There isn’t a doubting the truth that the naira redesign coverage of the Central Financial institution of Nigeria (CBN) which led to the unintended consequence of naira shortage was not meant to punish or torture Nigerians. It was meant to mop up extra money within the system, deliver down inflation, cut back criminality and advance the nation’s motion into full cashless financial system.

In its knowledge, the CBN had ensured that there have been a variety of viable alternate options that Nigerians might make use of earlier than introducing the coverage. There was web banking by way of the app and there was additionally USSD for cash transfers and different operations.

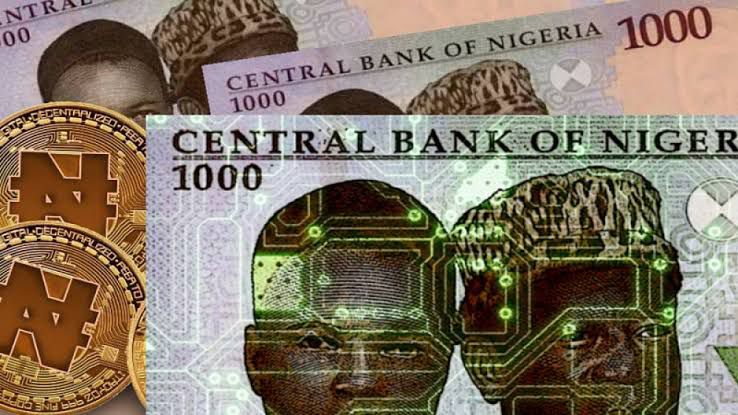

There was additionally the e-Naira which was launched in October 2021 as a retailer of worth which is the same as the bodily naira.

When President Muhammadu Buhari launched the Central Financial institution Digital Foreign money (CBDC), aka e-Naira, and made Nigeria the primary nation on the continent to embrace the official digital foreign money, he made it identified that it was a brand new daybreak for the financial aspect of the financial system.

On his half, CBN boss, Godwin Emefiele, stated the e-Naira would revolutionise transactions in Nigeria and provides Nigerians extra environment friendly, cheaper and simpler technique of doing enterprise.

Since 2021, thousands and thousands of Nigerians who’re on the e-Naira platform have been testifying to the vibrancy of the platform. They’ve seen how the e-Naira makes life simple, makes sending and receiving cash seamless and the way fee of payments is way more environment friendly with the digital foreign money.

Nigerians on the e-Naira platform are additionally excited that CBN has used the e-Naira innovation to eradicate intermediaries that make transactions cumbersome. Consequently, it’s cheaper to make use of e-Naira than the web platforms as a result of there aren’t any banks to pay fees to. The absence of banks additionally utterly eradicates the potential of depositors shedding their monies in case of any financial institution crashing. It’s because CBN is the one holding the cash on e-Naira and it may by no means crash.

Once more, the standard community issues related to typical web banking is totally absent in e-Naira transactions. e-Naira is quick and environment friendly and it takes away the pains and frustration related to conventional banking.

There are a few alternatives embedded within the e-Naira platform for each the CBN and people to introduce new merchandise that may additionally make life ample for folks. Whereas the CBN has inspired Nigerian tech specialists to provide you with lots which improvements which can be at completely different phases of incubation, the apex financial institution lately launched a USSD channel to spice up the utilization of the platform.

The platform was launched in Lagos final week throughout an occasion to debate the money crunch and the way the providers launched by Bullnet on the USSD channel of the e-Naira would clear up the issue.

In the course of the launch, the Chief Government Officer, Bullnet Bulletin and Enquiries Networking Providers, Bayo Akintoye, stated the USSD with the code *997*50#, would soothe the ache felt by Nigerians given the present shortage of money because it transitioned from cash-based financial system to a cashless one.

“The CBN has collaborated with Chamsmobile Restricted (a CBN licensed Cellular Cash Operator and Tremendous-Agent) to deal with challenges confronted primarily by the unbanked, the under-served and people on the opposite aspect of the digital divide by creating the service referred to as ‘eNairaeNhanced Providers’ by way of the eNaira USSD channel (*997*50#) which is totally run and powered by the patented Bullnet Platform.

“It’s anticipated that Nigerians will proudly affiliate with this innovation and register to have the e-Naira pockets. These wallets could be funded immediately with cash-purchased vouchers (just like the GSM recharge playing cards) or from funded financial institution accounts utilizing financial institution playing cards by way of the net portal or utilizing digital fee with any authorised agent.

“Customers may switch e-Naira from one pockets to a different just by inputting the recipient’s cellphone quantity. The service additionally makes it doable for customers to money out by sending the e-Naira immediately from their wallets to an ATM and withdrawing the money equal with out the necessity for a checking account or financial institution card. The consumer may ship e-Naira to a delegated checking account for financial savings or additional transactions,” he stated.

As a consequence of the brand new landmark, the community of banking brokers throughout the nation such because the Chamsmobile Tremendous Brokers and different cellular cash brokers, the POS brokers and the rising e-Naira adoption brokers would now grow to be e-Naira extension employees who can be concerned with e-Naira company, (promoting vouchers to prospects at a revenue and onboarding new customers), training and advocacy (creating consciousness and educating the lots in regards to the idea of the CBDC and its advantages).

The Mission Coordinator, e-Naira Mission Large Group, Otaru Abdulkadir, stated the e-Naira was launched to enhance monetary inclusion within the states, enhance cross border transactions, diaspora remittances and the likes and in addition complement our fee infrastructure.

“As it’s right now, we’re capable of transact on the eNaira with 4 strategies; you possibly can scan to pay, you may use your pockets ID that’s while you onboard, and the e-Naira provides you a ten digit quantity. And naturally you should utilize USSD energy, and it’s for everybody. It’s out there for everybody with a cell phone. It doesn’t should be a smartphone or any knowledge cellphone,” he stated.

It’s apparent that the e-Naira platform has limitless alternatives for lots of extra nice issues to be accommodated therein. And with the best way the CBN is working around the clock to develop the platform and encourage different Nigerians to provide you with completely different initiatives, the approaching weeks and months promise to be attention-grabbing for Nigerians who’re already on the e-Naira platform.

Within the subsequent few months, the e-Naira can be the massive deal within the banking nation.