Franca Afegbua, Nigeria’s first feminine senator is lifeless

Franca Afegbua, Nigeria’s first feminine senator, died within the early hours of Sunday, March 12, 2023, the household introduced. “The Afegbua household of Edo State has confirmed the demise of the primary lady senator in Nigeria, Senator Franca Afegbua, whose unhappy occasion occurred this morning, Sunday, March 12, 2023. She mixed magnificence and brains throughout her service to Nigeria. Funeral particulars can be introduced by the household quickly,” the household stated.

Afegbua, 79, a local of Okpella city within the Etsako-East Native Authorities Space of now Edo State, represented the previous Bendel-North Senatorial District within the aborted second republic within the nationwide meeting beneath the then Nationwide Celebration of Nigeria (NPN). She was a high-end, Bulgaria-trained, Lagos-based hairdresser who got here into prominence after she received a hair styling competitors.

Her political journey solely lasted for 3 months—October 1983 to December 1983.

Learn additionally: Cash crunch:Is Nigeria shutting down?

Money mop-up driving tens of millions of Nigerians into penury — CPPE

The Centre for the Promotion of Non-public Enterprise (CPPE), an financial suppose tank, stated on Sunday that the present money mop-up by the Central Financial institution of Nigeria shouldn’t be solely bringing the Nigerian financial system to a halt however that it is usually driving tens of millions of Nigerians into penury, distress, and destitution. In its report, the financial suppose tank stated that the financial system had misplaced about N20 trillion because it began this money mop-up and cashless coverage goal.

It stated that this money withdrawal coverage of the CBN was not solely taking away the supply of livelihood from tens of millions of Nigerians however was now turning into a nationwide menace more likely to end in extra civil unrest.

“Hundreds of thousands of residents have slipped into penury and destitution on account of the disruptions and tribulations perpetrated by the forex redesign coverage, particularly the mopping up of over 70 p.c of money within the financial system,” the Director of CPPE, Dr. Muda Yusuf, said whereas reacting to the forex redesign coverage.

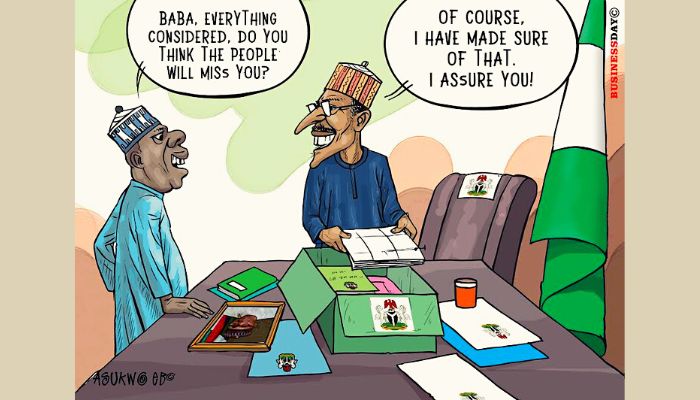

Yusuf known as on President Muhammadu Buhari to rethink this coverage, saying that “Nigerians haven’t been this traumatized in latest historical past.”

EEDC affords ASAP cost for patrons with excellent arrears

Emeka Ezeh, Head, Company Communications of the Enugu Electrical energy Distribution Firm (EEDC), advised newsmen on Sunday that EEDC has launched a brand new product often called the Accelerated Settlement of Arrears Venture (ASAP), which can help prospects with excellent arrears clear them whereas having fun with enticing reductions.

Ezeh stated that the brand new product had some distinctive advantages for the purchasers within the south-east zone.

He stated that the product affords graded reductions, starting from 25 p.c (for a one-time cost) and 20 p.c (for 3 months cost by installment).

“There’s additionally a graded low cost of 35 p.c (for money owed of 5 years and above) and appeals to solely non-maximum demand (NMD) prospects,” he stated.

To learn from the product, he stated that prospects’ accounts should not have benefited from any earlier low cost scheme supplied by EEDC, whereas the arrears have to be earlier than Jan. 1.

“As well as, prospects will need to have subscribed to the MAP metering, with demand notes issued as a acutely aware manner of making certain that money owed will not be allowed to accrue additional.

“This initiative is launched by EEDC to alleviate its prospects of some debt burden, contemplating the very difficult financial scenario within the nation,” he stated. (NAN)

AfDB helps Komadugu-Yobe basin with €362, 000 grant

The African Improvement Financial institution (AfDB) has signed a 362,000 Euro grant settlement with the Hadejia Jama’are Komadugu Yobe Basin-Belief Fund.

The financial institution, in a press release, stated the grant would put together extra research beneath the second part of creating a strategic plan for managing water sources within the Komadugu-Yobe Basin in northern Nigeria.

“Particularly, the grant will help the preparation of a Resettlement Motion Plan (RAP) for the Challawa Gorge Dam Watershed Administration Venture and a stakeholder engagement plan.

“It would help a grievance redress mechanism and stakeholder consultations involving riparian communities and the Lake Chad Basin Fee, which contains Cameroon, Chad, Nigeria, and the Niger Republic.

“The undertaking can be carried out over eight months, and the Hadejia-Jama’are-Komadugu-Yobe Basin Belief Fund will execute the undertaking,” the financial institution stated.

US rushes to avert disaster with SVB deposit assure, financial institution fund

US authorities raced on Sunday to stem jitters concerning the well being of the nation’s monetary system, pledging to completely defend all depositors’ cash following the collapse of Silicon Valley Financial institution whereas additionally giving any banks squeezed for money simpler phrases on short-term loans.

The Treasury Division, Federal Reserve, and Federal Deposit Insurance coverage Corp. collectively introduced the efforts, geared toward strengthening confidence within the banking system after SVB’s failure

spurred fear about spillover results. Considerations unfold Sunday when state regulators closed New York’s Signature Financial institution.

Regulators acted swiftly on quite a few fronts to include the potential fallout—the FDIC stated it should resolve SVB in a manner that “absolutely protects all depositors.” Equally, “all depositors” at Signature can be made entire.

The Fed introduced a brand new “Financial institution Time period Funding Program” that gives one-year loans to banks beneath simpler phrases than it usually gives.

The Fed is also enjoyable phrases for lending by its low cost window, its important direct lending facility. (Bloomberg)