Andrea Riquier, supplied by

Mortgage charges have skyrocketed this yr, scaring many would-be homebuyers and sellers out of the market.

However even when charges seesaw decrease, as they did this week, it nonetheless takes a toll on the housing market.

Why? As a result of when monetary circumstances are so erratic and unsettled, many would relatively wait it out.

“In the present day’s homebuyers and sellers are dealing not simply with increased housing prices, however extra uncertainty because of fluctuating mortgage charges,” Realtor.com® Chief Economist Danielle Hale says in her weekly analysis. “The uncertainty is resulting in hesitation.”

We discover the ramifications of when borrowing prices zigzag in all places, conserving each homebuyers and sellers on edge, in our column “How’s the Housing Market This Week?”

Wait, why are falling mortgage charges unhealthy?

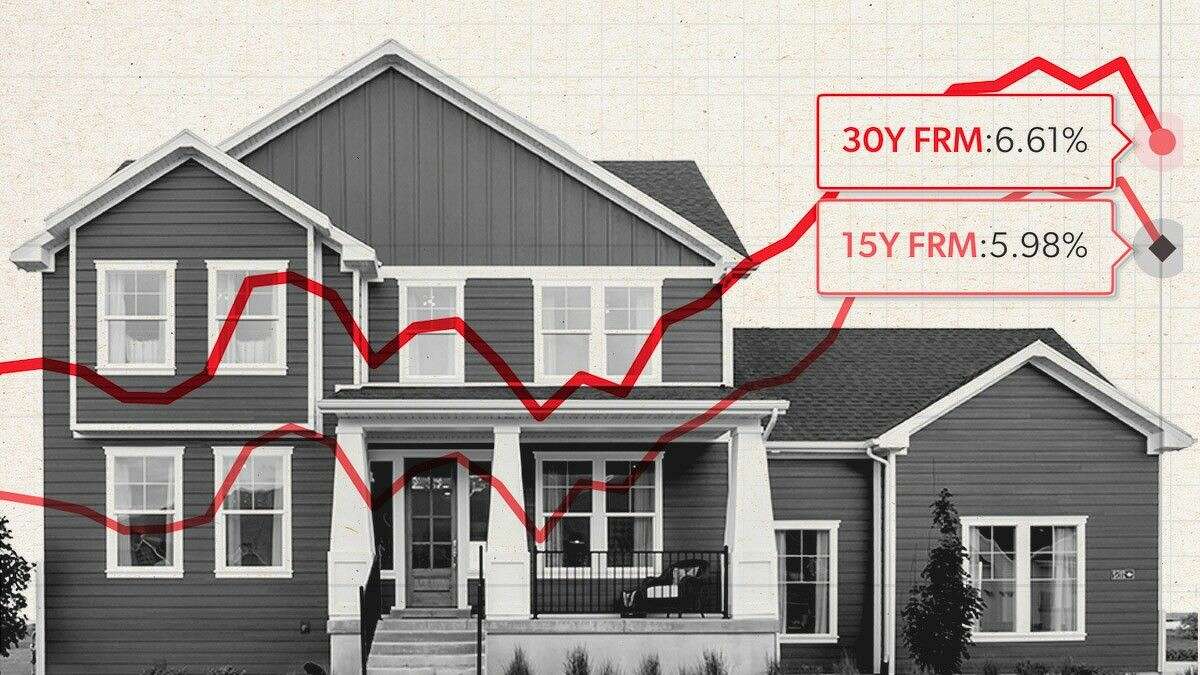

In late October, common rates of interest on 30-year fastened loans shot as much as a 20-year high of seven.08%, solely to dip the next week, then tick back up, in keeping with Freddie Mac.

Which brings us to now: For the week ending Nov. 17, rates of interest on 30-year fixed-rate loans not solely teetered, but additionally tumbled to six.61%.

Decrease charges are completely a boon for patrons, sellers, and the general housing market. As Hale factors out, this type of transfer means a financial savings of about $100 per thirty days for patrons utilizing a mortgage to pay for 90% of a house costing $425,000, which was the median price in October.

However there’s a caveat: “Expanded buying energy is undoubtedly factor for at the moment’s customers,” Hale says, “however fluctuations make it tough to funds and plan for patrons and sellers alike.”

What a stagnant housing market seems like

As each patrons and sellers hesitate, ready for issues to calm down, the housing market is stagnating. What does that seem like?

For starters, fewer sellers listing their properties, since they’re doubtful they’re going to even get a proposal—and even when they do, many must purchase a brand new residence at what could be double the rate of interest they at the moment have.

And the latest statistics bear this out: For the week ending Nov. 12, the variety of new listings fell by 18% in contrast with a yr in the past, marking the nineteenth straight week of declines.

In the meantime, wannabe patrons—daunted by darting rates of interest and excessive residence costs—may drop out. So properties which might be at the moment in the marketplace sit longer, too.

In truth, for the week ending Nov. 12, general stock (together with new listings and rancid ones nonetheless caught in the marketplace unsold) elevated by 45% from a yr earlier. Plus, properties lingered in the marketplace for eight extra days than they did presently final yr.

And when listings look stale, they’re typically much less prone to get snatched up, and that makes sellers much less prone to listing within the first place—and so forth. It is a harmful cycle.

What do altering mortgage charges imply for residence costs?

So many competing dynamics at work out there result in each excellent news and unhealthy information about residence costs.

First, the unhealthy information: Costs are nonetheless rising. In the latest week, residence costs elevated by 11.1% in contrast with that very same week final yr. That development is its forty sixth week at a double-digit tempo.

Now, the excellent news: Worth development, although nonetheless sturdy, has been slowing.

“The tempo of median itemizing value development may transfer again into single-digit territory simply earlier than the tip of the yr, and with this week’s step-down, that risk remains to be very a lot on the desk,” Hale predicts. “This implies the standard asking value will close to, however not going slip beneath, $400,000 once more this yr.”

The submit Mortgage Rates Just Tumbled—but Here’s Why That’s Still Bad for the Housing Market appeared first on Real Estate News & Insights | realtor.com®.