarketWatch in an interview. Not solely do data-center GPUs require Nvidia’s fundamental software program, however Nvidia plans to promote enterprise AI companies, together with inventive platforms like Omniverse, to start creating wealth on the AI arms race rapidly.

“There’s two issues to consider,” Kress advised MarketWatch. “The software program, being a supplier, but in addition the quantity of efficiency and efficiency enchancment for the entire price it’s essential to incur to do a majority of these workloads,” Kress advised MarketWatch.

Relating to the $1 trillion in data-center infrastructure that’s CPU-based, Huang hopes to completely speed up that put in base with GPUs in about 5 years, to accommodate rising AI workloads.

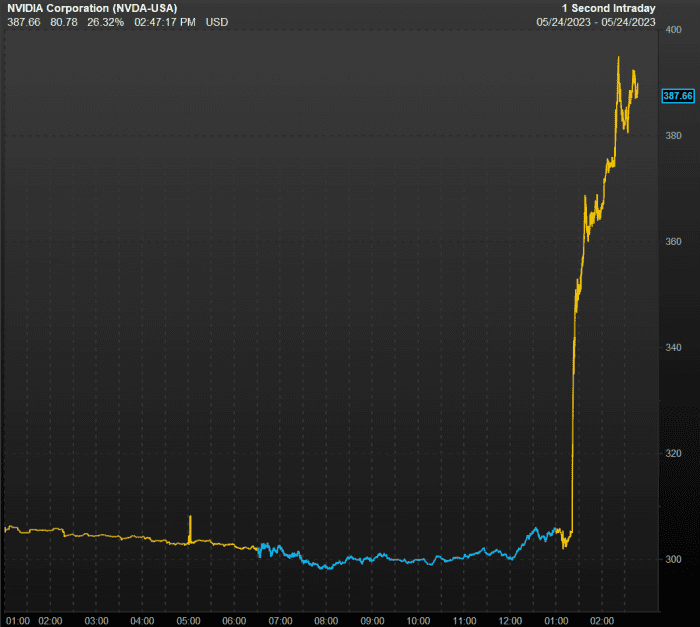

Nvidia shares soared 25% in after-hours buying and selling, following a 0.5% decline within the common session to $305.38. Nvidia’s file closing worth is $333.76 and the all-time intraday excessive is $346.47, based on FactSet information. After-hours “costs” topped each of these marks, reaching greater than 14% past all-time highs for the common session, as shares registered as excessive as $395, based on FactSet. The final time Nvidia shares rallied as a lot in a single session was Nov. 11, 2016, when shares surged 29.8% after the company reported that profit more than doubled.

Nvidia inventory spiked in after-hours buying and selling (at proper, in yellow) Wednesday.

FactSet

In the meantime, shares of rival Superior Micro Gadgets Inc.

AMD,

rallied 6% after hours.

Nvidia didn’t present full-year steerage, however Huang has been effusive in his predictions that elevated give attention to AI from Large Tech companions similar to Microsoft Corp.

MSFT,

and Alphabet Inc.

GOOGL,

GOOG,

will result in income positive aspects within the close to future. Chatting with the media at Nvidia’s builders convention in March, he stated that generative AI has solely accounted for a “tiny, tiny, tiny” single-digit share of income over the previous 12 months, however predicted that within the subsequent yr, income from generative AI will develop to be “quite large — exactly how large, it’s hard to say.”

Nvidia reported fiscal first-quarter earnings of $2.04 billion, or 82 cents a share, on gross sales of $7.19 billion, a decline from $8.29 billion a yr in the past however nicely forward of expectations. After adjusting for inventory compensation and different results, the chip maker reported earnings of $1.09 a share, a decline from $1.36 a share a yr in the past. Analysts on common had been anticipating adjusted earnings of 92 cents a share on gross sales of $6.53 billion, based on FactSet.

Gaming gross sales for the primary quarter fell 38% to $2.24 billion, whereas data-center gross sales at Nvidia rose 14% to a file $4.28 billion, “led by rising demand for generative AI and huge language fashions utilizing GPUs primarily based on our Nvidia Hopper and Ampere architectures.”

“The income development displays sturdy demand from giant client web corporations and cloud service suppliers,” the corporate stated in a press release. “Enterprise demand for GPU platforms was sturdy, though common objective networking options declined each sequentially and from a yr in the past.”

Analysts had anticipated gaming gross sales of $1.97 billion — almost half of final yr’s $3.62 billion — and data-center gross sales of $3.9 billion, a 4% enhance from a yr in the past. Auto chip gross sales soared 114% to $296 million from a yr in the past.

Nvidia’s revenue and gross sales have declined in latest quarters as the corporate offers with oversupply out there, a results of pandemic-era shortages flipping to a glut after demand for private computer systems and gaming gear waned. Analysts count on that pattern to finish with this report, nevertheless, as demand for gear that may energy synthetic intelligence kicks into larger gear amid a bevy of guarantees from tech corporations in regards to the energy of generative AI.

Nvidia’s inventory has soared toward all-time highs amid the hype for generative AI, which was launched after the profitable debut of OpenAI’s ChatGPT service. Shares have greater than doubled thus far this yr, rising 109% because the S&P 500 index

SPX,

has elevated 8%.