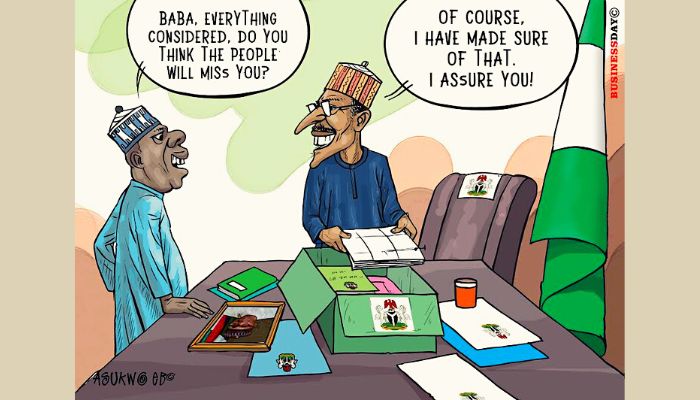

The agony of annoyed Nigerians who’ve cash of their financial institution accounts however can’t get money to resolve their fundamental wants has continued unabated as President Muhammadu Buhari and the Central Financial institution of Nigeria (CBN) have saved mum over the authorized tender standing of two previous naira notes.

A couple of week after the Supreme Court docket dominated that the previous N500 and N1,000 banknotes remained authorized tender till December 31, 2023, many Nigerians nonetheless continued to reject the foreign money notes over the weekend as they waited to listen to from both Buhari or Godwin Emefiele, governor of the CBN.

Some banks complied partially with the Supreme Court docket’s ruling final week by allotting the previous notes to their clients.

The previous naira notes had been rejected principally by merchants and transporters due to the confusion attributable to the silence of Buhari and Emefiele.

BusinessDay findings confirmed that the event has negatively affected many companies and workers who couldn’t go to their workplaces as a consequence of lack of money for transport fares.

“I spend a mean of three hours day by day scouting a number of banks in search of new naira notes. These are productive hours I’d have spent working,” Nathaniel Chukwu, a technician at Ketu, in Lagos, stated. “Gross sales have dropped drastically as everyone seems to be in search of money.”

“The naira shortage is irritating and tiring. I can’t go to work or wherever due to the shortage. I’m simply stranded. I can’t afford to purchase N2,000 for N600 day by day for transportation prices to the workplace,” stated Ayomide Williams, an worker with a consultancy agency on Victoria Island.

“The worst factor is that there is no such thing as a finish in sight till Might 29 as CBN and the Presidency are quiet in regards to the Supreme Court docket’s current ruling,” she added.

Nurudeen Mohammed, a pensioner, was stranded as he couldn’t discover money to pay his transportation fare again house after visiting a sick relative at Lagos Educating Hospital in Ikeja, the capital of the nation’s business metropolis.

“I left house with N1,000 from Ikorodu, believing I will get cash from the financial institution or Level of Sale (PoS) agent to pay for my transportation again house,” he stated. “I’ve visited a number of branches of First Financial institution throughout Ikeja and none is paying money. I used PoS however all of them additionally don’t have the money to provide.”

He stated he stood for over three hours as bus drivers refused to simply accept on-line transfers for fee earlier than somebody got here to his rescue.

“I’m 70 years previous and have been standing for over three hours now due to this naira shortage. The bus drivers usually are not accepting transfers; if not for Samaritan, I gained’t be capable of go house,” he stated.

Kelvin Obi, an analyst, stated the dearth of money was affecting his work. “Sincerely, the naira shortage scenario is admittedly unhealthy. I left house with N200 to the workplace hoping I’ll get money from the financial institution or PoS however couldn’t get any. The scenario is hitting me onerous and I can’t even think about work.”

A commuter who didn’t wish to be named stated: “The continued naira shortage has actually elevated the price of residing for me and the worst half is that there is no such thing as a reduction in sight. Getting money is extraordinarily troublesome and if I handle to get money, it’s often lower than N5,000, and I pay a big quantity to get it. Most market women and men now settle for switch or card fee however at a value. Final weekend, I spent over N1,000 on switch prices alone.

“I’m additionally compelled to restrict my motion as a consequence of this shortage. What’s even worse is that typically, I’m keen to pay the price of getting the money however it isn’t out there, not a single PoS machine dispenses money round me. The scenario is not humorous and I fail to notice the optimistic affect of this naira redesign.”

In a business bus on Thursday, a lady instructed one among our reporters that after attending to a financial institution by 5am, she was allowed in by 9am and realised that the financial institution was allotting previous notes on the counter. She stated she refused to gather the banknotes as a result of merchants and bus drivers weren’t accepting them. She needed to go to Obalende from Ajah to get money from a pal working a PoS terminal.

Tolu Adio, who resides in Kuje, Abuja, stated she bought N5,000 from a PoS agent and paid a charge of N300 however merchants refused to gather the previous notes from her.

“The brand new notes are largely unavailable as ATMs usually are not allotting money; even banks which are giving out the previous notes have stated they won’t settle for it if returned,” she stated.

Learn additionally: Business activities fall to lowest in 2yrs on naira scarcity

BusinessDay spoke with some financial institution officers who stated that they had not obtained any directive from the central financial institution. “The truth is, there’s confusion all over the place, even within the banking sector,” one official stated.

“All the train was a useless disruption of financial actions, particularly among the many most susceptible segments of the economic system, sadly,” Muda Yusuf, chief government officer of the Centre for the Promotion of Non-public Enterprise, stated.

He stated the CBN’s foreign money redesign coverage inflicted indescribable agony, struggling and misery on the vast majority of Nigerian residents. “The difficulty was not with the redesign, however the deliberate and unrestrained mopping up of money within the economic system.”

He stated the CBN had mopped up about N2 trillion money from the economic system, thereby paralysing the retail sector, crippling the casual economic system, stifling the agricultural worth chain, immobilising the transportation sector and disrupting the fee system within the economic system.

BusinessDay gathered over the weekend that the Supreme Court docket had served its orders within the foreign money redesign case on Abubakar Malami, the attorney-general of the federation.

“The President, AG Federation and Governor CBN have run out of excuses for not complying with these orders, notably paragraphs 9 and 10 on the ultimate web page,” a supply stated. “These had been served immediately. I anticipate the CBN to situation tips to banks stating that the N500 and N1,000 notes will probably be launched and telling them to place them again into circulation. Not later than Monday. It’s simple. Let’s see what they do.”